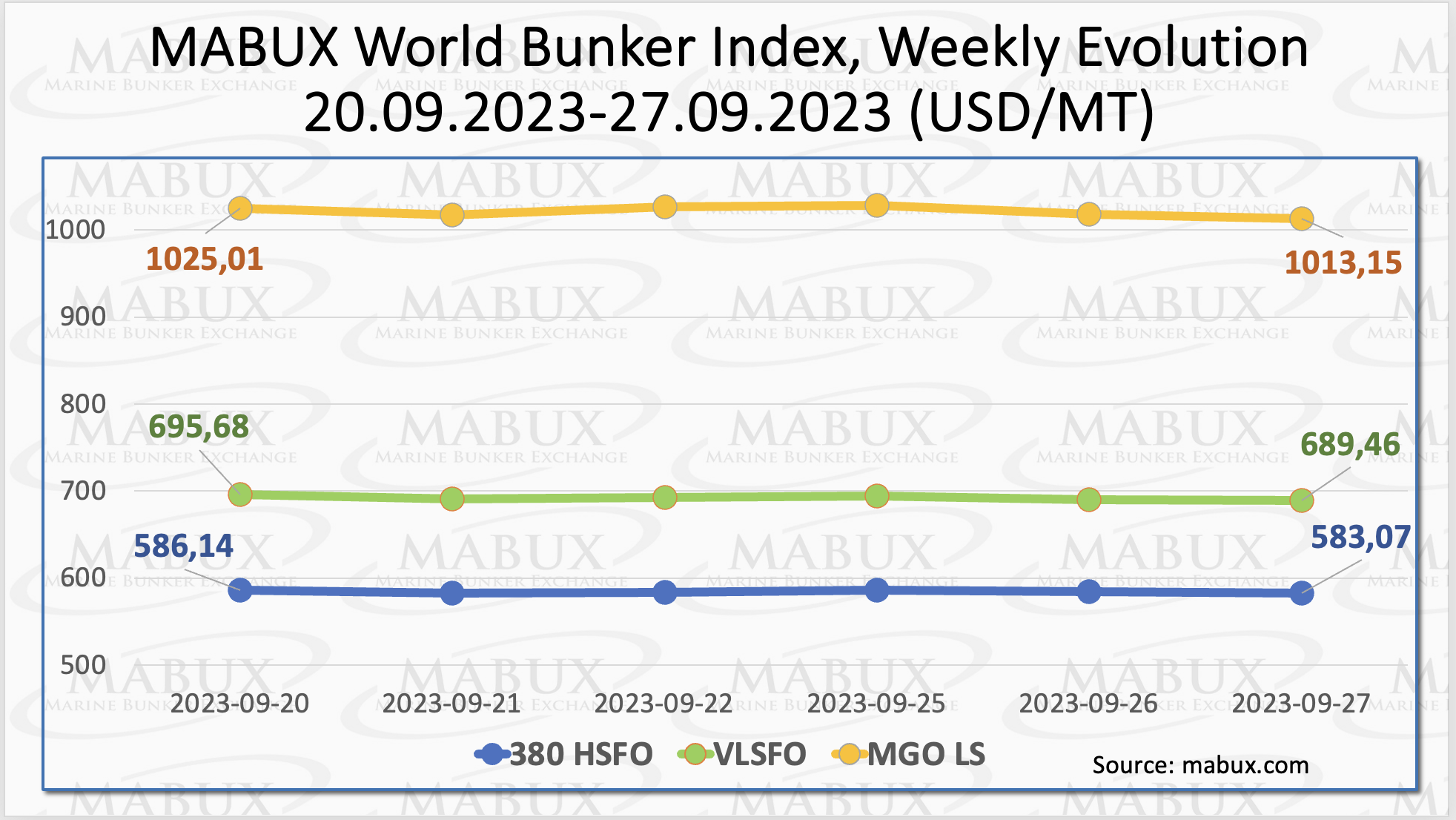

The Marine Bunker Exchange (MABUX) indices turned into a decline for the first time in the last four weeks. The 380 HSFO index fell by US$3.07, the VLSFO index lost US$6.22 and the MGO index decreased by US$11.86.

“At the time of writing, bunker indices have resumed an upward trend,” noted a MABUX official.

