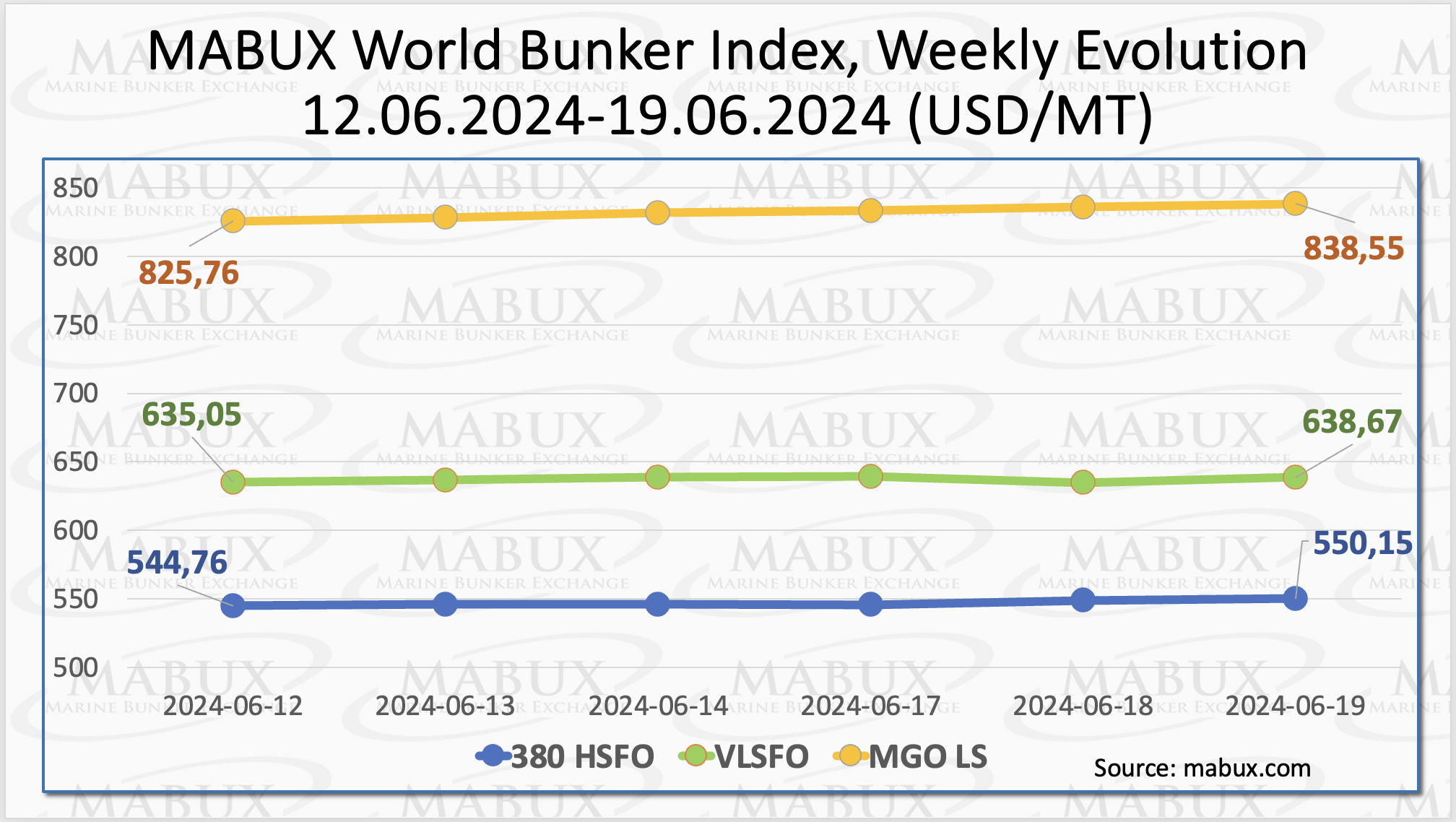

In the 25th week of the year, the Marine Bunker Exchange (MABUX) global bunker indices continued their upward trajectory.

The 380 HSFO index increased by US$5.90, rising to US$550.15/MT, the VLSFO index jumped by US$3.62, reaching US$638.67/MT, and the MGO index experienced the most significant growth, rising by US$12.79 to US$838.55/MT.

“As of the current update, the global bunker market maintains a moderate upward trend,” stated a MABUX official.

