Shipbroker Braemar is forecasting a significant increase in the demolition of feeder ships in the sector makes up the bulk of the 550 idled vessels, with 920 ships in the current aged over 20-years old.

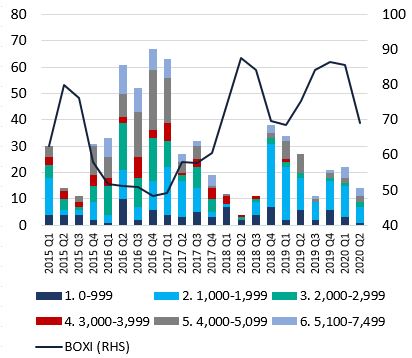

One hundred and thirty vessels in the 1,000-1,999TEU range are idle and 287 of these units are over 20-years old, while only 70 newbuildings are expected up to be delivered by the end of 2022.

Jonathan Roach, a container shipping researcher at Braemar, told Container News, “Position lists for feederships are increasing in length,” as the vessels are available with little cargo to transport the charter prices have declined substantially. “Charter rates for the 1,100TEU size are down to between US$5,000 and 6,000/day, while the rates for baby-Panamaxes [up to 4,200TEU] are around US7,000/day, it is the earnings potential that will decide whether the vessels are scrapped,” added Roach.

Steel prices are less of an issue, but even so the scrapping rate has fallen from US$430/ldt to about US325/ldt explained Roach.

He went on to say that it is unlikely that the larger sizes, from 8,000TEU upwards will come into the scrapping frame, even though their earnings potential has diminished substantially from US$30,000/day earlier this year to between just US$13,000 and 15,000/day now.

As such, the decision by Greek vessel owner Costamare to scrap its second ship of more than 7,000TEU in the last two weeks is a critical deal. The shipowner is closing in on the deal to demolish the 1996-built container ship Kure, two weeks after similar reports for its 7,403TEU sistership Kokura, a deal which Container News understands has yet to be closed.

Roach noted in his latest report that container ship demolition sales have increased and shipowners are looking at scrapping vessels as recycling yards are gradually getting up and running again, and these Costamare vessels are likely to draw the current demarcation line for candidates ready to be scrapped.

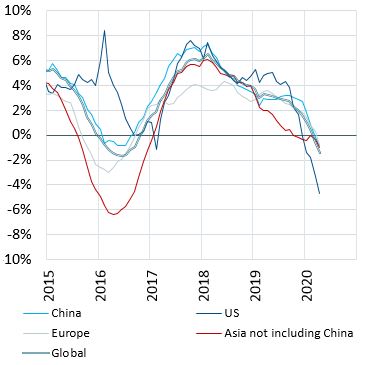

“The charter market has dropped by 34% since 1 January, and unsurprisingly container ship demolition has sparked into life as the yards re-open,” he pointed out.

Costamare officials responded similarly to the questions about the demolition of Kokura, saying they cannot confirm the sale of Kure because the deal is not officially closed. A Costamare spokesperson told Container News that neither Kure nor Kokura sales have been finalised.

Although some reports suggest that once the two transactions are closed a third vessel of the same series, the 1997-built Kawasaki, will follow, the Costamare official highlighted that the company analyses each vessel-case separately and noted that there is no specific strategy for the sale/purchase of ships.

Braemar expects more container vessels to be removed from the fleet in 2020, estimating 1.2-1.5% of the container fleet to be demolished, compared to 0.5% in 2019, because “the owners of older, less economical and unemployed vessels are starting to ramp up demolition, as the charter market weathers the storm from the global demand shock.”

The UK shipbrokers see plenty of demolition candidates, as 12% of the trading fleet is inactive due to the significant volumes decreased caused by the global pandemic. While in 2019, the idle fleet averaged approximately 3% of the trading fleet, the current percentage of the inactive fleet represents 2.7 million TEU and 550 ships, mainly made up of feeders and regional ships. 359 ships of them sized up to traditional-Panamax and the other 191 are post-Panamax units.

The Braemar expert told Container News there is an estimation that “approximately 920 container ships are 20-years old or more, around 850 ships fall into the traditional-Panamax size band (up to 5,099TEU) along with another 70 post-Panamax ships, we expect the aging fleet to drive more demolition over the next few years.”

According to media reports, the price for Kure was around US$318/ltd, which translates to an overall price of over US$10.5 million, while Kokura’s reported price was about US$330/ltd.