Global trade is in turmoil after the googly thrown at it by the Coronavirus, which has turned the outlook sharply from the expectation of decent growth to a likely batting collapse.

For the uninitiated the googly is a spinning ball that looks, when bowled, like it will head in one direction, but turns sharply in the other direction when it pitches. But cricketing analogies aside, there is a serious feeling that this year the global economy could be written off, as growth collapses like an England cricket team.

Braemar, quotes the Organisation of Economic Co-Operation and Development (OECD)’s secretary general, Angel Gurría, who believes the economic “shock” is already bigger than the financial crisis of 2008/09.

Gurria says that the global pandemic could halve this year’s growth, putting the forecast at 1.5%, but Braemar adds that this expectation is “already looking too optimistic”.

Maintaining a similar theme Allied Shipbroking’s research analyst George Lazaridis argues that “Most stock markets have seen their steepest decline (comparable to the time frame) witnessed since world war II.”

To emphasise his point Lazaridis drives home the intensity of the current crisis by arguing that if the current trend continues “It would take less than a month for us to mark similar accumulated losses to those summed up in 400 days during the financial crash of 2008.”

Lazaridis is not merely concerned with the immediate effect of the pandemic, but also what he calls the “Long-term linger hit from the sharp drop in consumer confidence”.

That will see pressure put on many companies as they struggle to survive, not just the period of lockdown in demand economies, such as Europe and the US, but also the prolonged anxiety that the post-pandemic period will bring.

“Insecurity is now ruling the markets and as such more and more will seek to hold on to their cash so as to boost, the best way they can, their longer-term financial security,” believes Lazaridis.

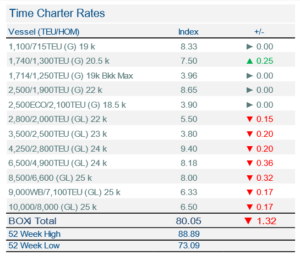

That liquidity held so dear, by the consumer is also the reasoning behind the fluid charter market which Jonathan Roach at Braemar argues is caused by the apparent recovery of production in China, which, he says “is evident from a liquid container chartering market”.

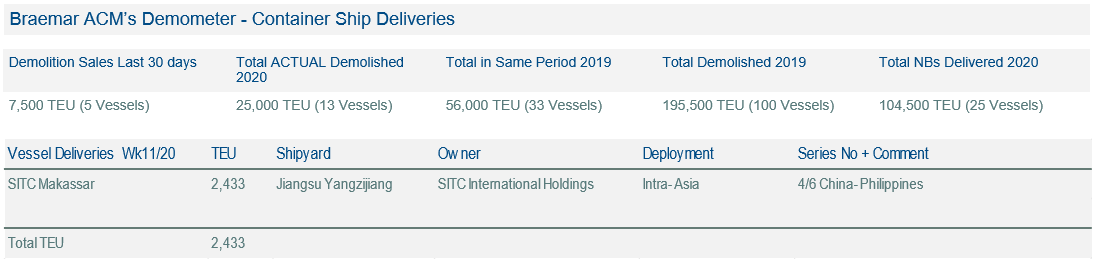

Meanwhile, Roach says that the demolition markets on the Sub-Continent have effectively closed, with little prospect of them reopening in the short-term and the Turkish demolition yards are likely to follow suit.

A liquid charter market, a moratorium on demolition and newbuildings still being delivered, it is a batting collapse that far exceeds anything a cricketing eleven can muster and leaves brokers hoping for a rapid resolution to this innings.

That said, many fear that the economy’s second innings could also be a shambles as “There is still a fear of an ‘encore’ event taking place in early Autumn, placing ever more weight on the need for an exit strategy from this crises, whether that be a vaccine, improved treatment or better protection measures for people.” Desperation may be taking hold in a market that needs something to stop the rot.