Sea-Intelligence has analysed the financial and volume performance of the global shipping lines, founding that they have made an astounding operating profit of over US$110 billion in 2021.

“Accounting for the carriers that are yet to report their figures (HMM and OOCL), we are likely looking at an additional US$10-15 billion,” said the Danish data analysts.

“To put this into perspective, the combined 2010-2020 operating profit across all years was a combined figure of US$37.54 billion. In short, the industry has tripled its operating profit in 2021-FY compared to the past decade. And this is discounting MSC (privately held) and PIL (irregular updates),” commented Alan Murphy, CEO of Sea-Intelligence.

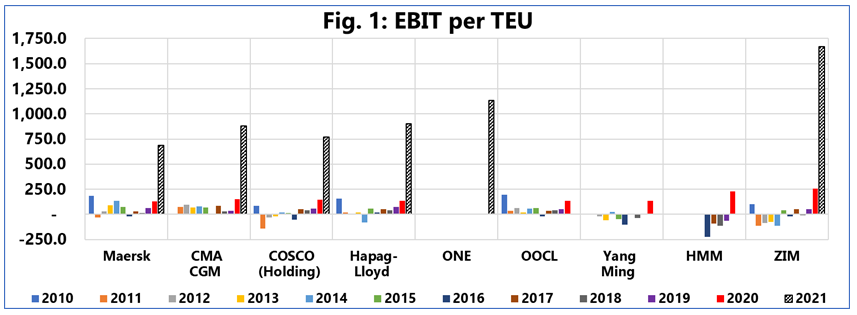

The following figure shows the EBIT/TEU of the shipping lines that report on both their EBIT (earnings before interest and taxes) and global volumes for the 2010-2021 period.

“Just by looking at the chart, we can see the absurd nature of the supply/demand situation and the freight rate environment of 2021, dwarfing each of the previous years in terms of EBIT/TEU,” noted the analysts of Sea-Intelligence.

The previous years are hardly relevant in the context of the outsized EBIT/TEU numbers of the current year, according to Sea-Intelligence. In 2021-FY, the smallest EBIT/TEU was recorded by Maersk of US$686/TEU, whereas the largest EBIT/TEU was recorded by ZIM, of a staggering US$1,671/TEU.

On average, these six shipping lines netted an operating profit of US$861/TEU. Putting it into perspective, in the entire last decade, the highest average EBIT/TEU of these global shipping lines was US$155/TEU; and that was back in 2010.