With the upcoming Golden Week holiday in Asia in early October, as factories close, and container demand to and from Asia declines, shipping lines respond by blanking sailings to match supply with the lower demand, according to latest Sea-Intelligence report.

“However, when we first looked at the blanked capacity at the 2023 Golden Week two weeks ago in issue 629 of the Sea-Intelligence Sunday Spotlight, the carriers had not planned anything near to what was necessary to meet the blanked percentages of pre-pandemic years,” pointed out the Danish analysts.

Now, there are 29 additional blank sailings scheduled on the Transpacific, and 18 more on Asia-Europe.

According to Sea-Intelligence’s report, scheduled capacity reductions on Asia-North America West Coast went from 3.7% to 14.1%, from 2.2% to 16.1% on Asia-North America East Coast, from 6.8% to 19.9% on Asia-North Europe, and from 7.7% to 21% on Asia-Mediterranean.

“This means that carriers are now on track to blank capacity in line with both 2019 and the 2017-2019 average,” commented Alan Murphy, CEO of Sea-Intelligence.

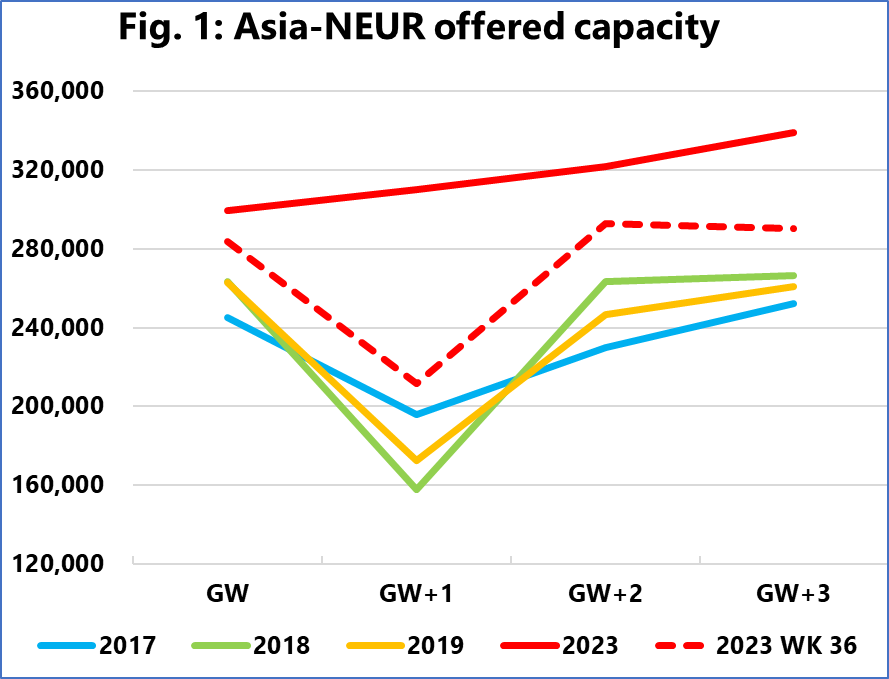

Figure 1 depicts the development in Asia-North Europe, with the red line representing the scheduled capacity for the 2023 Golden Week (+3 weeks), as it stood two weeks ago in week 43, compared to the same period in 2017-2019, as the pandemic years of 2020-2022 are too volatile to be used as a reasonable benchmark.

“Two weeks ago, we effectively saw no Golden Week capacity reductions, as the scheduled capacity was far above what we had seen in the pre-pandemic period. The red dashed line shows what has happened over the past two weeks: A massive reduction in scheduled capacity, due to a large number of “last minute” blank sailings,” said Alan Murphy.

The percentage of blanked capacity on Asia-North Europe, across the four-week period, is now at 19.9%, which is higher than the 2017-2019 period.