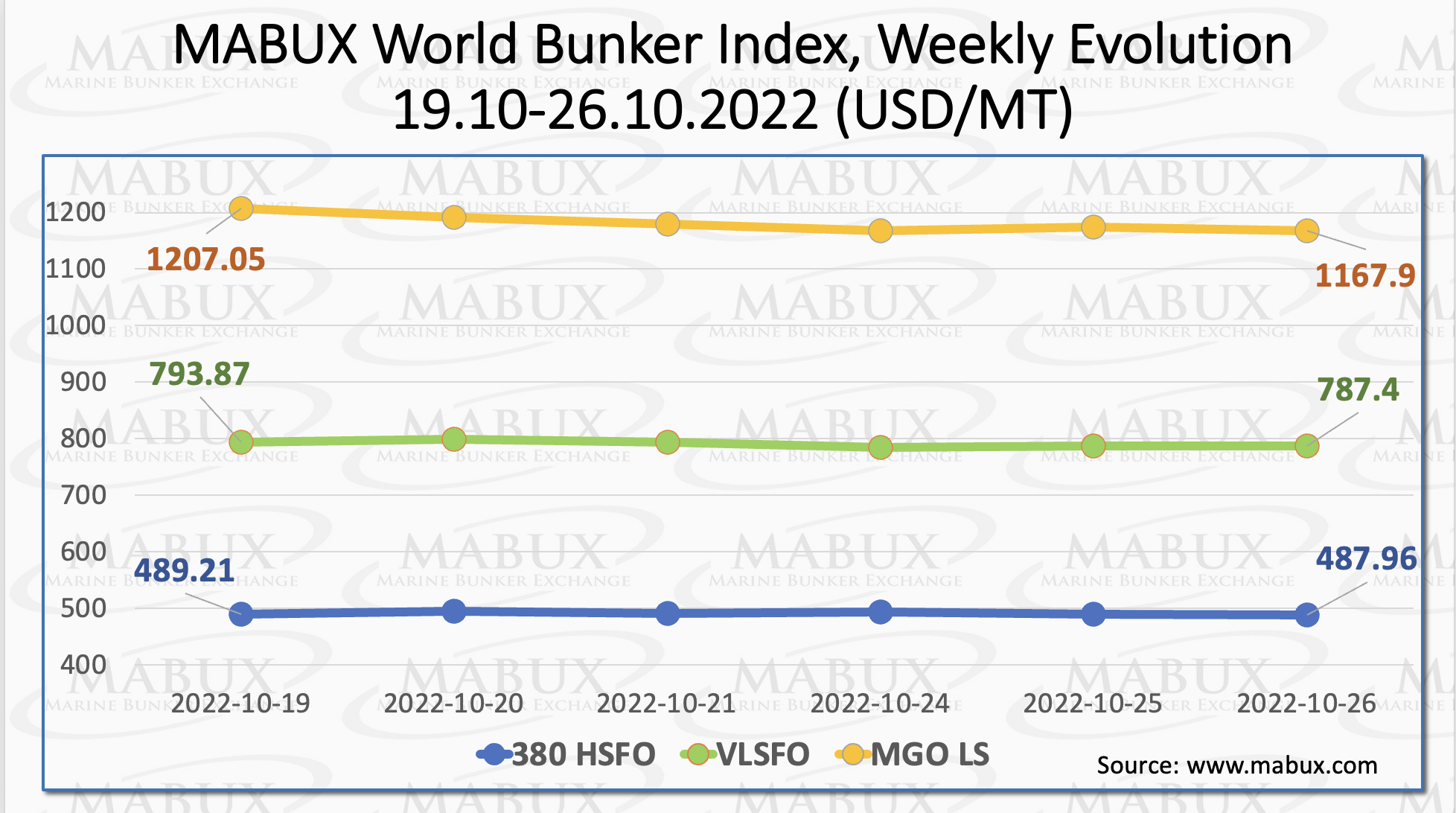

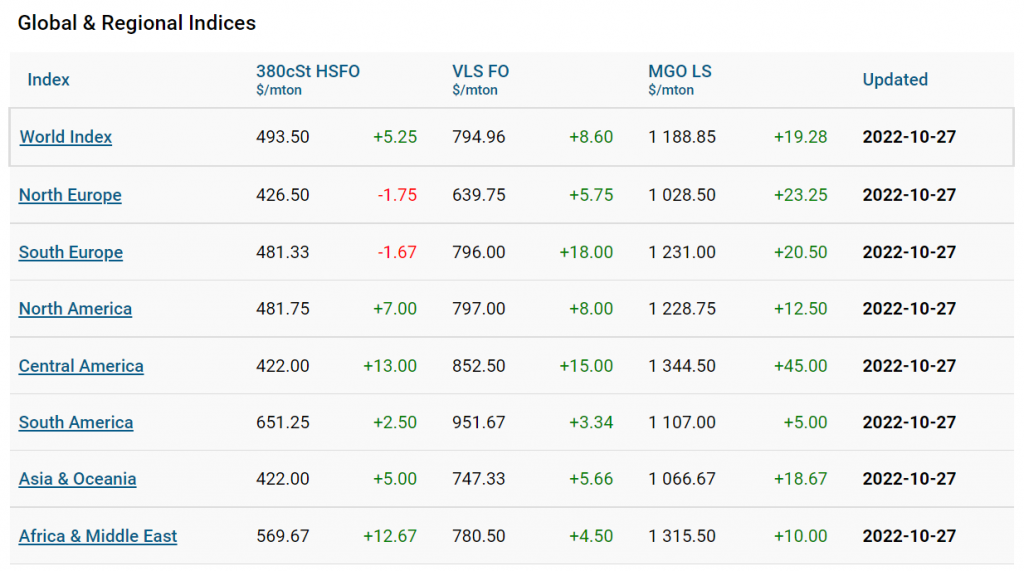

Over Week 43, MABUX global bunker indices continued their moderate downward

movement. The 380 HSFO index fell to US$487.96/MT, the VLSFO index, in turn, fell to US$787.40/MT and the MGO index showed the most significant drop to US$1,167.90/MT.

