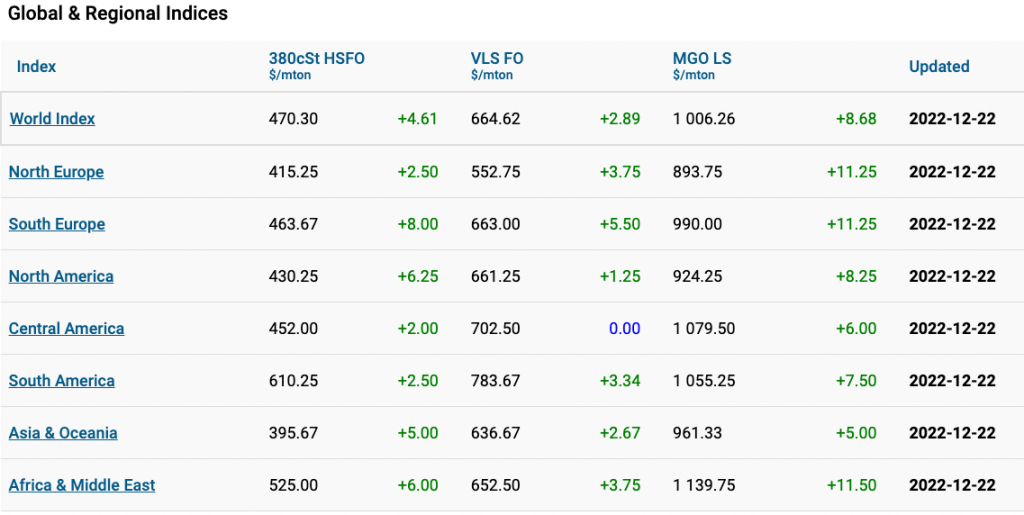

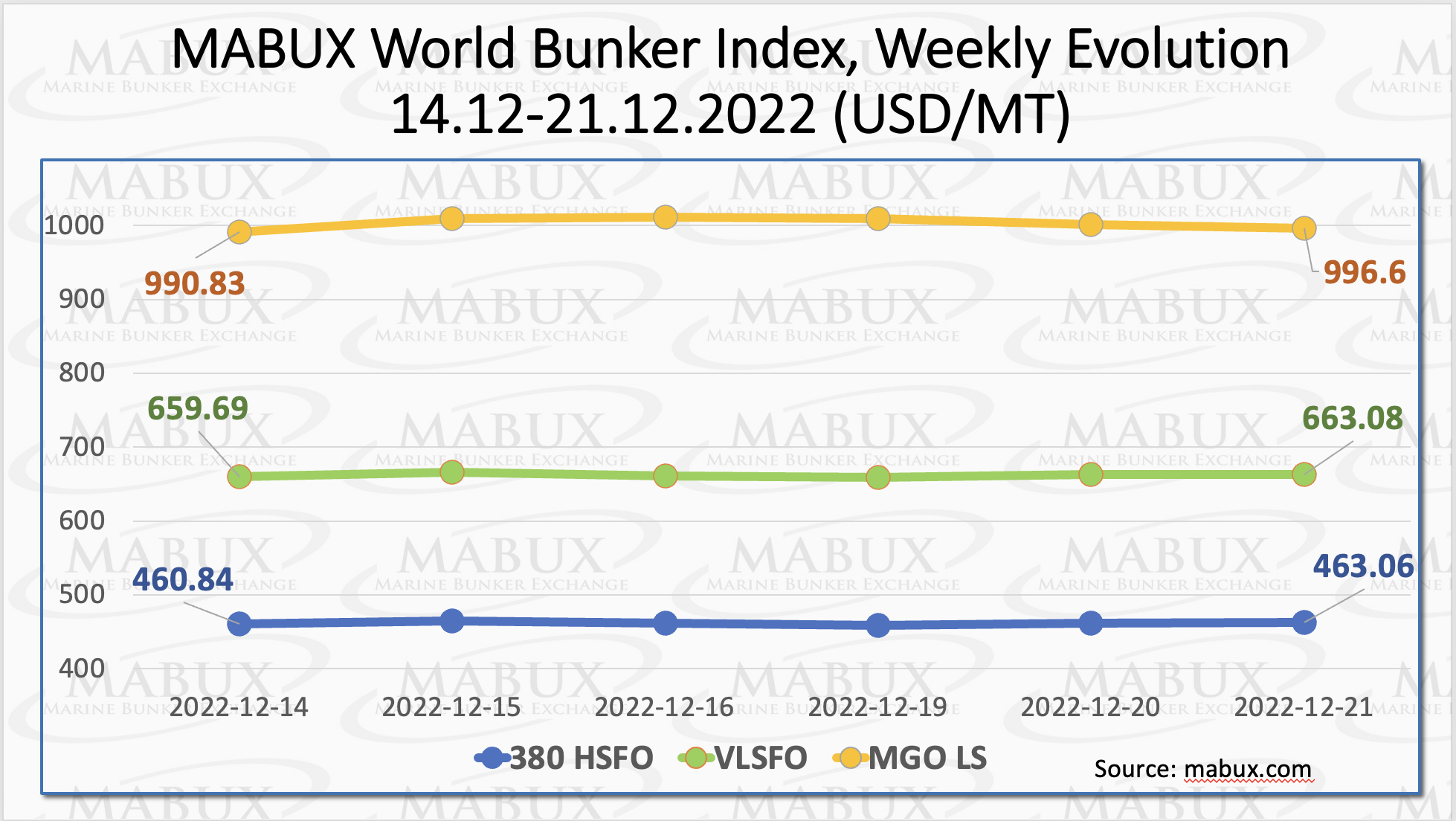

According to the weekly outlook of Marine Bunker Exchange (MABUX) for fuel prices, global bunker indices stopped declining and switched to moderate upward correction.

The 380 HSFO index rose slightly to US$463.06/MT, the VLSFO index increased to US$663.08/MT, while the MGO index climbed to US$996.60/MT.

“However, the emerging growth of the indices has not yet transformed into a firm uptrend,” pointed out a MABUX official.

