- Black Sea region growth for five countries

- Top five container terminals of the region

- Lines’ market shares in the region

Black Sea container terminals of Ukraine, Romania, Russia, and Bulgaria handled 3,099,168 TEU in 2021, including empty containers and excluding transshipment.

This review observes only full containers of the region, which translates to 2,425,673 TEU. The total increase achieved by these five countries for the period was 2,59% compared to the same period last year.

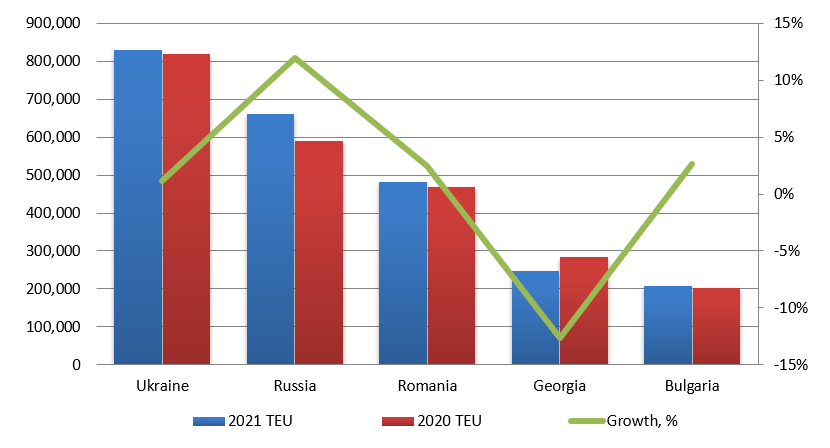

Black Sea region turnover, 2021 and 2020, TEU, laden containers

The laden container turnover increase was in all countries of the Black Sea region, except Georgia. In 2021 the highest growth was achieved by Russia – 11,97%, while in Georgia there was a decrease of 12,70%.

The laden container turnover increase was in all countries of the Black Sea region, except Georgia. In 2021 the highest growth was achieved by Russia – 11,97%, while in Georgia there was a decrease of 12,70%.

Laden container turnover by countries

| Country | 2021, TEU laden | 2020, TEU laden | Growth, % |

| Ukraine | 829,725 | 819,958 | 1,19% |

| Russia | 660,581 | 589,961 | 11,97% |

| Romania | 481,210 | 469,664 | 2,46% |

| Georgia | 247,415 | 283,404 | -12,70% |

| Bulgaria | 206,742 | 201,346 | 2,68% |

| Total | 2,425,673 | 2,364,333 | 2,59% |

During this period, 56,53% of full containers handled were imported, with 43,47% of the volume being exported. It is estimated that laden containers share was 78,27% and empty containers share was 21,73%.

Import volumes to the aforementioned countries increased by 2,38% compared to 2020. The highest import volume increase was shown by Russia and Romania – 10,39% and 6,37% respectively. In Ukraine and Bulgaria, there was an increase of 5,56% and 0,64% respectively, while in Georgia import volume has dropped by 17,79%. Exports from the region increased by 2,88%, mainly because of Russia and Georgian export volume growth of 14,01% and 14,20%. There was an increase of laden export volume in Bulgaria – 4,68%, meanwhile, Ukrainian and Romanian laden export volume have decreased by 3,87% and 1,28% respectively.

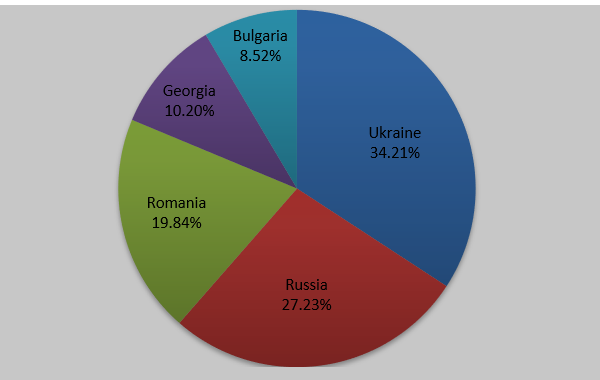

Thus, the percentage of laden volume handled by each country in 2021 distributed as follows: Ukraine – 34,21%, Russia (Black Sea) – 27,23%, Romania – 19,84%, Georgia – 10,20%, Bulgaria – 8,52%.

