A feared second wave of coronavirus infections may have arrived, according to MABUX, with cases rising in many parts of the US, while exploding much more rapidly in Latin America. In China, a small number of new cases raised fears of a return of the virus.

“With much of the market pricing in a steady rebound in demand, any renewed lockdown or economic hit may drag fuel prices back down,” commented a MABUX spokesperson.

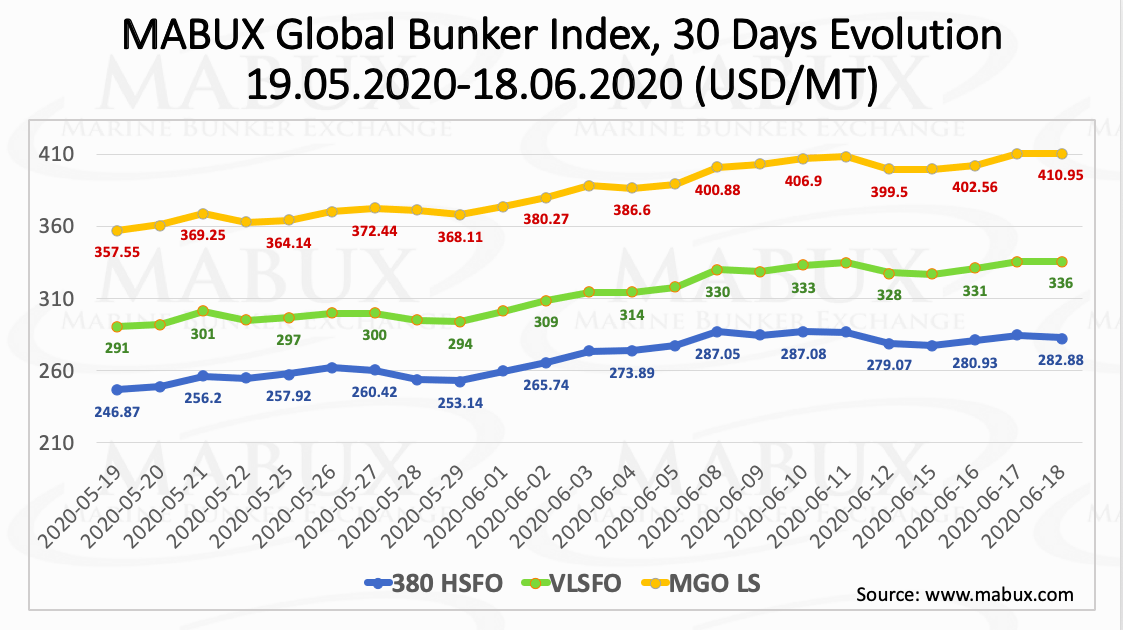

However, global bunker prices remained steady last week while a short decline was registered on 15 June. MABUX Global Bunker Index for 380 HSFO decreased slightly from US$287/mt on 11 June to US$283/mt today (18 June).

On the contrary, VLSFO saw a minor increase of US$1/mt (from US$335/mt to US$336/mt) and MGO LS rose from US$408/tonnes to US$411/tonnes.

The impact of the coronavirus on global trade could perhaps be seen in the bunker volumes, said MABUX.

At the Port of Singapore, the marine fuel market has registered a 2% dip in year-on-year sales to 3.93 million tonnes, while volumes for the year to date are ahead of 2019 figures.

Moreover, Panama Canal bunker volumes in May fell back by 5.1% year on year, and they were also down on April’s volumes, which totalled 414,137 mt.

Meanwhile, in Rotterdam weekly Scrubber Spread index (SS) jumped to US$70.96 (+ US$28.63) while today’s SS index stands even higher, at US$96. At the same time, in Singapore, this week SS index dropped from US$87.17 to US$67.17 and today stands at US$79.00.

The fluctuations of the SS index at the major hubs reflect the state of the high volatility of the global fuel market existing so far. A significant slowing was noticed by Clarksons Research in the number of ships already in service installing scrubbers, estimating there were under 100 vessels undergoing retrofits versus over 300 at the start of the year.

The average VLSFO-HSFO global spread (Scrubber Spread) has increased slightly during the last 7 days and stands at US$43.96 (+US$1.49 for index a week ago).