The provider of supply chain visibility platform for shippers and logistics firms, project44, has conducted a report showing that carriers have struggled with schedule reliability in December as congestion at ports and the omicron variant of Covid-19 resulted in delays.

“While carriers implemented various strategies, including blank sailings and sailing schedule changes to improve on-time reliability, it has not proven as successful as carriers had hoped,” explained Project44 analysts.

Particularly, these measures resulted in shippers paying higher freight rates and experiencing delivery delays. According to Nicholas Sly, an economist with the Kansas City Federal Reserve Bank, a 15% increase in shipping costs leads to a 0.10 percentage point increase in core inflation after one year.

In addition, China’s zero-Covid policy is playing a major role in shipping delays.

“Covid impacts to shipping will be a toss-up in terms of labour available at Asian manufacturers, ports and throughout the supply chain,” said Josh Brazil, vice president of Supply Chain Data Insights at project44.

This will likely continue to impact carriers’ schedule reliability which in turn will cause a ripple effect downstream of supply chains, according to Brazil.

In December, the number of Covid cases was reported in the Chinese province of Zhejiang, which includes the city of Ningbo. As a result, a new covid-19 lockdown was imposed in early December.

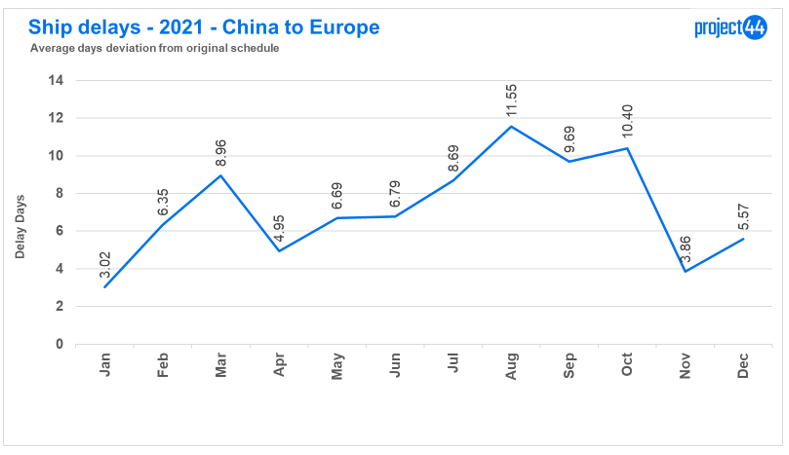

The lockdowns restricted trucks going in and out of the port, slowing operations. This latest lockdown probably led to the increase in the number of delayed shipping days from China to Europe in December to 6 from 4 in November.

Ship Delays

After reaching a high of 12 delay days in August, ship delays from China to Europe dropped in November but spiked in December due to high demand, as seen below.

On 22 December 2021, the port of Rotterdam, Europe’s largest port, announced it surpassed 15 million TEU, the first time a European port has reached that level.

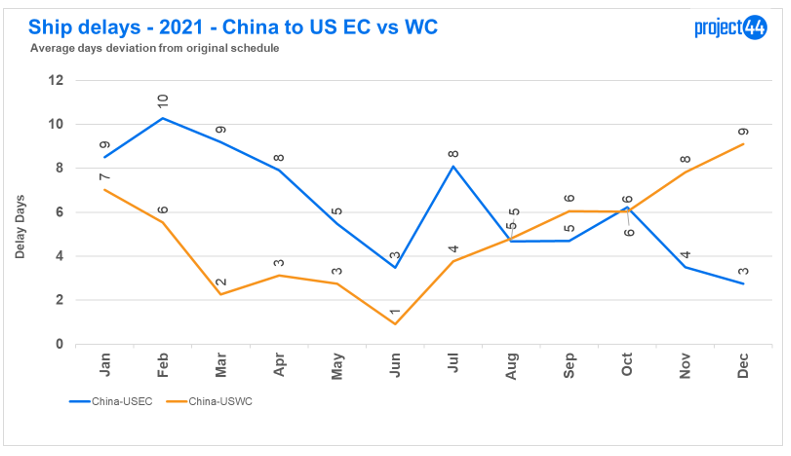

The number of ship delay days to the US West Coast has been steadily increasing since October. This coincides with the holiday peak season in the US, according to Project44.

“Typically, the peak occurs in September, but 2021 was not a normal year for the ocean freight market as retailer inventories ear-marked for the holiday season arrived at stores later in the season, due to port congestion on the US west coast,” explained the company’s officials.

That was also due to the lack of truck drivers to move stacks of containers from ports quickly in order to make room for incoming containers.

On the East Coast, the opposite occurred. Since October, the number of ship delay days has declined. This was likely due to various measures ports, such as Savannah took to ensure carriers could load and unload containers in a timely manner.

