The persistent worry that world economies are not recovering from the coronavirus lockdowns robustly enough to absorb a new increase in oil production is still the downward driver on the global fuel market.

At the same time, International Bunker Industry Association’s (IBIA) members expect significant 2020 bunker demand drop due to the Covid-19 crisis.

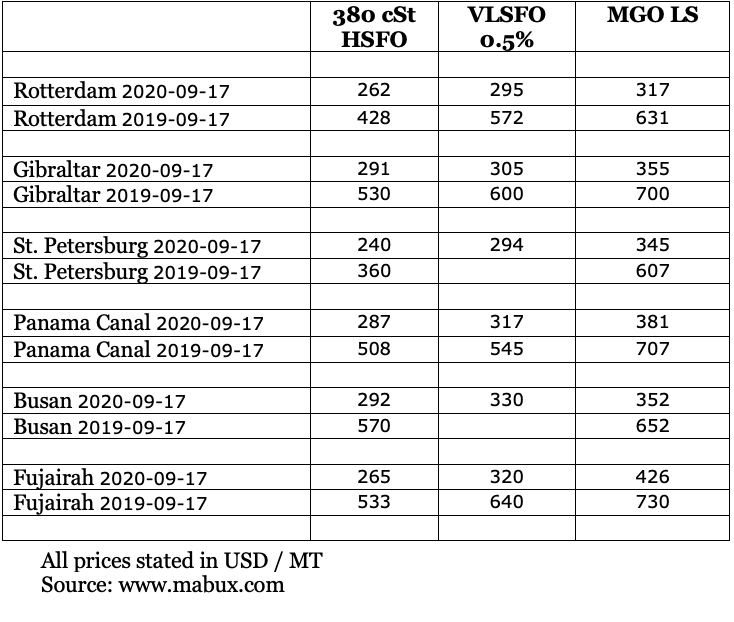

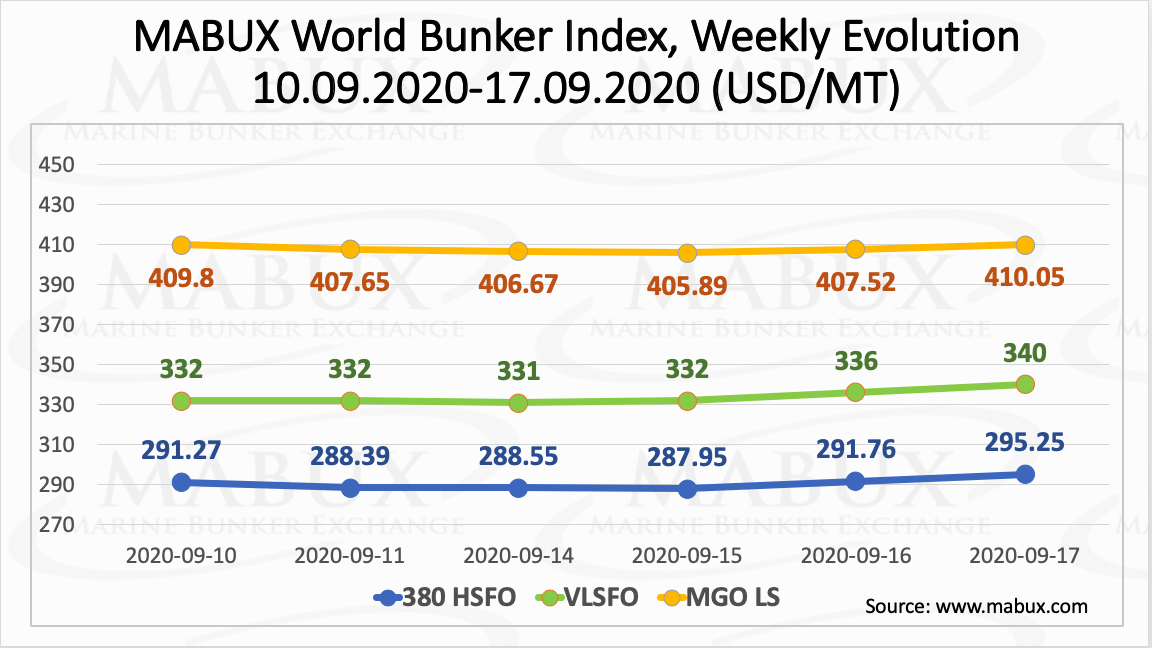

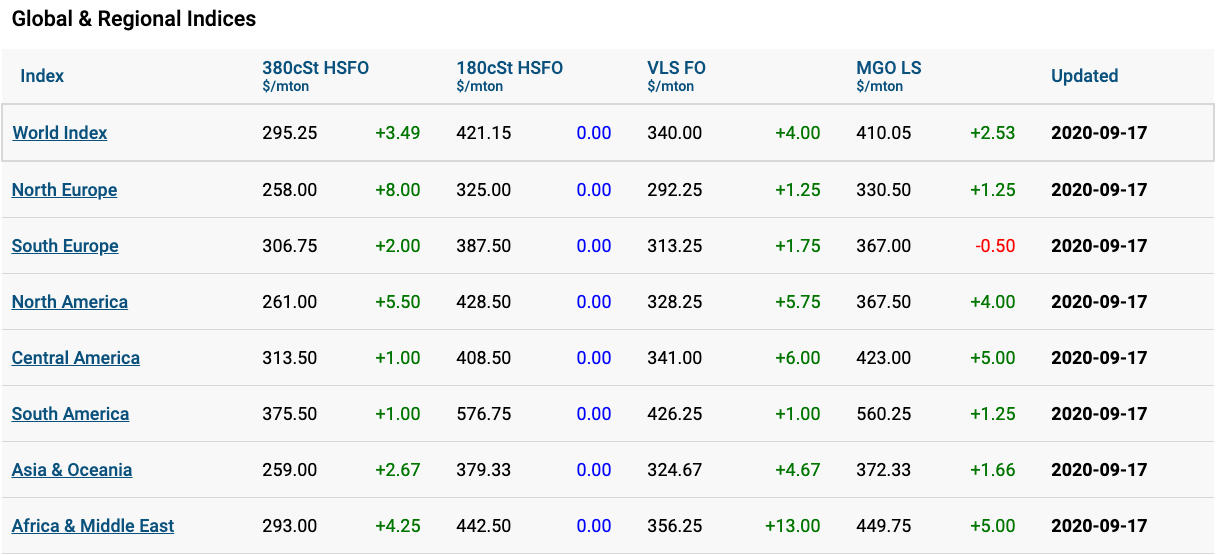

However, the World Bunker Index MABUX has demonstrated a slight upward evolution for a week, as all 380HSFO, VLSFO and MGO indexes increased.

At the same time, there are no significant changes in the global scrubber spread (the price difference between 380 HSFOs and VLSFOs). In particular, it has narrowed by US$1.42 and averaged US$43.31.

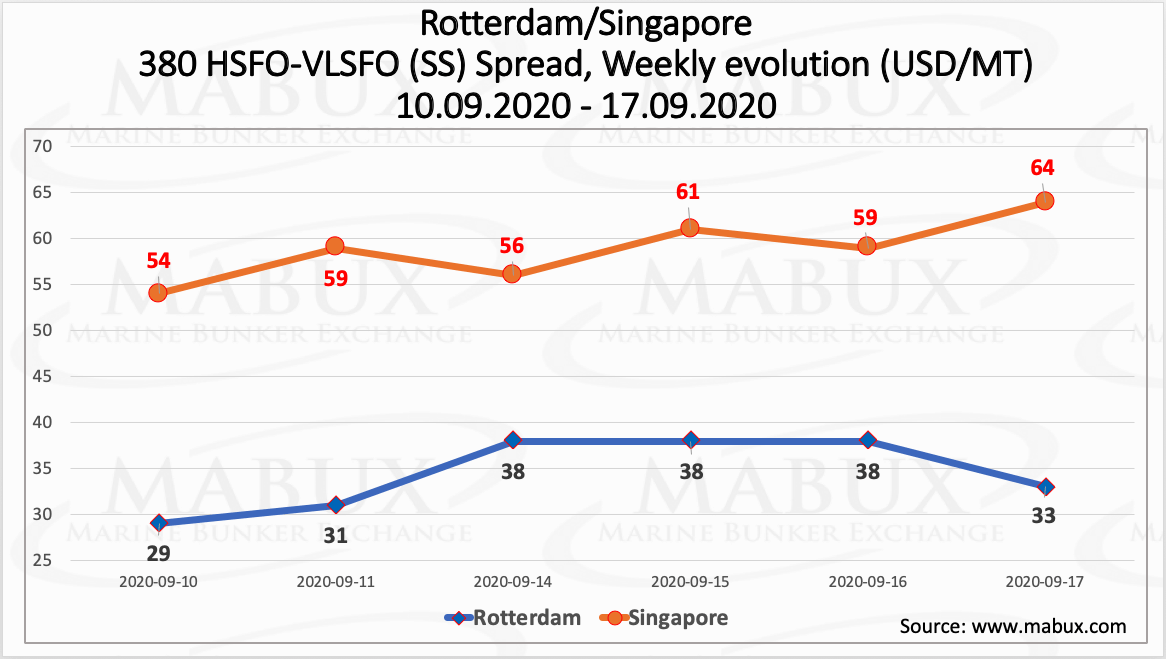

Meantime, the spread in Rotterdam has fluctuated during the week from US$29.00 up to US$38 and down to US$33.0 today, 17 September. The average value of the spread for the week has increased marginally to US$34.50.

In Singapore, the spread has changed slightly upward during the week and added US$10, while the average weekly SS Spread has increased to US$58.83.

An independent research and consultancy organisation specialised in developing innovative solutions to environmental problems, CE Delft reported, the use of scrubbers leads to an increase of CO2 emissions between 1.5% and 3% for a range of representative ships.

Another option to comply with limits for the sulphur content of fuel oil – using fuel oil with a sulphur content of 0.50% (VLSFO), respectively 0.10% or less (ULSFO) – leads to an improvement of the fuel quality in terms of aromatics content and viscosity.

The increase of emissions associated with desulphurisation in a refinery are higher than 1% and in many cases multiple times higher, depending on the quality improvement of the fuel, the refinery layout and the crude used. As per CE Delft, in many cases, the carbon footprint of using a scrubber is lower than low-sulphur fuels.

The European Parliament on 15-16 September voted in favour of including greenhouse gas emissions from the maritime sector in the European Union’s carbon market from 2022.

This would force shipowners to buy EU carbon permits to cover these emissions. The plan is to expand the scheme to include emissions from voyages within Europe, and this may affect voyages that are beyond EU borders according to some industry bodies.

It is expected that the expansion of the scheme may take until 2023 to implement.