Black Sea countries shares by full containers turnover, 2021

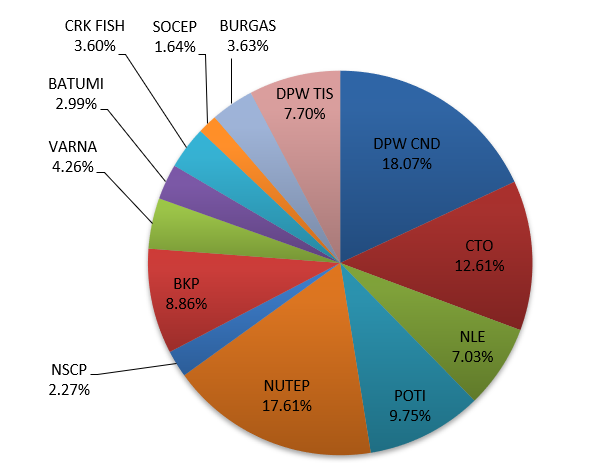

The top-five container terminals of the region in 2021 had a few changes in their positions by total volume handled: DPW (Constanta, Romania) still was the largest terminal, while NUTEP (Novorossiysk) remained second.

APM Terminals Poti (Georgia) moved to fourth place and CTO (Odessa, Ukraine) became the third-largest in the region. BKP (Odessa, Ukraine) remained fifth.

Black Sea Container Terminals shares by total turnover, 2021

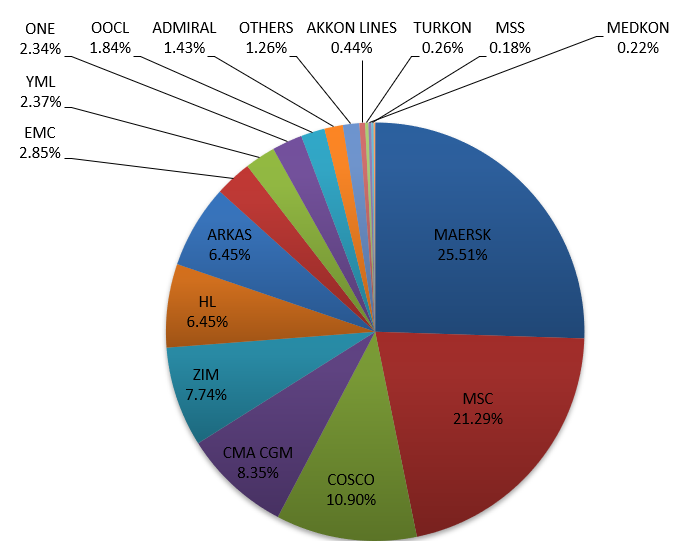

Regarding the leading carriers of the Black Sea region, the five largest box lines in the region secured their positions. In particular, Maersk, MSC, COSCO, CMA CGM and ZIM controlled 73,77% of this market.

Lines’ shares at the Black Sea region by full containers turnover, 2021

In 2020 the total market share of 2M Alliance partners, Maersk and MSC, was 47,44% and in 2021 it has decreased slightly to 46,79%.

At the same time, the total share of CMA CGM and COSCO, both members of Ocean Alliance, was 19,73% in 2020, while in 2021 it has decreased marginally to 19,24%.

In the meantime, ZIM remained a top-5 carrier of the region with its share remaining essentially stable at 7,73% in 2021.

Additionally, the Singapore-based container carrier Ocean Network Express (ONE) remained the 10th largest carrier of the region in 2021 with its share comprising 2,34%.

The Black Sea container market review was conducted by INFORMALL BG, an independent consulting and private equity firm, which has been established in 2005 by a team of executives with extensive experience in the transportation industry and corporate management.

Informall BG accommodates foreign investors in business set up and development in the Black Sea countries: Ukraine, Romania, Bulgaria, Russia (Black Sea), Georgia.