The military conflict in Ukraine and the potential of up to three million barrels per day (bpd) loss of Russian supply have caused extreme volatility in bunker markets.

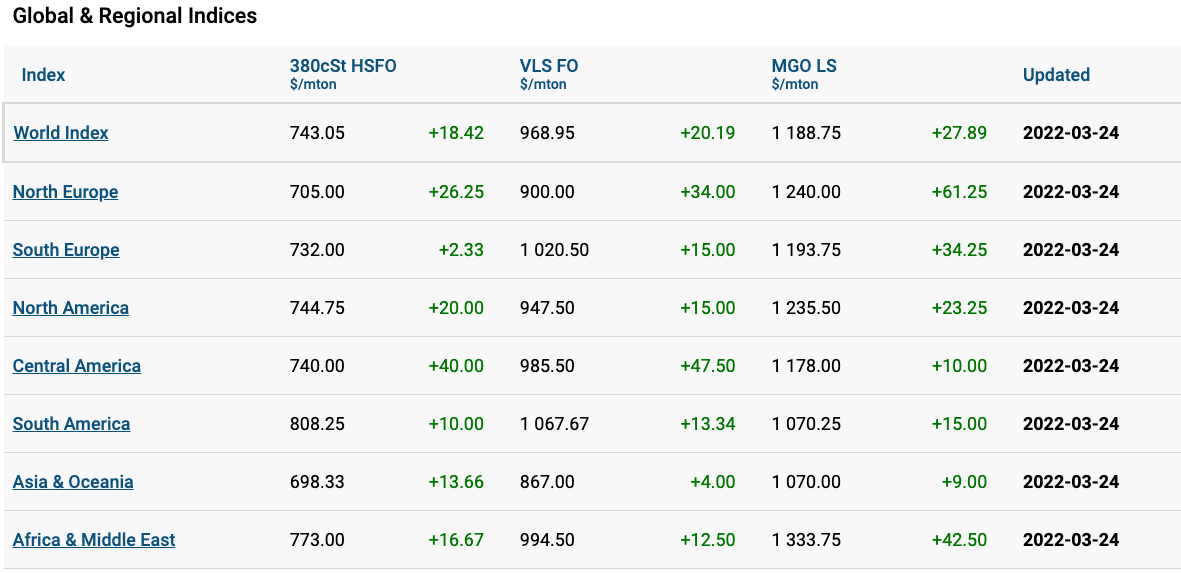

The 380 high-sulphur fuel oil (HSFO) Index rose to US$721.83/MT during the twelfth week of the year, the very low sulphur fuel oil (VLSFO) index grew to US$943.85/MT, while the marine gas oil (MGO) jumped to US$1,159.08/MT.

At the same time, growth rates have significantly decreased compared to those two weeks earlier, according to Marine Bunker Exchange (MABUX) analysts.

