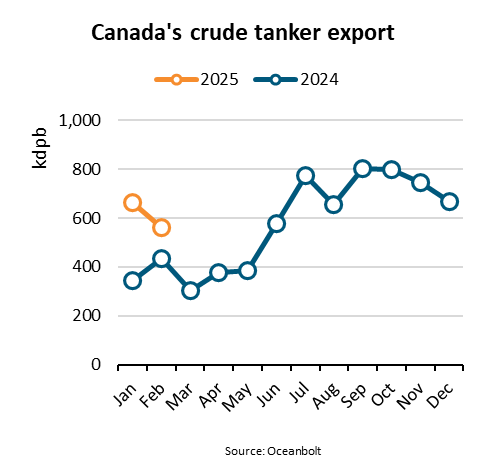

“Year-to-date, Canadian crude tanker exports have reached 618,000m barrels per day (kbpd) up from 388 kbpd during the same period last year, an increase of 59%,” stated Niels Rasmussen, Chief Shipping Analyst at BIMCO.

When the Trans Mountain Pipeline extension opened on 1 May 2024, its capacity grew from 300 kbpd to 890 kbpd. Consequently, exports from Vancouver, Canada increased significantly starting in June.

So far this year, the Vancouver exports have reached 373 kbpd to contribute 60% of total Canadian crude tanker exports. Before the Trans Mountain Pipeline expansion, Vancouver volumes made up only 10-15% of total exports.

“Since June 2024, Aframax and Panamax crude tankers have benefitted from the increased volume, loading respectively 75% and 25% of the Vancouver volumes. The Panamax ships mainly export to the US, whereas Aframax ships also export to Asia and therefore benefit from longer sailing distances,” says Rasmussen.

Despite the increase in exports to Asia following the opening of the Trans Mountain pipeline extension, 58% of Canada’s seaborne crude tanker exports are still headed to the U.S. East Asia has emerged as the second largest destination, taking 21% of total volumes and 35% of those loading on the Pacific Coast. China has been the main importer in East Asia.

In addition to the seaborne cargo, the US imports an estimated 3.7 mbpd from Canada via pipeline and rail. Nearly two-thirds of US crude oil imports in 2024, therefore, came from Canada, while 95% of Canada’s crude exports went to the US.

Even though the Midwest and Rocky Mountain districts are 100% reliant on Canada for imports, President Trump has implemented a 10% tariff on oil imports from Canada, thereby threatening the trade.

Following an increase in Canada’s oil production of about 50% during the past 10 years, the International Energy Agency (IEA) estimates that oil production will increase another 0.2 mbpd in 2025 to hit 6.23 mbpd. As US trade is threatened, the importance of finding other export outlets increases.

“According to the IEA, the Trans Mountain pipeline still has 150-200 kbpd spare throughput, which points to a further increase in seaborne exports to Asia during 2025, further benefitting crude tankers. In addition, it appears likely that if US tariffs go ahead, the seaborne cargo previously going to the US will instead head to Asia and Europe, increasing tonne miles. Lastly, a phase 3 expansion of the Trans Mountain pipeline is again under discussion, which could add another 300 kbpd of export capacity via Vancouver,” stated Rasmussen.

The article was provided by BIMCO.