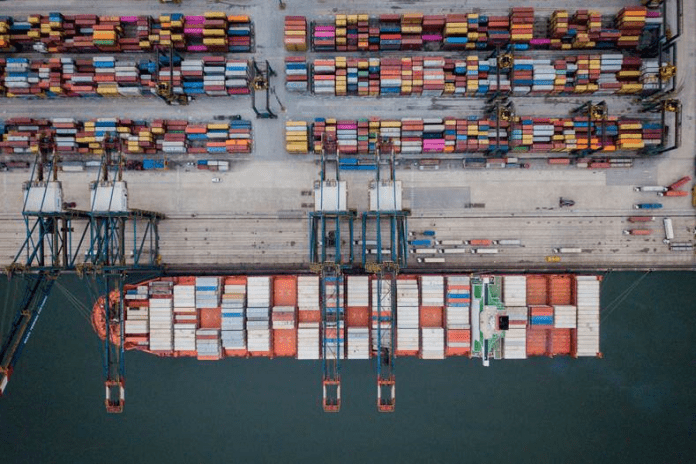

APM Terminals’ CEO Keith Svendsen pledged an investment of approximately US$1 billion in the company’s Brazilian operations up to 2026.

This figure includes around US$322 million of a total US$525 million investment exclusively for the Phase One development of a new terminal in Suape, a terminal located in Estaleiro Atlântico Sul, Brazil that is in the final stages of acquisition and will rejuvenate infrastructure and increase competition in the port.

Additionally, APM Terminals has committed an additional US$724 million investment in its four other terminals and inland depots in the country by 2026. A large share of this, around US$310 million, is allocated to Brasil Terminal Portuário, Santos.

Maersk-owned port operator, which plans to multiply storage capacity fivefold at its inland container depots in the Northeast and Southeast of Brazil, will prioritise early renovation of its terminal in the Port of Santos, Brasil Terminal Portuário (BTP), which is operated in partnership with Terminal Investment Limited (TIL), a subsidiary of MSC.

APM Terminals is currently negotiating with the federal government to extend its concession agreement, which expires in 2027, for another 20 years. In exchange, the port operator would modernise and double the current 1.5 million TEU capacity of the terminal, which is currently operating at close to full capacity (92%).

Under the previous government, the tender was subject to controversy, as other port operators expressed concern over the dominance of Maersk and MSC, the parent companies of APM Terminals and TIL respectively. Responding to this, APM Terminals’ CEO Keith Svendsen said that experience in other countries shows that the concern is unfounded.

Finally, APM Terminals has committed to Net Zero Greenhouse Emissions by 2040 and a 70% reduction in absolute emissions as an interim milestone for the period 2020-2030 for its commercially controlled terminals. This will involve investment in the electrification of equipment, purchase or generation of renewable energy and optimisation.