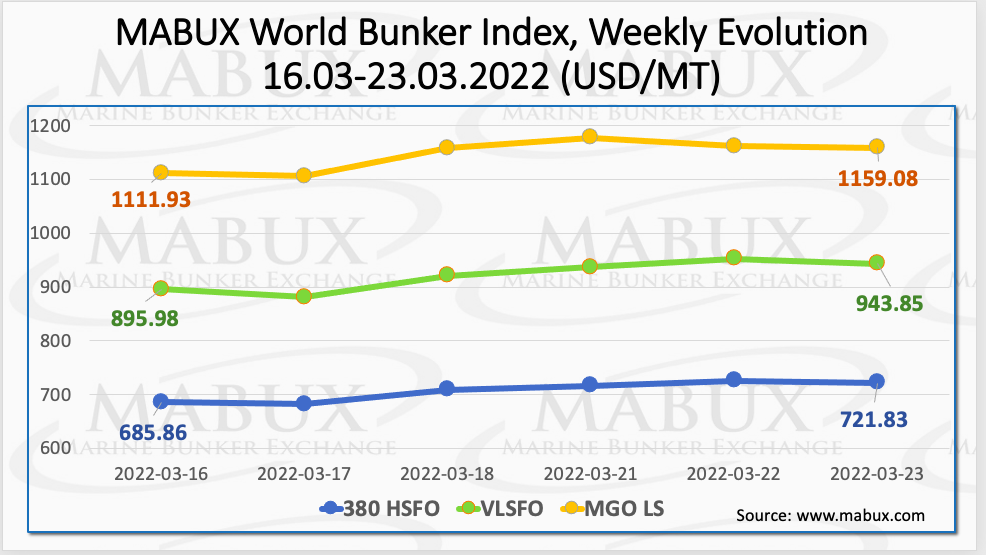

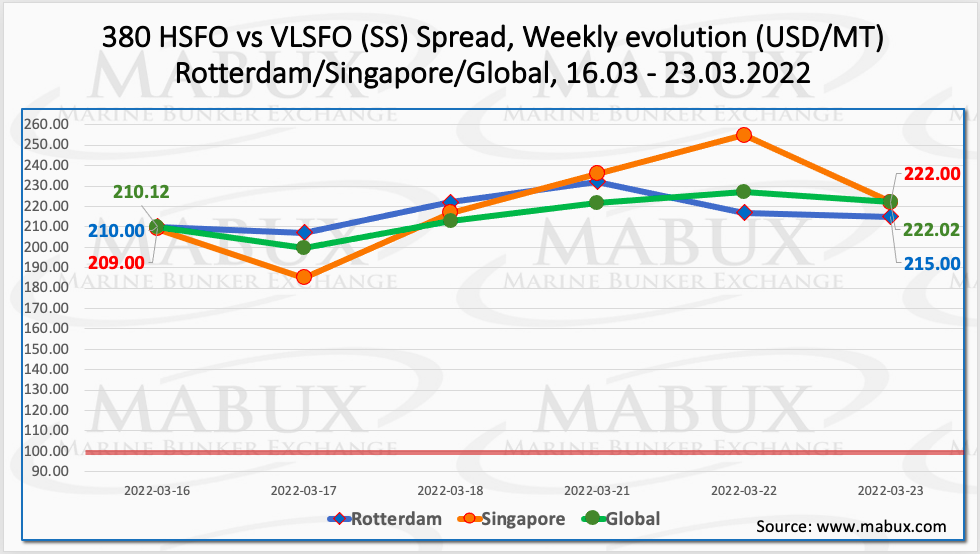

The Global Scrubber Spread (SS) weekly average, indicating the difference between 380 HSFO and VLSFO, fell slightly over the week compared to the sharp growth two weeks earlier to a minus of US$22.42. In Rotterdam, the average SS Spread dropped to US$217.17, and in Singapore, it also fell to US$220.67.

Meanwhile, gas prices in Europe remain at record levels amid escalating geopolitical risks. Liquefied natural gas (LNG) as a bunker fuel is still not listed.

As per Avenir LNG, with gas prices surging in Europe, LNG as a marine fuel is currently more interesting in America and Asia than in the Baltic Sea region, according to a MABUX report.

In addition, many of the dual-fuel vessels, originally designed to allay concerns over LNG availability, are now using small volumes of LNG to keep the tanks cold or to operate on LNG when they’re in port, but the majority of the dual-fuel fleet is running on diesel.

The LNG consumption is rather low currently and there are reportedly only a few companies that are still highly invested in LNG or running on LNG, or liquefied biogas (LBG), which is even more costly.

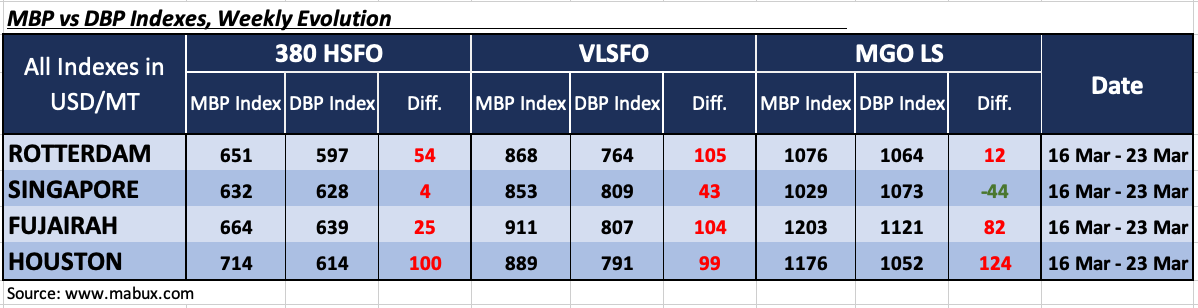

Regarding the average correlation of the MABUX market bunker prices (MBP) index vs the MABUX digital bunker benchmark (DBP) index over the twelfth week, it showed that the global bunker market was still prevailed by an overpriced fuel trend amid high volatility.

Thus, 380 HSFO fuel-grade remained overpriced in all four selected ports: in Rotterdam, by plus US$54, in Singapore, plus US$4, in Fujairah plus US$25 and in Houston plus US$100. The most significant was a 54-point drop in 380 HSFO overpricing level in Singapore, compared to the previous week.

Moreover, VLSFO fuel grade, according to the MABUX MBP/DBP Index, also remained overpriced in all selected ports, with a plus of US$105 in Rotterdam, plus US$43 in Singapore, plus US$104 in Fujairah and plus US$9 in Houston, while a decline of 50 points in fuel overprice ratio at Singapore was the most significant.

As for MGO LS, the MABUX MBP/DBP index registered an overpricing of this fuel grade in three out of four selected ports: Singapore was in the undervaluation zone with a minus of US$ 44. In Rotterdam, Fujairah and Houston, MGO LS was overvalued by US$12, US$82 and US$124 respectively.

The most significant change was a sharp drop of the overprice margin in Houston by 65 points, according to MABUX data.

MABUX noted in a statement, “We expect the global bunker market to remain highly volatile with a predominance of sharp irregular changes next week.”