Since April 2017, the three-alliance structure comprising Ocean Alliance, THE Alliance, and the 2M alliance has shaped the shipping industry.

After nearly eight years, this structure is set to change in February 2025 with the introduction of new alliance arrangements. The Gemini Cooperation (Maersk – Hapag-Lloyd), Premier Alliance (HMM – ONE- Yang Ming) and Ocean Alliance (CMA CGM – COSCO – Evergreen – OOCL) retaining its structure, will now form the new container shipping alliance landscape.

Capacity market share is an interesting metric to see the extent of the presence of a carrier alliance in any given trade, according to Alan Murphy, CEO of Sea-Intelligence.

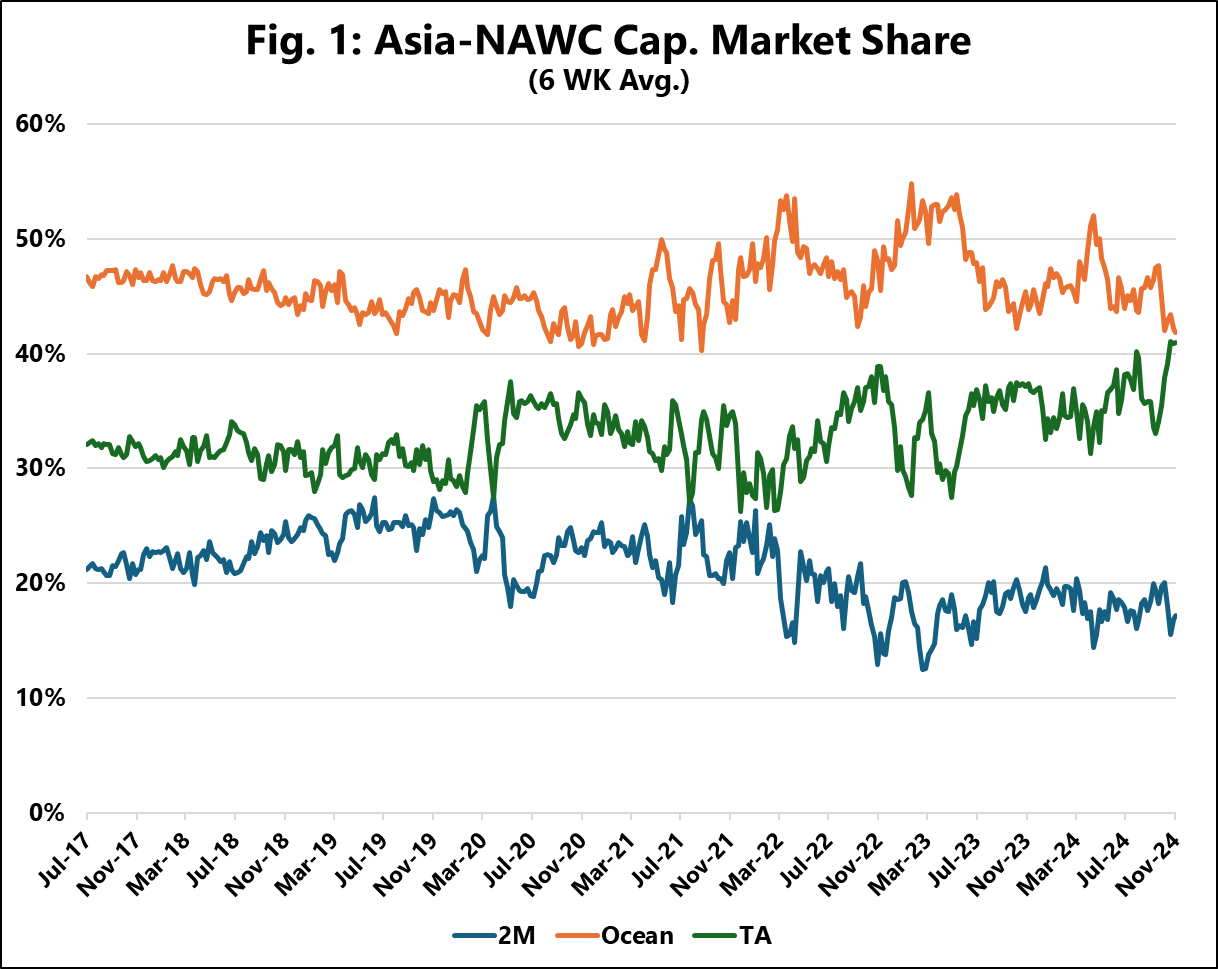

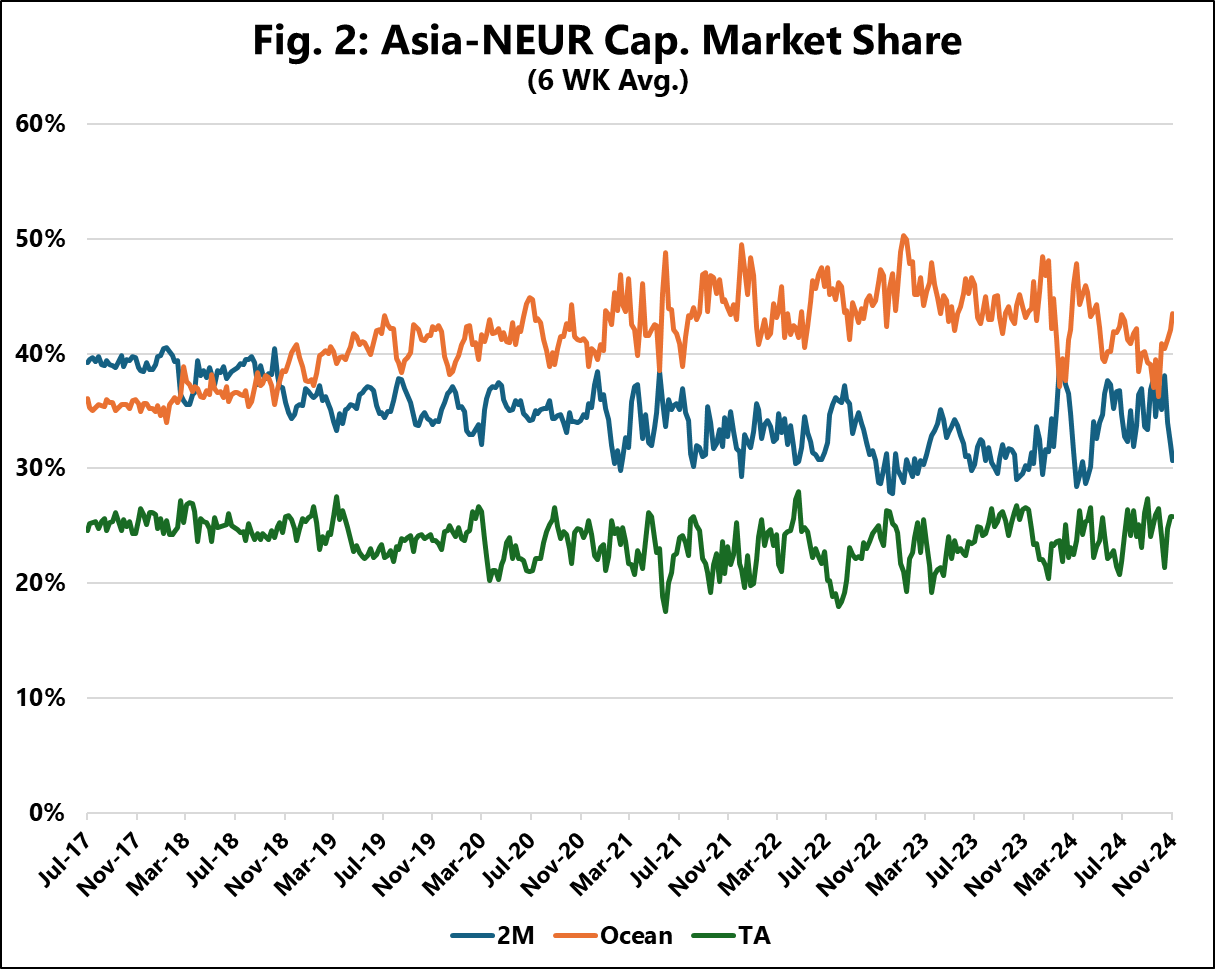

The following figures illustrate this metric for the current three alliances over their lifecycle on the Asia–North America West Coast (Asia-NAWC) and Asia–North Europe (Asia-NEUR) trade lanes, respectively. These figures focus solely on the capacity market share within the alliances.

On the Asia-NAWC route, the Ocean Alliance has consistently been the dominant alliance in terms of deployed capacity, while 2M has occupied the lower end of the spectrum. Over the years, there has been little fluctuation in these rankings, indicating stable market dynamics. However, THE Alliance recently gained ground, closing in on Ocean Alliance.

In the Asia-NEUR trade lane, Ocean Alliance surpassed 2M in capacity market share by the end of 2018 and has since maintained its lead. 2M remained a close second, while THE Alliance has adopted a distinct market strategy, consistently holding the smallest share of capacity in this region.

With the upcoming launch of the new container line groupings in February 2025, significant shifts in trade dynamics are anticipated. It will be intriguing to observe how the new synergies shape strategies across various trade lanes and where each alliance will choose to concentrate its efforts.