In the ever-evolving landscape of global trade, container shipping remains a critical pillar of the economy. During the past week, key players in the sector experienced varied stock performances, reflecting the impact of ongoing economic and geopolitical factors.

As rising operational costs, supply chain disruptions, and geopolitical tensions continue to shape market dynamics, investors are closely monitoring these developments. In this article, we will highlight the weekly stock movements of major container shipping companies, examining how they navigate the complexities of a volatile environment while adapting to changing demand and conditions.

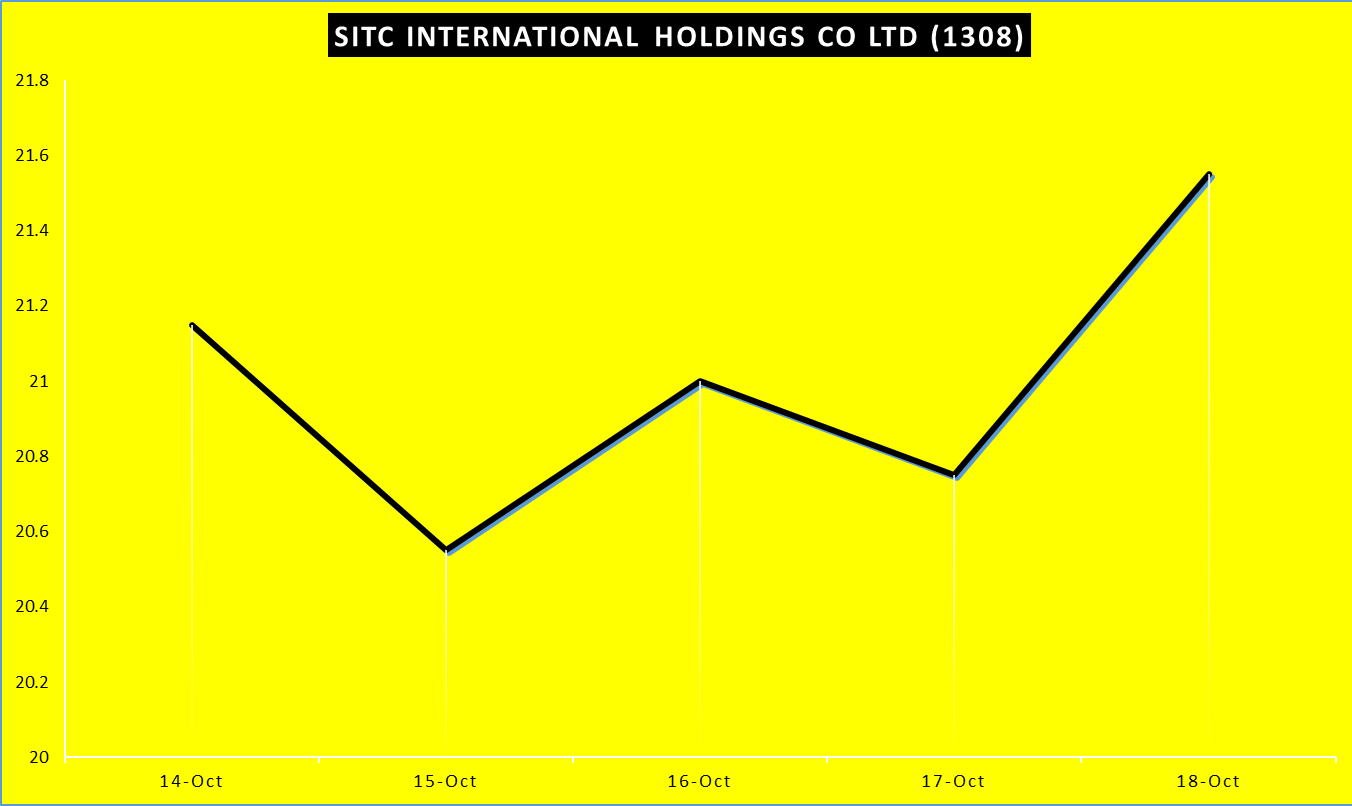

- SITC International Holdings Co Ltd (1308)

HKD

HKD

SITC International Holdings Co Ltd (1308) experienced some moderate fluctuations between October 14 and October 18. The stock started at HKD 21.15 on October 14, dipped to HKD 20.55 on October 15, then steadily recovered over the next few days, closing at HKD 21.55 on October 18, the highest price in this period. The overall movement suggests short-term volatility, with the stock showing resilience after the dip, potentially indicating renewed investor interest or positive market sentiment.