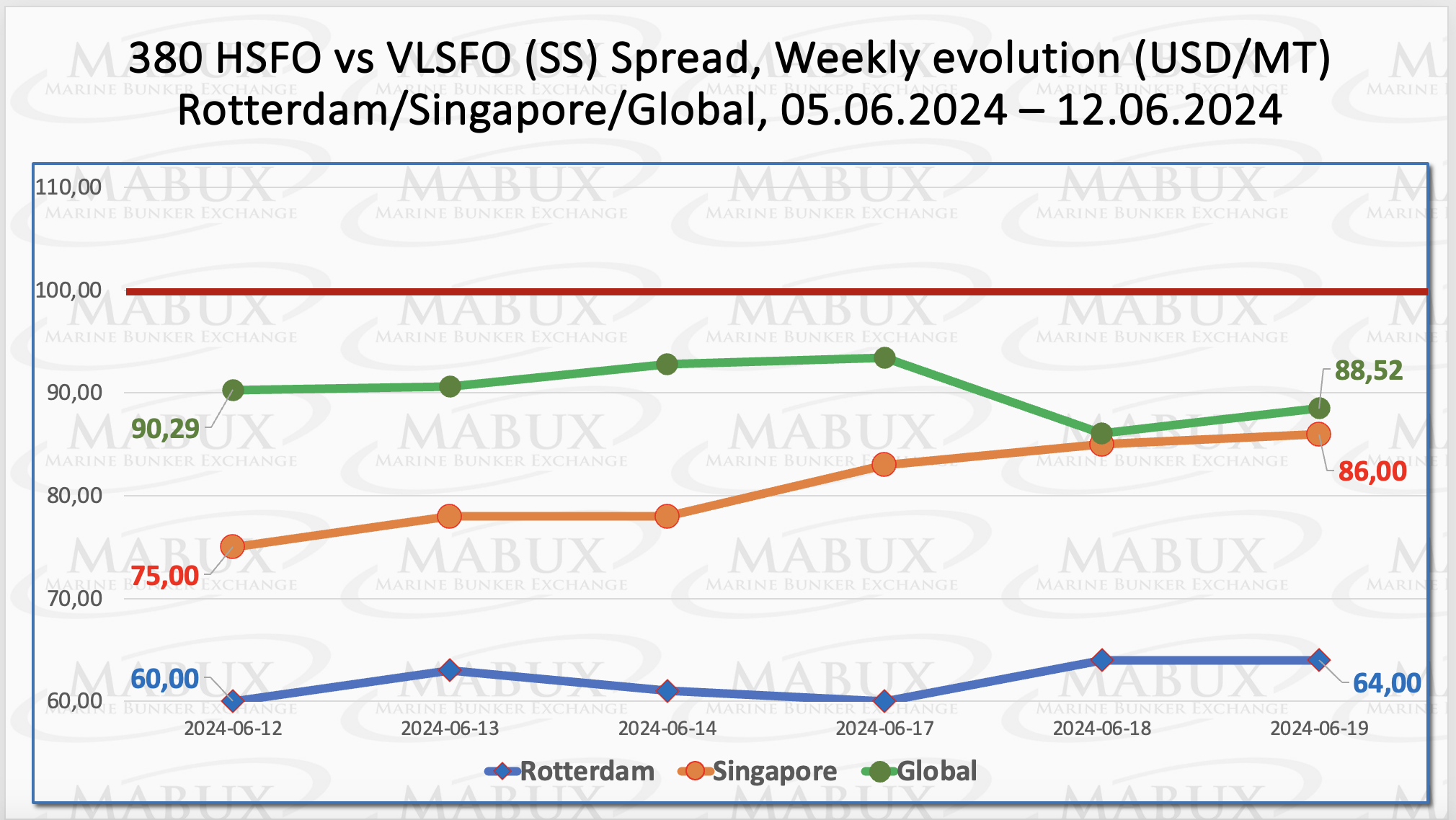

The MABUX Global Scrubber Spread (SS), which represents the price difference between 380 HSFO and VLSFO, showed a slight decrease to minus US$1.77. Despite this decline, the spread remains consistently below the US$100 mark, known as the SS Breakeven. Conversely, the average weekly value increased by US$2.05.

In Rotterdam, the SS Spread increased for the first time in three weeks, rising by US$4. However, the average weekly value at the port decreased by US$5.17. Meanwhile, in Singapore, the price difference between 380 HSFO and VLSFO widened to US$11, steadily approaching the US$100 threshold. The weekly average at this port increased by US$7.83.

Overall, the SS Spread has stabilized at these levels, suggesting a potential upward correction in the near future.