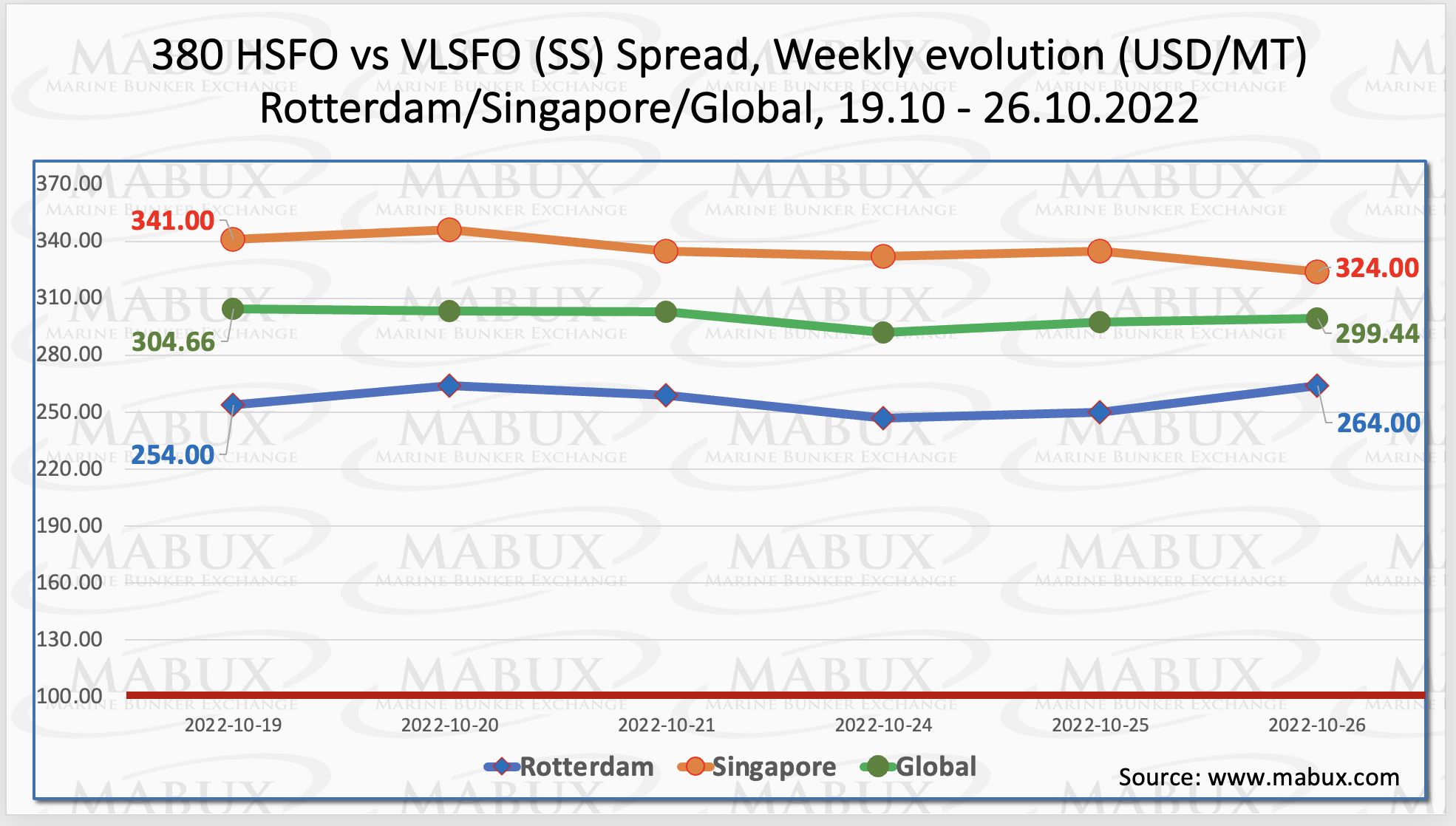

The global weekly average Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – showed a downward reversal in week 43 and fell below US$300. In Rotterdam, the average SS Spread increased to US$256.33. In Singapore, the average weekly spread of 380 HSFO/VLSFO fell to $335.50.

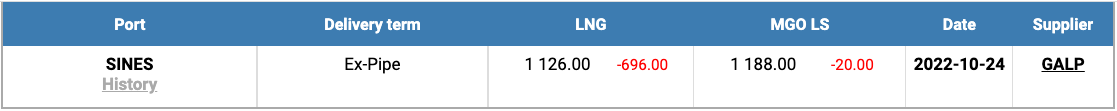

European countries have reported that their gas storage facilities have been filled at higher

than usual levels before the start of winter. Yet more LNG cargoes are arriving in Europe. As a result, the price of LNG as bunker fuel at the port of Sines (Portugal) continued its sharp decline on 24 October and reached US$1,126/MT. Thus, the LNG price fell below the level of MGO LS at the port of Sines for the first time since June 2021. On 24 October, the price of MGO LS in the port of Sines was quoted at US$1,188/MT.

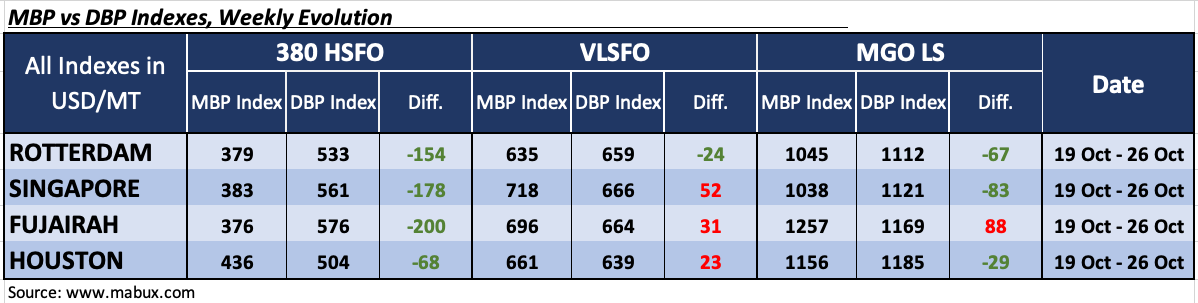

Over Week 43, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) continued to register

underpricing of 380 HSFO fuel in all four selected ports.

Underestimation margins changed irregular, increasing in Rotterdam – minus US$154 and Fujairah – minus US$200, and decreasing in Houston to minus US$68. In Singapore, the undercharge ratio of this fuel grade has not changed.

VLSFO fuel grade, according to MDI, was overpriced in three out of four ports selected, Singapore – plus US$52, Fujairah – plus US$31 and Houston – plus US$23. The overcharge dynamics did not have a firm trend. The only underpriced port in the VLSFO segment remained Rotterdam – minus US$24.

In the MGO LS segment, MDI registered the return of the port of Houston to the

undercharge zone – minus US$29, where it joined Rotterdam, and Singapore. Fujairah remained the only overvalued port in this fuel segment – plus US$88.

“The global bunker market is waiting for the formation of a sustainable bunker trend, while fuel indices are expected to continue irregular fluctuations,” said Sergey Ivanov, director of MABUX.