The time charter (TC) rates for post-panamax container vessels rose by 111% year-on-year (y-o-y) in 2024, hitting US$73,330/day, and has led to a huge uptick in newbuild orders and a slowdown in demolitions, according to Veson Nautical’s 2024 End- Of-Year-Report.

The report states that the bullish market conditions for the container sector are reflected in the TC rates as well as the 76% y-o-y increase in new ship orders which witnessed 321 deals including options, compared to 182 orders in 2023.

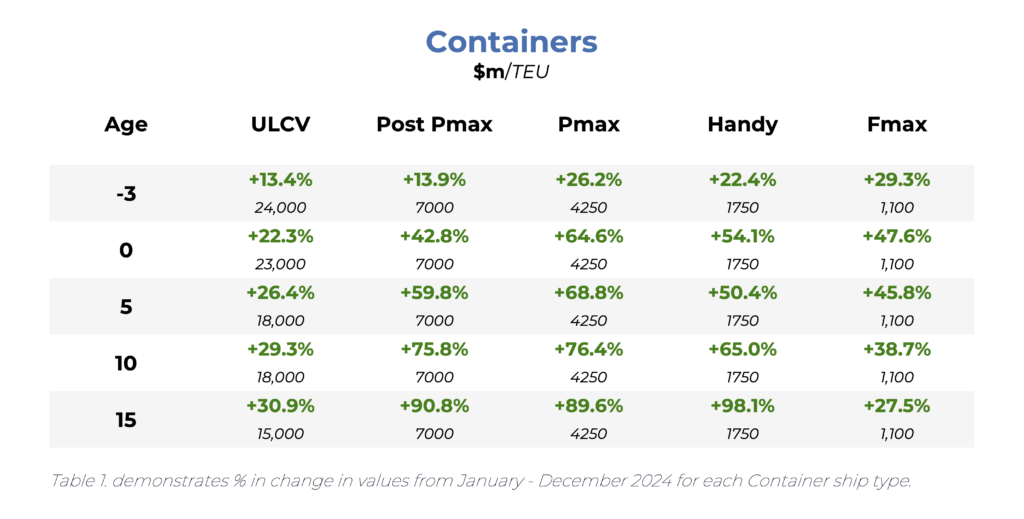

“The container market experienced remarkable growth over the past year, driven by increased demand, rising earnings, and a robust asset value resurgence across all sectors,” says Rebecca Galanopoulos, Senior Valuations & Analytics Analyst at Veson Nautical.

“Despite the large volumes of new vessels hitting the water, the situation in the Red Sea lent support to container freight rates by increasing ton-mile demand. The potential de-escalation of hostilities would allow for Suez Canal transits to resume which could have an impact on demand.”

Galanopoulos adds that if supply begins to exceed demand, there is potential to scrap older vessels.

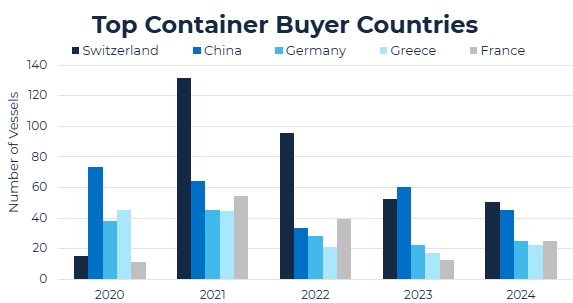

The report also states that the bulging orderbook for new container vessels was driven by Taiwan and Singapore in 2024 with 42 new orders each. Switzerland and China followed with 36 and 34 orders respectively.

The highly attractive terms on price and availability being offered by Chinese shipyards meant that they dominated the market, receiving orders for 259 vessels, equating to a market share of around 81%, South Korean shipbuilders secured 52 deals and Taiwan 12 vessel orders.

The report adds that the bullish conditions witnessed during 2024 also impacted demolition sales with figures dropping by about 34% y-o-y as 51 vessels were sent to the breakers.

This article was written by Rebecca Galanopoulos, Senior Valuations & Analytics Analyst at Veson Nautical.