The Danish research and analysis firm for the global supply chain industry, Sea-Intelligence, has made a study to examine the dynamics between the alliance-controlled and non-alliance services, in order to see whether the disruptive market of 2021 has led to material changes.

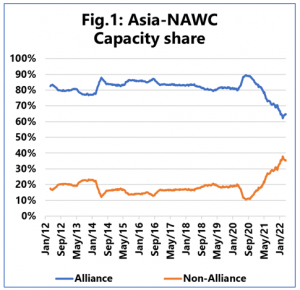

The following figure (Fig.1) shows the 13-week rolling average of the share of total Asia-North America West Coast capacity that is under the control of alliances versus non-alliance services.

“There are three key elements here,” points out Alan Murphy, CEO of Sea-Intelligence, and explains, “The first is the relatively stable share in 2012-2020 with a rough 15-20% / 80-85% split between non-alliances and alliances, despite the changes in alliance and VSA constellations over this 8-year period. The second element is the sharp decrease in non-alliance capacity in the first part of 2020. Clearly, the immediate impact of the pandemic was that non-alliance services were much more likely to be blanked than alliance services. Regarding the third element, it is the development seen over the past 18 months, where there has been a very substantial increase in the share of capacity offered outside the alliances.”

Presently, 35% of the capacity offered is on non-alliance services, according to Sea-Intelligence’s data.

Asia-North America East Coast, which was fully served by alliance services in 2019-2021, saw an increase in non-alliance services from the second half of 2020, to a point where 10% of the capacity in the market is currently serviced by non-alliance services.

The development on Asia-Europe is starkly different than on Asia-North America, while the market on this trade is nearly fully serviced by alliances.

“The recent market disruption has done little to change this situation. A few non-alliance services have been seen,” said the Sea-Intelligence report.

However, the number of such sailings and the small size of the vessels being used, means that this has an overall insignificant effect on the total capacity in the market. What this development implies is that the barriers of entry on the Asia-North America trades are much lower than on the Asia-Europe trades.