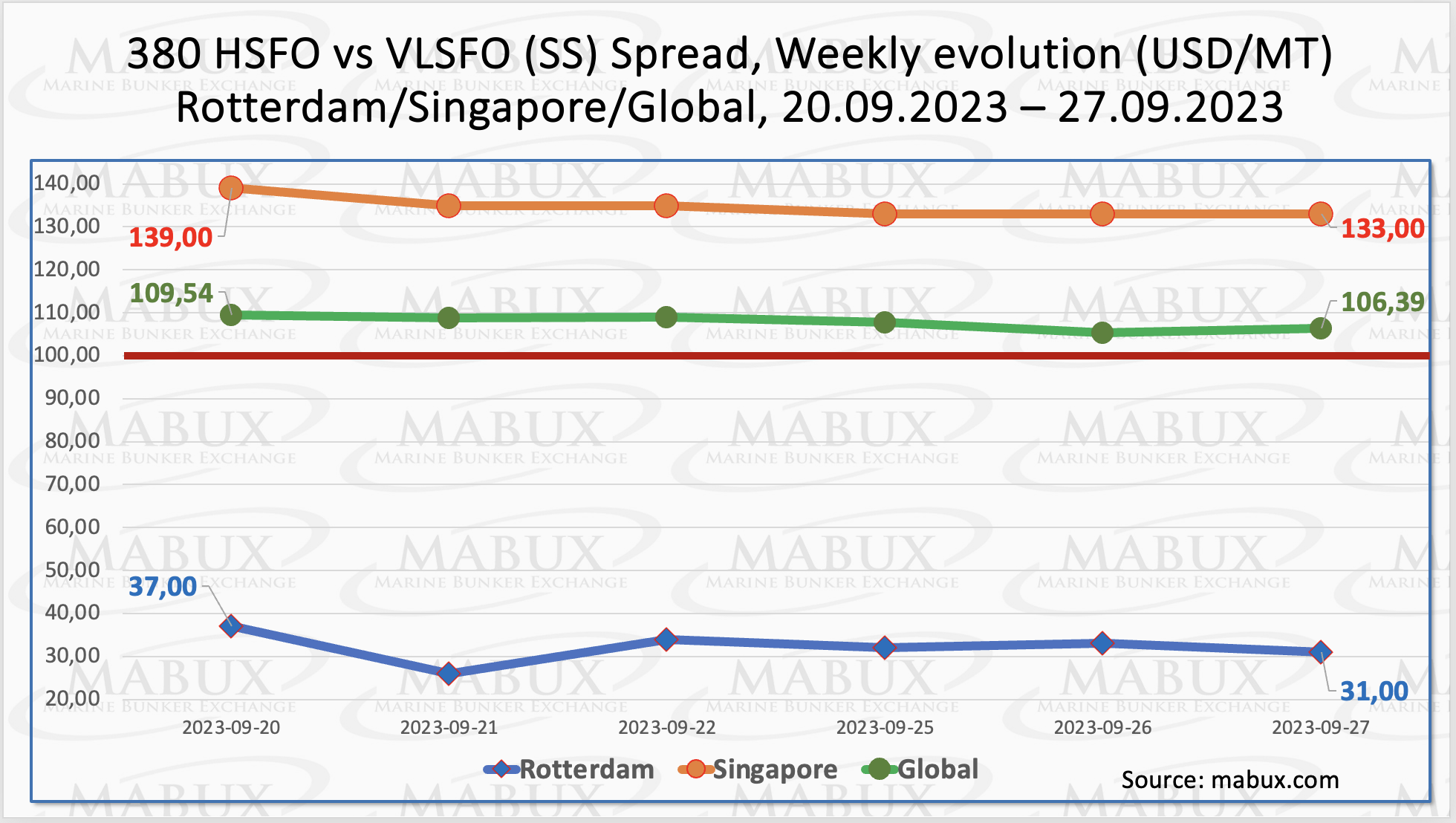

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – has also shown a decline of US$3.15. Meanwhile, the weekly average increased slightly by US$1.19.

In Rotterdam, SS Spread dropped by US$6 from US$37 last week to US$31. The average weekly SS Spread in Rotterdam, on the contrary, increased by US$3.34.

In Singapore, the price difference between 380 HSFO and VLSFO decreased by US$6, while the weekly average rose by US$15.50.

“We do not expect a sustainable trend in the SS Spread dynamics for the following week,” pointed out the MABUX representative.

