The Board of Directors of the shipping and logistics Group CMA CGM has published the company’s financial and operational report for the second quarter of the year, highlighting strong increases in profits and revenues.

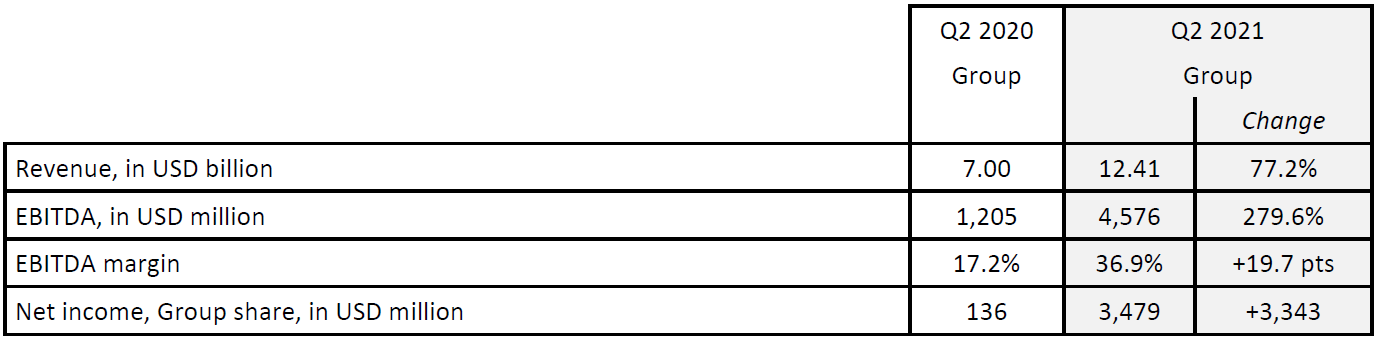

In particular, the group’s second-quarter revenue reached US$12.4 billion, recording a significant rise of 77.2% compared to the same period of 2020 which was marked by the slowdown in international trade due to the Covid-19 pandemic.

Furthermore, during Q2 the French company’s earnings before interest, taxes, depreciation and amortisation (EBITDA) exceeded US$4.5 billion and represented an EBITDA margin of 36.9% which translates to 19.7 points up over the corresponding period of the previous year.

“This increase has been driven by the steady demand for consumer goods,” noted CMA CGM in its announcement.

Meanwhile, the net income of the company stood at US$3.5 billion during the second quarter, while net debt totalled US$14.9 billion as of the end of June.

Through net debt reduction, CMA CGM Group took initiatives in the amount of US$725 million during the second quarter in order to further strengthen its financial infrastructure, according to a statement.

Chairman and Chief Executive Officer of the CMA CGM Group, Rodolphe Saadé commented, “The strong rebound of the global economy has resulted in an unprecedented demand for transportation and logistics services”, and added that “container shipping performance was driven by higher volumes and freight rates.”

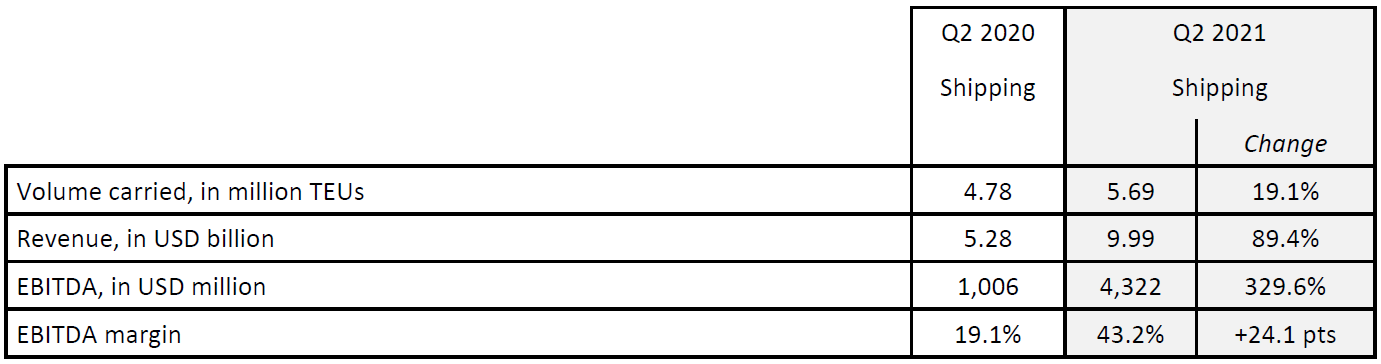

Particularly, the Marseille-based carrier has registered a container throughput growth of more than 19% over the Q2 of 2020 and an increase of 4.4% over 2021 Q1, by transporting 5.7 million TEU in the last quarter.

“Container shipping activity was particularly dynamic on the Transpacific, Latin America and Intra-Regional routes,” pointed out CMA CGM.

Regarding the financial results of the group’s container shipping sector, revenue saw a year-on-year spike of 89.4%, reaching US$10 billion, driven by the increase in volumes and unit revenue, EBITDA skyrocketed by 329.6% to US$4.3 billion, while EBITDA margin accounted for 43.2%, up 24.1 points in comparison to the same period of last year, supported by average revenue per TEU of US$1,756.

In the context of ongoing tensions on global supply chains, the CMA CGM Group said it is consistently investing in industrial assets to enhance services, strengthen its transportation offering as well as support decarbonisation.

Particularly, since the beginning of the year, the French shipping group has taken delivery of one new chartered 15,000TEU vessel, 15 second-hand container ships, as well as eight new owned vessels, including the last five of its fleet of nine 23,000TEU ships powered by liquefied natural gas (LNG).

Last but not least, CMA CGM has added more than 520,000 containers in one year, increasing its fleet by 13%.