The Georgia Ports Authority, for example, set up multiple inland locations as temporary container yards to expedite the flow of imports and exports at Savannah. Containers will be shuttled to these facilities by truck or rail to create more space for cargo coming off vessels and stacking cranes to manoeuvre.

Blank Sailings

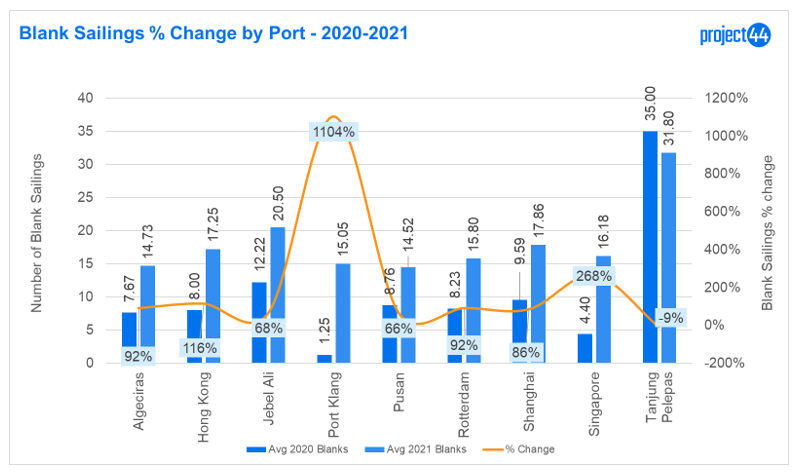

A shift from Ningbo port to Shanghai because of Covid outbreaks backfired on some shippers as congestion at Shanghai increased. As a result, Shanghai recorded an 86% increase, year-over-year in blank sailings, according to a statement.

Meanwhile, the Port of Klang experienced heavy rainfall and flash floods, which affected port operations. According to authorities, warehouses, container depots and roads were flooded. Hence, because of the weather conditions, carriers bypassed the port.

Other ports experiencing year-over-year increases in blank sailings included Rotterdam, Singapore and Hong Kong, primarily due to global port congestion, which resulted in ships not getting back to these ports in time.

Transit Times & Schedule Changes

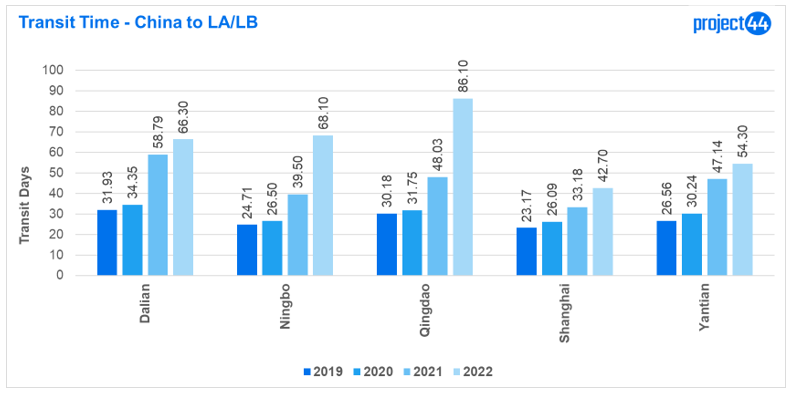

Transit times increased from China’s leading ports to Los Angeles and Long Beach due to port congestion, due to which ships were either slow steaming or loitering off the coast of Mexico and other locations before arriving in US West Coast waters.

The new queuing system at West Coast ports also seems to have played a role in this increased transit times although it has reportedly helped with the air pollution situation in that area, according to Project44 researchers.

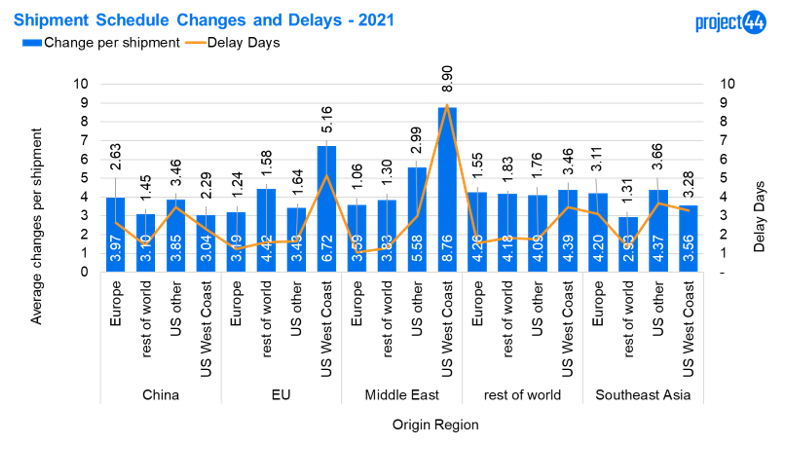

Not just on transit time, there have been several delays due to schedule changs as well. The below chart shows the details of the schedule changes and the resultant delays across the main trade lanes of Europe, the US West Coast, US Other and the rest of the World.

