Abu Dhabi Ports Group has published its financial report for the first half of the year, recording improved results, driven by organic growth, diversification into new businesses, new leases and partnerships.

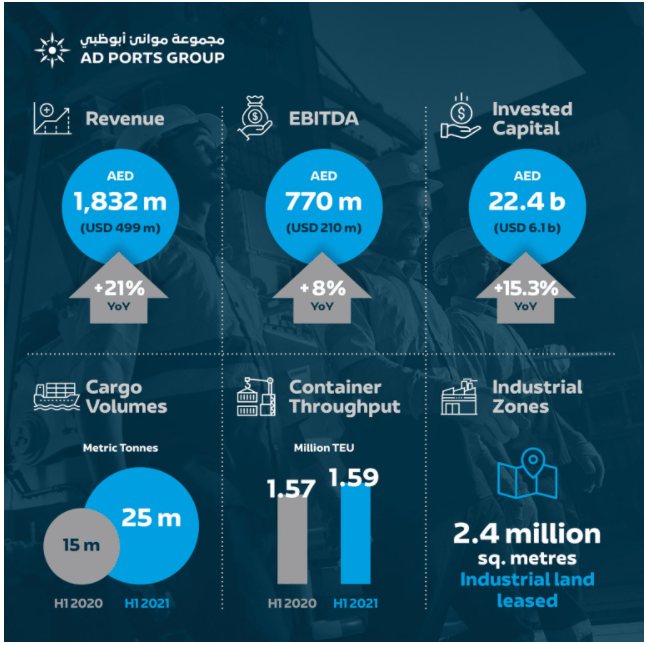

More specifically, the United Arab Emirates (UAE) port operator achieved a revenue of US$499 million, significantly increased by 21% over the first six months of the previous year.

During the same period, the Group’s Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA) rose by 8% year-on-year to US$210 million, marking growth across most of the business clusters.

Commenting on the financial results, Captain Mohamed Juma Al Shamsi, CEO of AD Ports Group, stated, “Our results demonstrate our resilience and the robust growth we have achieved across our business in line with our strategy.”

“Our financial performance is underpinned by continued expansions and increased activity, with key partnerships and joint ventures being established that are expected to deliver reliable returns in the future,” he added.

Regarding the AD Ports’ operational results for the first six months of the year, cargo volumes grew to 25 million metric tonnes (MMT), from 21 MMT in the same period of 2020, while container throughput grew from 1.57 million to 1.59 million TEU.

Moreover, the Dubai-based group reported a slight decline in return on invested capital (ROIC) to 5%, which was mainly due to an increase in invested capital across the portfolio, especially in the ports and industrial zone businesses, which are expected to yield incremental returns going forward.

“Our invested capital increased from US$5.3 billion in 2020 to US$6.1 billion in 2021, in line with our ongoing expansion program,” noted Martin Aarup, Group Chief Financial Officer of AD Ports Group.