The latest data by the Maritime and Port Authority (MPA) of Singapore showed that the country’s bunker fuel sales for the 380 CST HSFO grade fell to a one-year low in the world’s largest bunkering port in September amid limited cargo availability.

In the meantime, total marine fuel sales volume also dipped overall last month, reflecting a weak bunker demand. Bunker fuel sales of 380 CST HSFO in Singapore’s port slipped by 7.1% during September to 908,000 metric tonnes (mt).

Bucking the overall downtrend was sales of low sulfur (0.1%) marine gasoil, which was increased by 14.4% month-on-month at 331,700mt, but decreased by 8.6% on the year, while 0.5%S marine gasoil sales rose slightly by 0.2% month-on-month to 26,800mt, according to the MPA data.

Total marine fuel sales in Singapore slid by 3.4% month-on-month and by 6.7% on the year in September to 3.935 million mt.

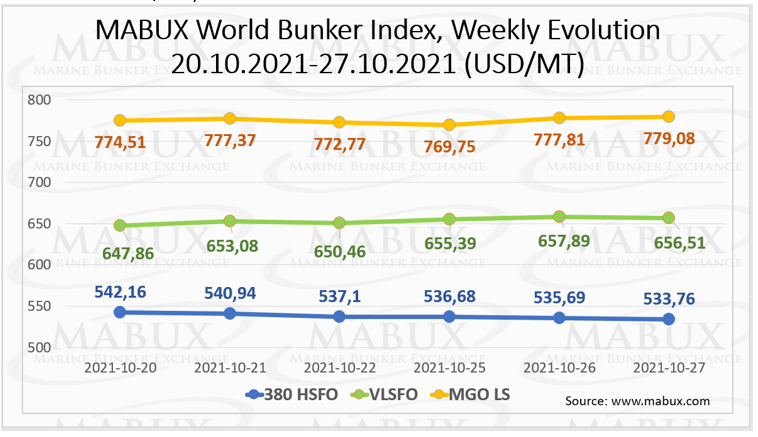

Meanwhile, the Marine Bunker Exchange (MABUX) World Bunker Index demonstrated irregular changes during the 43rd week of the year.

The 380 HSFO index declined to US$533.76/MT, while the VLSFO index increased to US$656.51/MT and the MGO index also grew to US$779.08/MT.

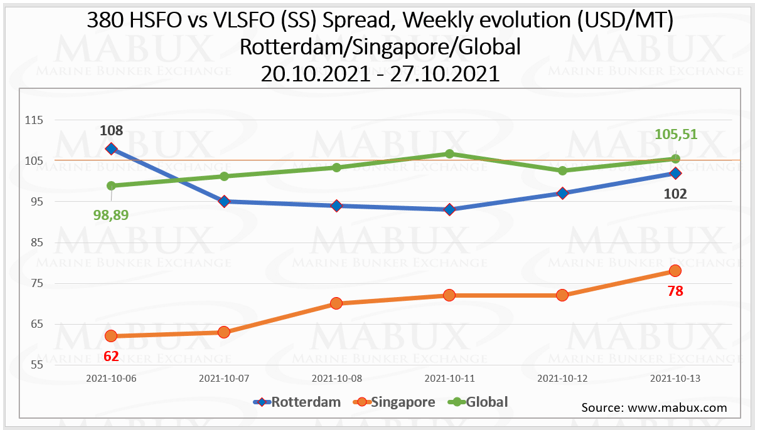

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued to rise during the week and amounted to US$115.81.

The average weekly SS Spread in Rotterdam also widened to US$126.67, while the average SS Spread in Singapore also grew to US$120.33.

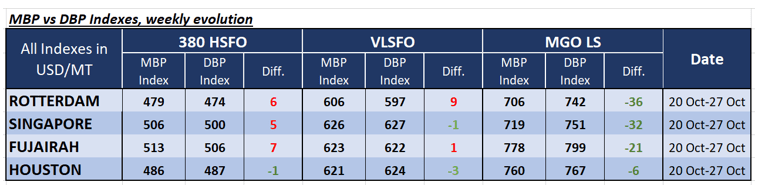

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was overvalued in three out of four selected ports, except Houston, where the index recorded a moderate underpricing of US$1.

In other ports, 380 HSFO was overcharged: in Rotterdam – plus US$6, in Singapore – plus US$5 and in Fujairah – plus US$7. Overall, MBP Index became much closer to DBP Index.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, was in the overvaluation zone in two out of four selected ports: In Rotterdam by plus US$9 and in Fujairah by plus US$1.

In Singapore and Houston, this fuel grade became undervalued by minus US$1 and minus US$3 respectively.

The MABUX MBP / DBP Index registered an undercharge of MGO LS fuel in all selected ports: minimum value in Houston, with minus US$6 and maximum value in Rotterdam with minus US$36.