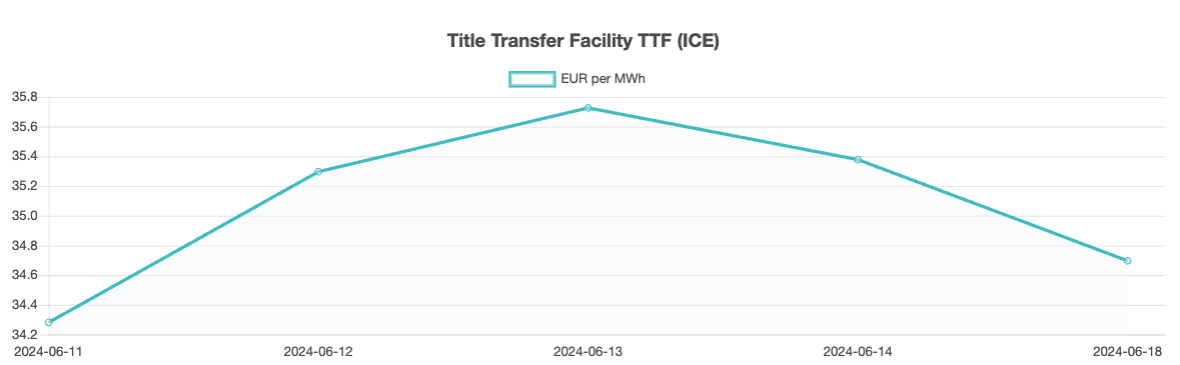

As of 11 June, gas storage sites in the European Union were filled to 72.3% capacity. The refilling season began following winter, during which storage levels were at a record high of 58%, influenced by a mild winter and reduced industrial demand. Despite this, the pace of replenishing gas inventories has been slower than usual, contributing to the upward trend in European gas prices.

These price increases also reflect recent supply uncertainties from Norway and Russia. Moreover, heightened competition for LNG supply in Asia, driven by severe heat waves in South and Southeast Asia, has diverted cargoes away from Europe. In Week 25, the European gas benchmark TTF saw a slight increase, rising by 0.415 EUR/MWh to 34.700 EUR/MWh compared to 34.285 EUR/MWh the previous week.

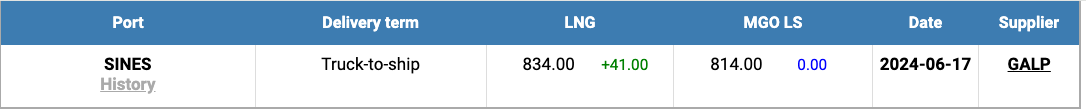

The price of LNG as bunker fuel in the port of Sines (Portugal) began to rise again, reaching US$834/MT on 17 June, an increase of US$41 from the previous week. Simultaneously, the price difference between LNG and conventional fuel on 17 June showed a US$20 advantage for MGO LS, compared to a US$4 advantage for LNG the week before. On that day, MGO LS was priced at US$814/MT in the port of Sines.

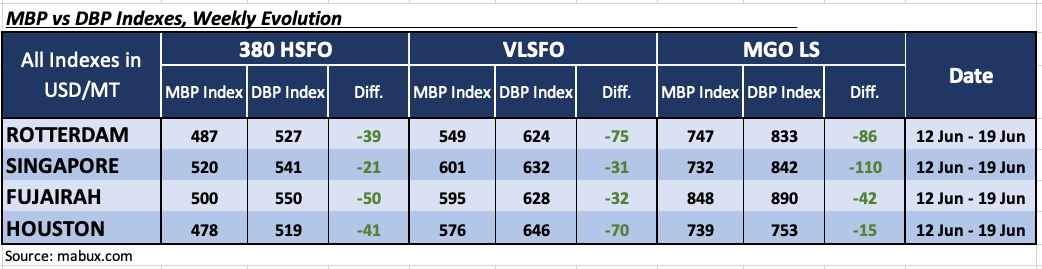

In Week 25, the MDI index, which measures the correlation between market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index), indicated underpricing across all fuel segments in the four largest hubs: Rotterdam, Singapore, Fujairah, and Houston.

In the 380 HSFO segment, the weekly underprice averages increased by 4 points in Rotterdam, 12 points in Singapore, 18 points in Fujairah, and 11 points in Houston.

For the VLSFO segment, the average weekly undervaluation levels rose by 18 points in Rotterdam, 8 points in Singapore, 12 points in Fujairah, and 13 points in Houston.

In the MGO LS segment, the weekly averages grew by 16 points in Rotterdam, 13 points in Singapore, 26 points in Fujairah, and 10 points in Houston. Notably, the MDI index in Singapore surpassed the US$100 mark once again.

“We expect the global bunker market to continue its steady upward movement next week,” pointed out Sergey Ivanov, director of MABUX.