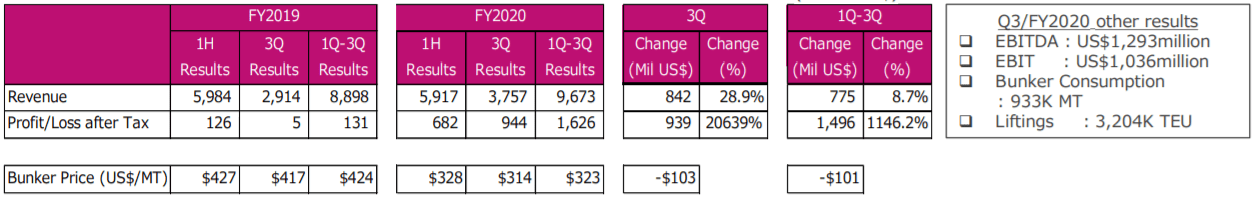

Ocean Network Express (ONE) has announced increased profits taking its earnings before interest and tax to over US$1 billion, in the third quarter of its financial year 2020, which started in March 2020.

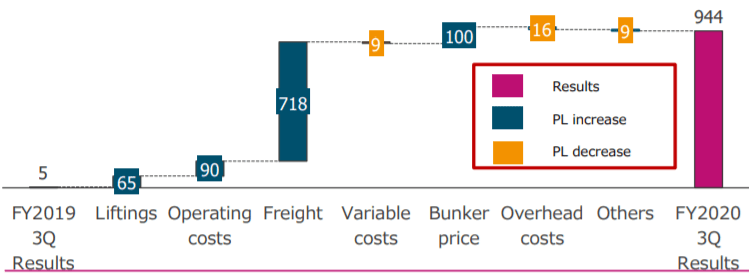

[s2If is_user_logged_in()]In particular, the sharp recovery in cargo demand and increased in the short-term freight market has boosted ONE’s profit to US$944 million, which represents a slight growth of US$6 million compared to the same period last year.

A steady recovery trend was observed in the global cargo volume, while in Asia-North America trade, the cargo volume increased by approximately 25% and the Asia-Europe trade also increased on a year-on-year basis.

Additionally, ONE said in its report that severe shoreside and inland congestion became problematic due to a sharp increase in cargo volumes and the resurgence of the Covid-19 epidemic caused turmoil within the entire global supply chain.

ONE has also reported increased container volumes during the third quarter of its financial year with total volumes reaching 3.2 million TEU. At the same time, the company’s operating costs are noticeably reduced. “Vessels idled at many ports due to increased congestion and the vessel turnover rate worsened,” pointed out the Singaporean line, which, however, proceeded with several cost-saving initiatives as shoreside and inland congestion has caused additional costs.

In the meantime, the short-term market conditions have improved freights, according to ONE’s financial report.

Moreover, ONE noted that bunker prices have seen a further decline during the specific period, while agency fees have increased.

“Excessive strain on the entire global supply chain has caused turmoil throughout the world. Shipping lines have suffered vessel delays, a deterioration of schedule reliability, shortage of space and a lack of container availability have been observed,” highlighted ONE.

During ONE’s Q3, the resurgence of the coronavirus pandemic has led to labour shortages and operational restrictions in many locations, which has resulted in port congestion, longer port stays due to lower productivity and heavy rail and truck traffic, said the company.

The Asian joint venture has also pointed out a couple of Covid-19 related challenges during the third quarter; increased container dwell times due to truck and chassis shortages and warehouse capacity shortages, additionally flexible crew changes became difficult due to international travel restrictions.

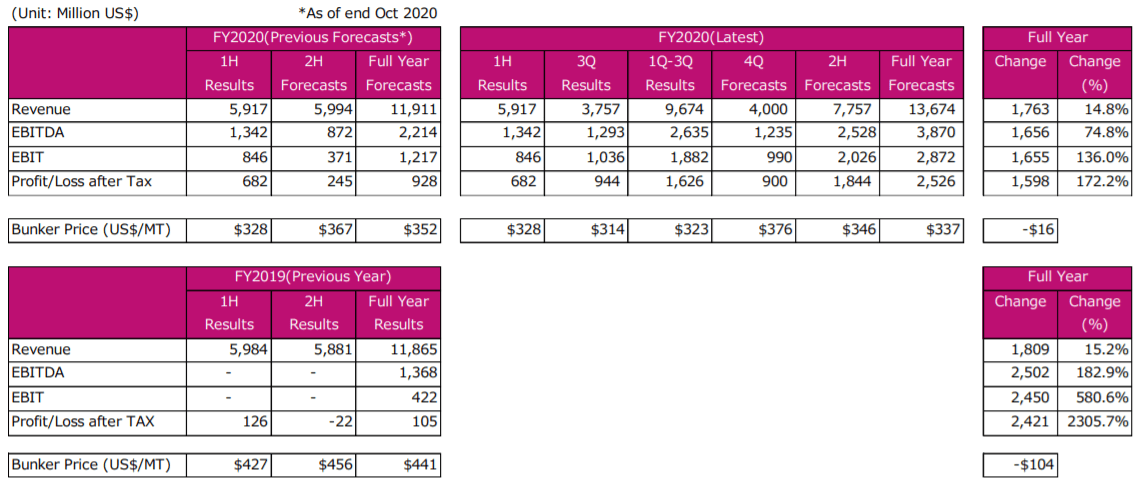

In the fourth quarter, seasonal factors such as the Lunar New Year holidays or the resurgence of Covid-19 could affect demand, according to ONE, which said, “at present steady cargo volumes are expected and a net profit of US$900m after tax is forecast [for the fourth quarter].”

At the end of 2020, ONE has reported 220 container ships in its fleet with a total capacity of 1,581,173 million TEU. Some 37% of the vessels are deployed on the carrier’s Transpacific network, 21% is used in Asia-Europe services, while another 21% is sailing on intra-Asia routes.[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]