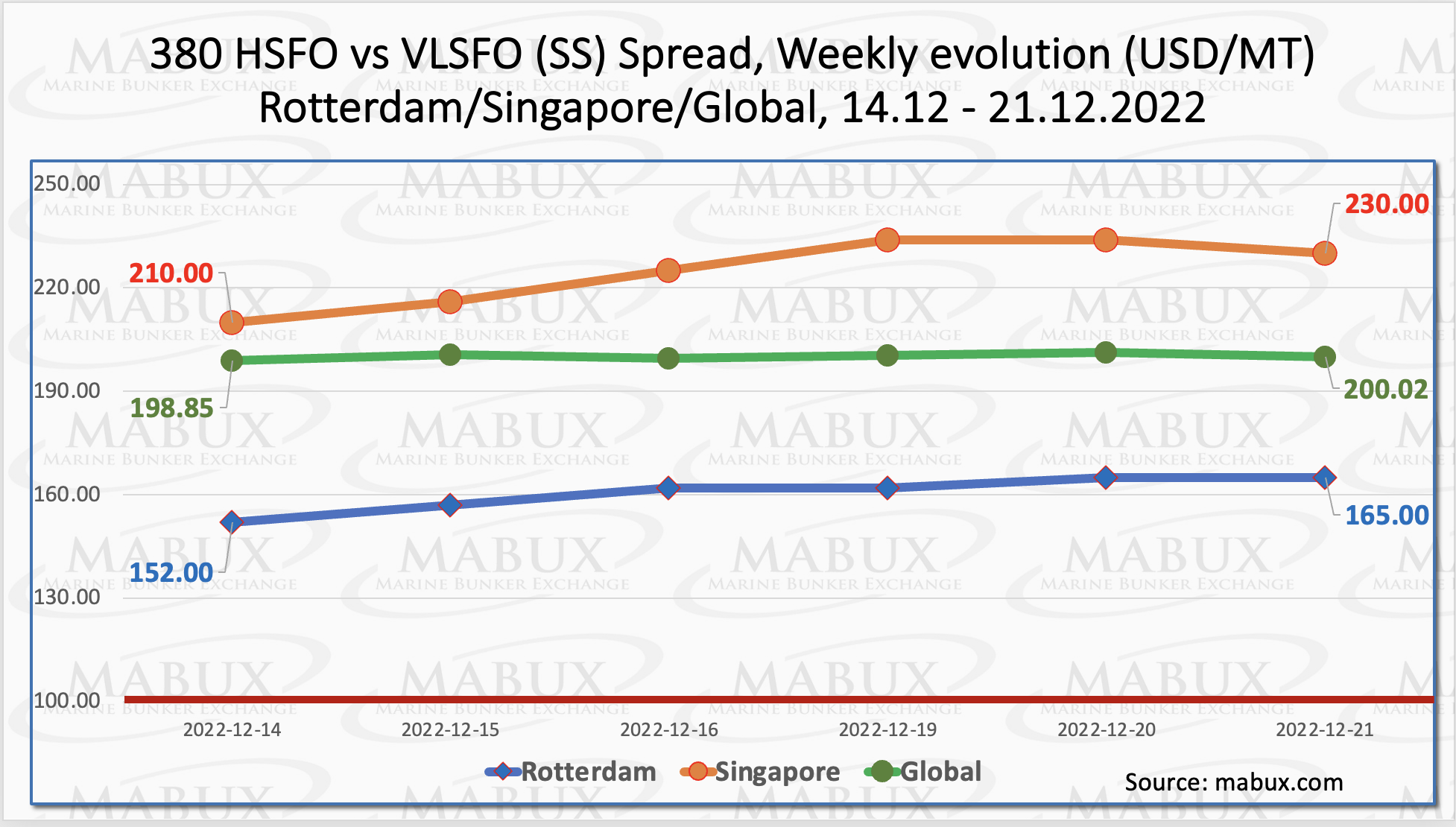

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – also showed a slight increase over Week 51, reaching US$200.02. In Rotterdam, SS Spread added US$13 climbing to US$165, while in Singapore, the 380 HSFO/VLSFO price differential showed the most significant increase of US$20, reaching US$230.

“It is expected that SS Spread does not have significant changes next week due to the start of the New Year holidays,” noted a MABUX official.

According to MABUX, the European Union (EU) finally agreed on 19 December to set a price cap on natural gas to protect consumers from excessive price spikes and limit inflationary pressure and industrial damage to European economies. The price cap, however, could limit Europe’s capacity to continue to draw most of the global spot LNG supply.

Some EU member states, such as Germany and the Netherlands, had concerns about a price cap, saying that market intervention and a ceiling on prices could take away Europe’s key advantage in attracting LNG supply this year—higher prices than in Asia.

Europe’s energy systems were already put to the first real test this month amid an Arctic blast that swept through most of northwestern Europe, bringing freezing temperatures, snow in the United Kingdom, and depressing wind speeds in Germany. Meantime, natural gas storage sites in the EU started to drain, with storage at 84% as of 17 December.

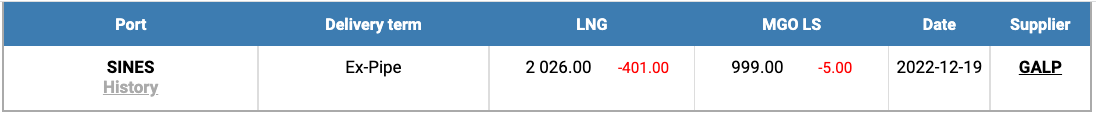

The price of LNG as bunker fuel at the port of Sines in Portugal fell further to US$2,026/MT on 19 December.

