February 1st marked the beginning of a new competitive landscape in the crucial deep-sea container trades from Asia to North America and Europe.

Sea-Intelligence analyzed the shifts in market share among shipping line alliances compared to the previous year.

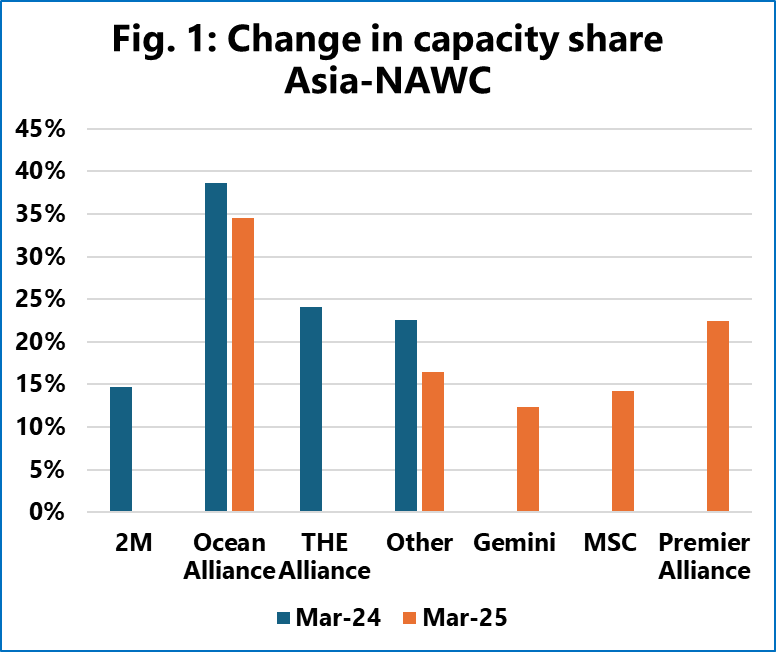

The following figure illustrates the Asia–North America West Coast market share for March 2024 and March 2025, reflecting the alliances in operation during each period. The category labelled “other” includes capacity from all non-alliance services, encompassing both independent carriers and alliance-affiliated carriers operating outside their alliance agreements.

“Here we find a slight loss of market share for Ocean Alliance,” pointed out Alan Murphy, CEO of Sea-Intelligence, who went on to explain, “It is not because they are reducing their capacity, but simply because the other carriers are injecting capacity at a higher pace than Ocean Alliance itself.”

Murphy continued: “They [Ocean Alliance] do, however, clearly remain the largest alliance, operating 35% of the planned capacity. Premier Alliance is an interesting one to watch. Despite seeing Hapag-Lloyd leave the alliance, Premier Alliance essentially maintains the same market share as THE Alliance had. Gemini Cooperation is the smallest player in the Transpacific trade into the NAWC.”

Sea-Intelligence’s boss went on to note that there is a “similar pattern” on Asia-North America East Coast as well, where Ocean Alliance continues to hold the largest market share, with Premier Alliance maintaining a similar market share as the outgoing THE Alliance, while Gemini Corporation has the smallest market share.

“The difference between Premier Alliance and Gemini Cooperation, however, is a very marginal 0.2 percentage points in favour of Premier Alliance,” said Murphy.

These shifts in the competitive landscape among carrier alliances are expected to intensify market competition as carriers adapt to the evolving environment. For shippers, this will likely lead to downward pressure on freight rates, according to the Sea-Intelligence’s report.