Shipments from the Middle East to US West Coast had the most schedule changes resulting in most delayed days followed by shipments from the European Union (EU) to the US West Coast and other combinations were also affected.

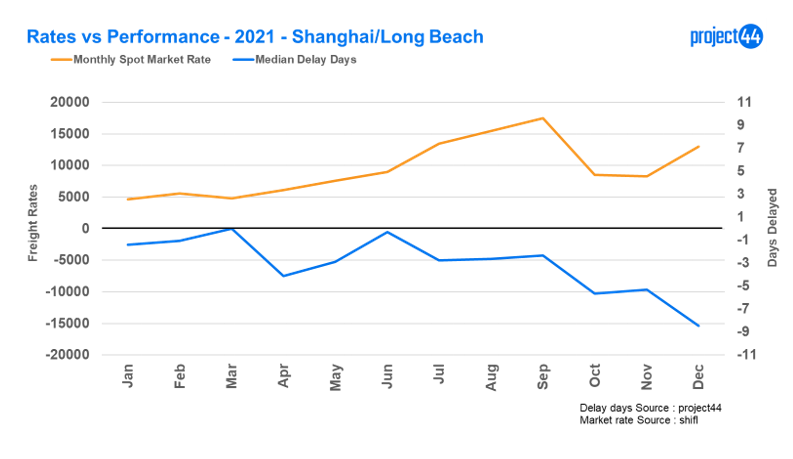

Freight Rates vs Performance

After little change from October to November, Shanghai to Long Beach median delay days and average spot rates increased from November to December.

Over one hundred ships lined up to enter Long Beach and Los Angeles during December, while the threat of a container dwell fee helped move full containers from the complex during the month.

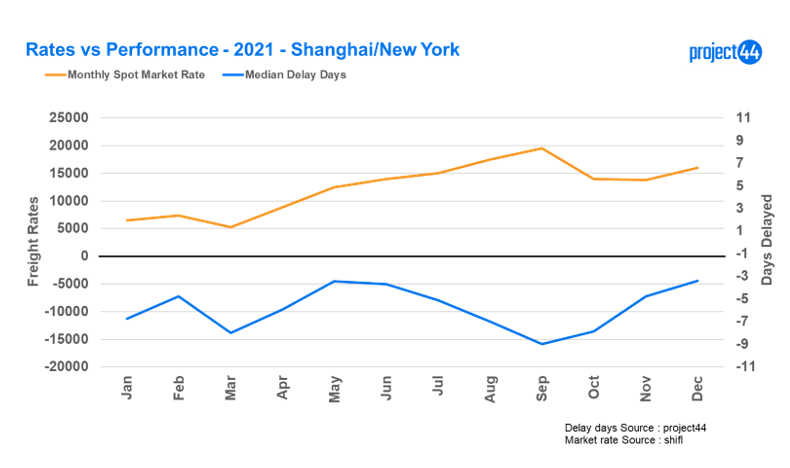

Meanwhile, despite rising spot rates from Shanghai to New York, median delay days continued to improve, a trend that began in September.

Director of Port Authority of New York and New Jersey, Sam Ruda, credited the waterfront workforce and other stakeholders that run 24-7 operations for keeping anchorage waits short.

However, some issues such as the omicron variant, the year-end holidays and an increase in charter vessels that need one-time berth space resulted in delays during December.

Outlook

Delays are likely to continue well into 2022 as Covid breakouts continue throughout supply chains and consumers continue to buy at a healthy rate.

Carriers like Maersk expect the exceptional market conditions in shipping to persist until the first quarter of 2022 or longer.

Maersk’s expectation of a continuation of “exceptional market conditions” into the first quarter of 2022 will likely include elevated spot rates.

“Spot rates will remain high throughout most of 2022 however it’s unlikely port conditions will return to pre-pandemic levels,” said Brazil.

Meanwhile, economists at the investment banking company Goldman Sachs expect backlogs and elevated shipping costs to persist at least through the middle of 2022.

A reason for that is that there is no immediate and short-term solution for the underlying supply-demand imbalance at US ports.

Similarly, the investment firm Keybanc Capital Market estimates the current backlog of containers could be cleared in three to five months, but exact timing may vary depending on a variety of factors including labor availability domestically and in Asia.

“Blank sailings will continue well into 2022 as ports work down backlogs and consumer spending remains strong,” added Brazil.