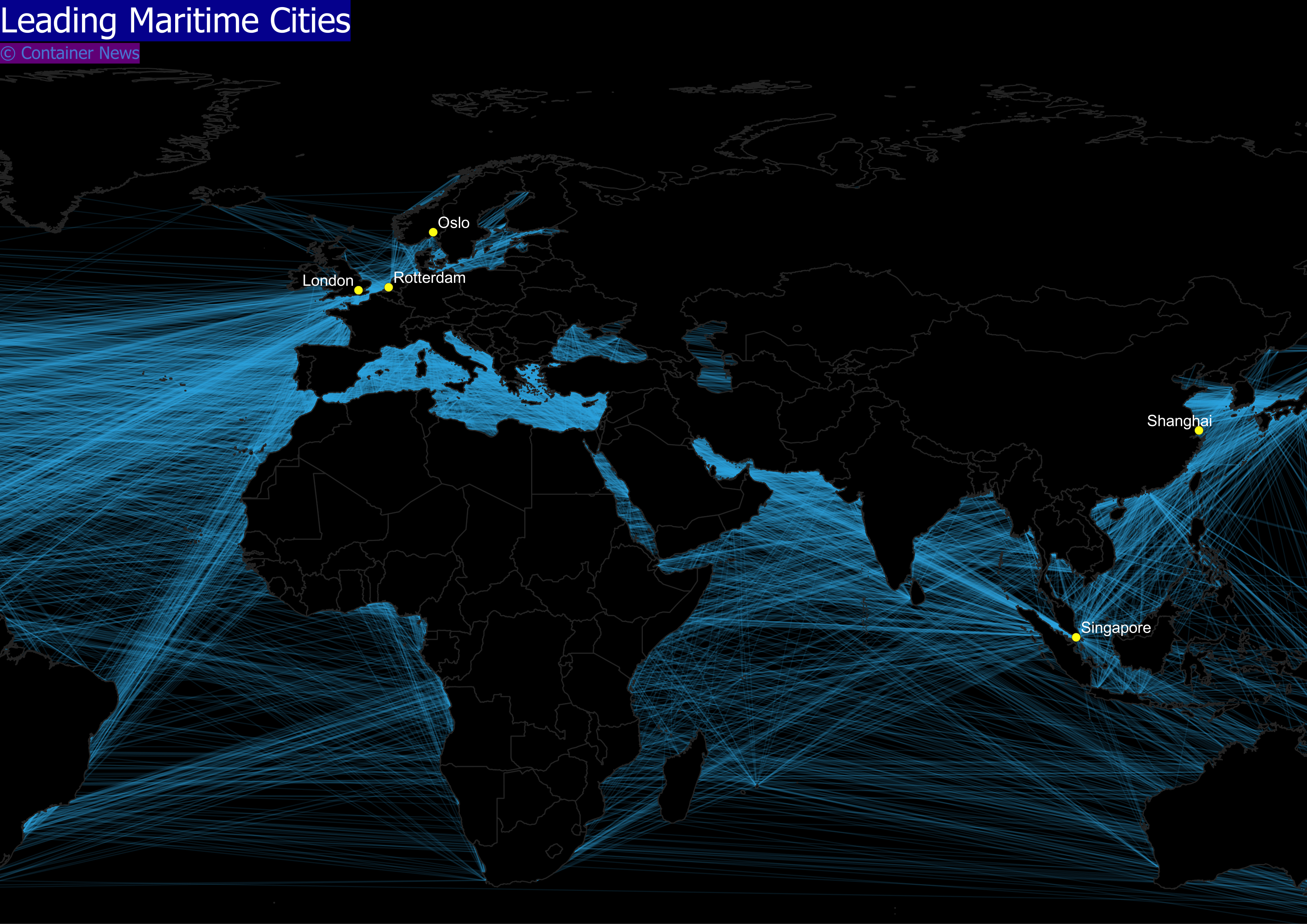

Significant changes have unfolded since the last publication of the Leading Maritime Cities (LMC) report. Global tensions have echoed across the maritime sector, markedly influencing the recent trends.

Notable events, including the Ukraine conflict, territorial disputes in the South China Sea, and ongoing unrest in the Red Sea, have created a multifaceted geopolitical environment that affects maritime pathways, regulations, and market dynamics.

Despite these challenges, the shipping industry has shown impressive resilience. Trade volumes have not been negatively impacted with forecasts remaining positive, anticipating an annual growth exceeding 2% from 2024 to 2028.

The 2024 edition of the LMC report introduces fresh insights into the world’s premier maritime cities, highlighting their capabilities to support maritime enterprises and professionals.