However, the price of LNG still surpasses that of the most expensive traditional bunker fuels by US$1,02. On 19 November the price of MGO LS at the port of Sines was quoted at US$999/MT.

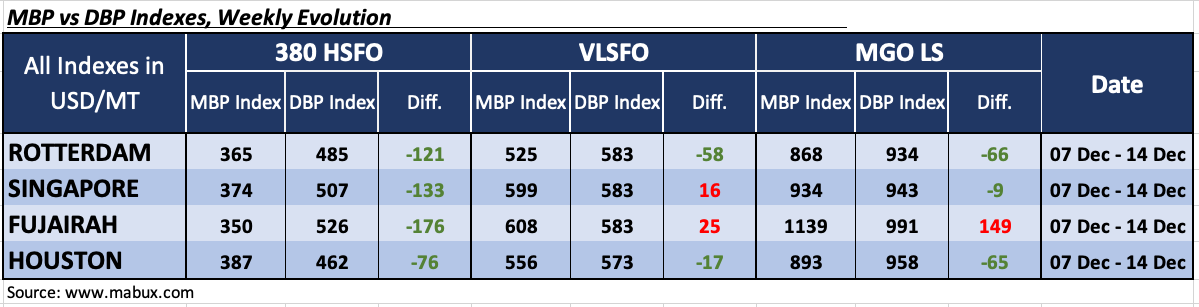

Over the Week 51, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered an underestimation of 380 HSFO fuel grade in all four selected ports. Underprice ratio slightly increased in all ports. The undercharge margins were registered as: in Rotterdam – minus US$121, Singapore – minus US$133, Fujairah – minus US$176 and in Houston – minus US$76.

In the VLSFO segment, according to MDI, Singapore and Fujairah are still overvalued. The overcharge ratio moderately decreased and amounted to plus US$16 and plus US$25, respectively.

In Rotterdam and Houston, this type of fuel was underestimated by an average of minus US$58 and minus US$17. The underestimation has increased slightly.

In the MGO LS segment, Singapore moved into the undercharge zone with minus US$9. Thus, according to the MDI, except Singapore, Rotterdam – minus US$66 and Houston – minus US$65 also remain underestimated over the week. The only overvalued port is Fujairah, plus US$149. Undercharge premium has risen, while overprice one has declined.

“We do not expect any drastic changes in bunker indices since the New Year holidays have started. Irregular changes with no sustainable trend will prevail in Global Bunker Market next week,” stated Sergey Ivanov, director of MABUX.