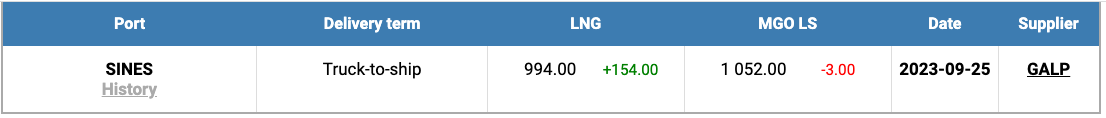

Benchmark natural gas prices in Europe and the UK experienced an early drop following the resolution of a labor dispute between Chevron and trade unions, resulting in the cancellation of strikes at two significant LNG export facilities in Australia.

European prices have been marked by substantial volatility in recent weeks, primarily attributed to the strikes in Australia and operational issues at major US LNG export facilities. Additionally, European gas prices witnessed a decline as the substantial Troll gas field in Norway resumed production and began increasing its exports to Europe after an extended maintenance period.

Nevertheless, the price of LNG as bunker fuel in the port of Sines (Portugal) surged, reaching US$994/MT on 25 September. The difference in price between LNG and conventional fuel on 25 September decreased significantly, US$58 in favor of LNG versus US$214 a week earlier, MGO LS was quoted that day in the port of Sines at US$1052/MT.

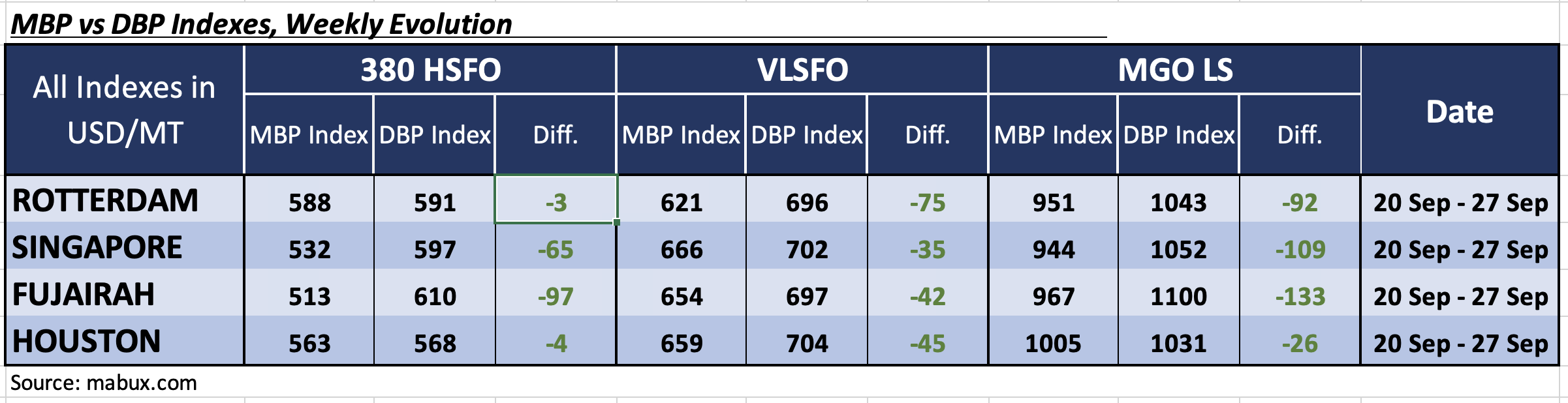

During Week 39, the MDI index (the ratio of market bunker prices to the digital bunker benchmark MABUX) recorded underpricing of all types of bunker fuels in the selected ports.

Thus, in the 380 HSFO segment, the average weekly underpricing increased in all ports, by 13 points in Rotterdam, by 33 points in Singapore, by 19 points in Fujairah and by 3 points in Houston.

For the VLSFO segment, according to the MDI, the average undervaluation index increased by 11 points in Rotterdam, 9 points in Singapore, 5 points in Fujairah and 12 points in Houston.

In the MGO LS segment, the average underpricing premium increased in Rotterdam by 3 points and in Singapore by 13 points, but decreased in Fujairah by 3 points and in Houston by 12 points.

“We expect that next week there will be no sustainable trend in the global bunker market, while bunker prices will change irregularly,” commented Sergey Ivanov, director of MABUX.