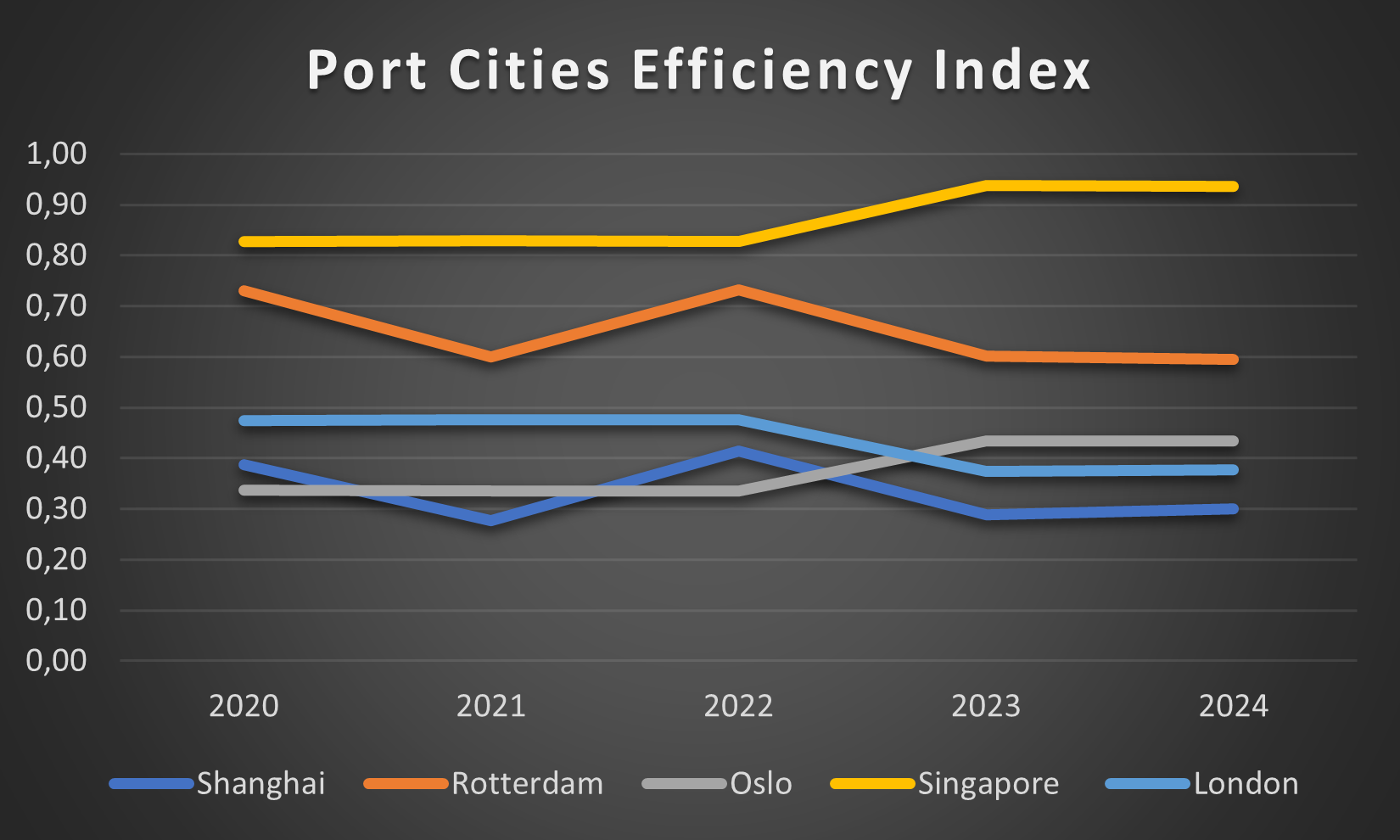

Container News expanded on this analysis by evaluating the report’s top five port cities across sectors such as technology adoption, customs efficiency, and connectivity scores. This deeper exploration aims to track performance trends from 2020 to 2024.

The Five Port Cities Included in the Analysis:

- Singapore, Singapore

- Rotterdam, Netherlands

- Oslo, Norway

- London, United Kingdom

- Shanghai, China

The analysis revealed a noticeable performance gap between Singapore and Rotterdam, with other port cities closely aligned in terms of efficiency.

Singapore consistently outperformed across all years, while Rotterdam maintained robust scores despite some volatility, particularly a decline post-2022. In contrast, Singapore’s performance notably improved during the same period.

Shanghai experienced fluctuations, possibly due to irregular technological enhancements or integration, though it ultimately surpassed London and Oslo by mid-2022 and stabilized thereafter.

London displayed a gradual decline throughout the period, indicating potential difficulties in keeping up with technological advancements in port operations. Meanwhile, Oslo registered the lowest scores among the cities studied, though it showed modest improvements in the last two years.

The analysis suggests a shift towards Asian port cities leveraging technological advancements, likely in response to the global maritime trade’s eastward pivot, while European ports grapple with significant fluctuations possibly triggered by global maritime trade disputes.

However, as geopolitical tensions influence trade policies and agreements, countries and companies may seek to diversify their trade routes and partnerships to mitigate risks. This could lead to the emergence of new maritime hubs or the strengthening of alternative routes such as the Arctic Route.