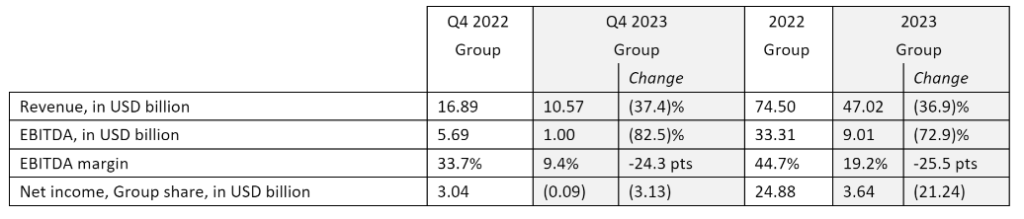

French ocean carrier CMA CGM reported revenues of US$47 billion in 2023, translating to a 36.9% decline compared with 2022 figures, EBITDA of US$9 billion, down by 72.9%, and net income of US$3.6 billion from US$25 billion in the previous year.

“Gradual deterioration in the maritime shipping environment throughout 2023, including in the fourth quarter, causing an anticipated year-on-year decline in revenue and operating profit,” said the company in its yearly results announcement.

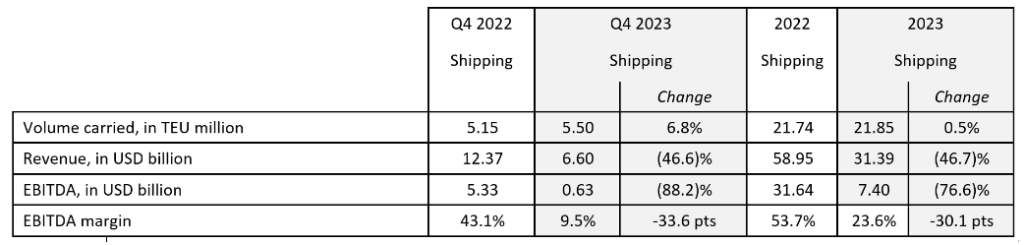

Additionally, CMA CGM saw its container volumes increase slightly by 0.5% reaching 21.8 million TEUs, while the company’s revenue from the maritime shipping operations fell by 46.7% year-on-year to US$31.4 billion.

Commenting on the results for the year, Rodolphe Saadé, chairman and CEO of the CMA CGM Group, said, “As our sector normalized, the Group’s performance remained solid in 2023. Shipping market conditions deteriorated progressively during the year. Our results are down as we expected. Logistics, on the other hand, is proving more resilient, and accounts for a significant part of our business. Our Group now stands on two solid pillars, which will enable us to weather cyclical changes more efficiently. Backed by our financial strength and the commitment of our employees, we will continue to invest in the transformation of the Group, particularly decarbonization and artificial intelligence, in order to pursue our sustainable and profitable development.”

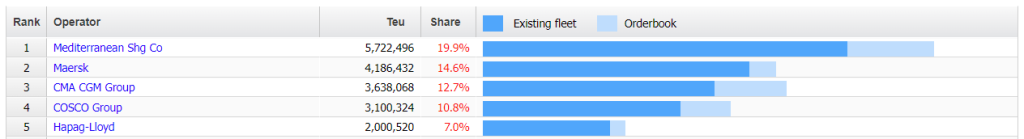

The Marseille-based shipping company noted it has invested more than US$15 billion in a fleet of nearly 120 LNG and methanol-powered ships by 2027. CMA CGM is currently the third largest box line in the world with approximately 3.64 million TEUs.

The current year is likely to be shaped by sluggish global economic growth, although global trade for goods is expected to rebound from 2023 lows, driven by consumer spending and replenishing inventories, according to CMA CGM.

The French carrier believes volume growth will remain strong in the first half, supported by these base-line effects, but the second half looks more uncertain.

In addition, new container shipping capacity is expected to come into service, pushing global supply in excess of forecasted demand, and leading to an anticipated adverse impact on freight rates, according to the company’s outlook for 2024.