Since 2019, the global container market has grown 8%, ending at 183.2 million TEUs in 2024, according to Container Trade Statistics.

This growth, however, has been very uneven, according to BIMCO’s Chief Shipping Analyst Niels Rasmussen, with regional imbalances between exports and imports having increased by 33%.

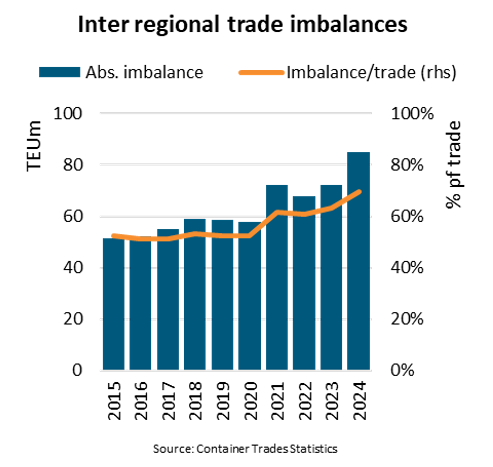

In 2019, regional imbalances totalled 58.8 million TEUs, equal to 52% of inter-regional trade, but grew to 84.9 million TEUs and 70% in 2024.

In absolute terms, the imbalance in the East & Southeast Asia region remained the largest at 42.4 million TEUs, up from 29.4 million TEUs in 2019. In other terms, the region exported 3 TEUs for every TEU imported in 2024.

“The increase in trade imbalances has been driven by faster export growth from East & Southeast Asia compared with all other regions except Sub-Saharan Africa, according to Rasmussen, who said: “In fact, exports from the Asian region have grown by 10.9 million TEUs, whereas the total inter-regional market has grown by only 9.5 million TEUs since 2019.”

In addition, East & Southeast Asian imports were 9% lower in 2024 than in 2019 which contributed to a contraction in exports, especially from Europe & Mediterranean and North America regions.

Historically, the relative imbalance has been the largest in the Sub-Saharan Africa region. In 2024, however, the imbalance in North America was the largest. North America imported 2.5 TEUs for every TEU exported. In Sub-Saharan Africa, imports were 2.3 times larger than exports.

The relative imbalance also grew in the Europe & Mediterranean and South & Central America regions but reduced in Oceania, Sub-Saharan Africa and Indian Subcontinent & Middle East regions.

Overall inter-regional trade balances remained within a 48-53% band between 2012 and 2020. It started climbing in 2021 as exports from East & Southeast Asia grew 11%. In 2024, those regions’ exports ended 21% higher than in 2019, whereas the total inter-regional market grew only 8% in the same period.

Rasmussen commented: “Imbalances within regions, and specific imbalances for specific container sizes and types, dictate liner operators’ cost for positioning empty containers. However, the increasing regional imbalances point to a larger and potentially more costly problem. To accommodate growing head-haul trades liner operators must deploy ever more and/or larger ships only to see a relatively smaller revenue potential in the back-haul trades.”

The article has been provided by BIMCO.