Spot rates have continued to soar this week, causing significant concern among shippers about how high these rates might climb.

However, the reality is that no one can predict the exact ceiling. Prices will keep rising until a sufficient number of shippers are unable to afford to transport their goods, which will subsequently reduce container demand to align with available vessel capacity. The precise threshold at which this balance will occur remains unknown.

According to Sea-Intelligence, the simplest response to the question of “how high can rates go?” might be to reference the peak levels observed during the pandemic. However, this does not take into account the increased sailing distances around Africa, which were not a factor during the pandemic.

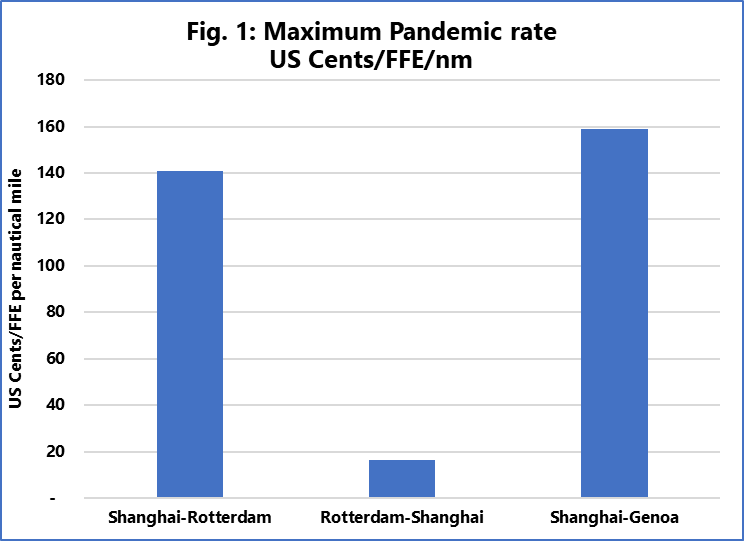

To account for the longer sailing distances, we can analyze rates relative to the distance travelled, measured in US cents per FFE per nautical mile. Figure 1 illustrates this for the pandemic period. While Figure 1 merely presents historical data, it also establishes a precedent: during periods of severe distress, freight rates per nautical mile can reach exceptionally high levels.

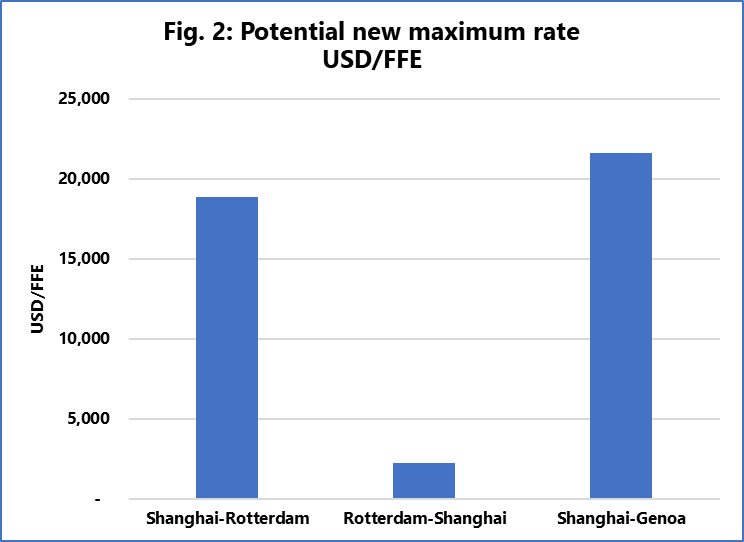

By extrapolating the data from Figure 1, we can estimate how high the market could potentially climb based on the pandemic surge in rates. Applying the new, longer sailing distances allows us to calculate the possible spot rates per FFE if the current crisis continues.

“The result of this calculation is shown in Figure 2. And here we arrive at the scary scenario for shippers. If the rate paid per nautical mile reaches the same level as during the pandemic, we will see spot rates of 18,900 USD/FFE from Shanghai to Rotterdam, 21,600 USD/FFE from Shanghai to Genoa, and 2,200 USD/FFE on the back-haul from Rotterdam to Shanghai. This is not to say that the rates couldn’t go any higher, this is just to say that rates per nm go as high as during the pandemic, then spot rates would go as high as shown in Figure 2,” stated Alan Murphy, CEO, Sea-Intelligence.