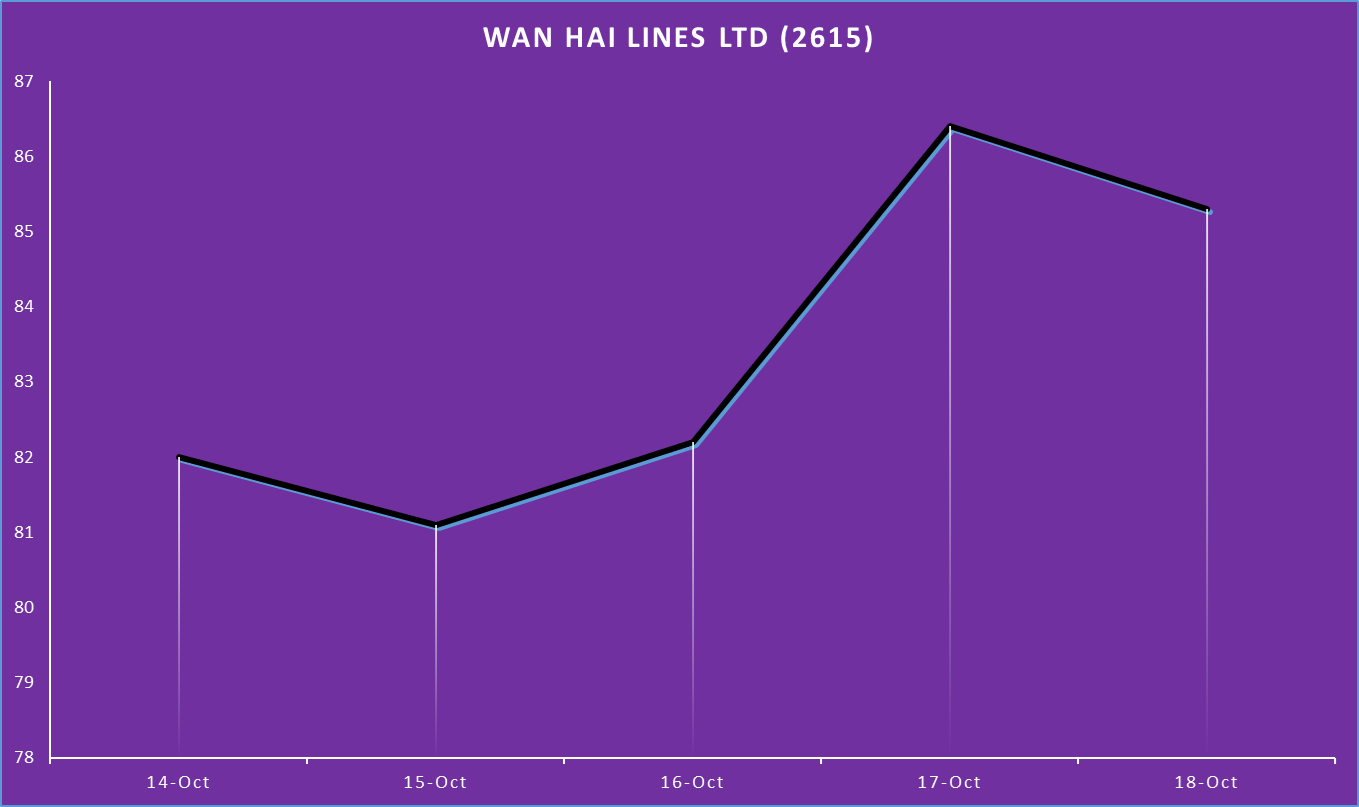

- Wan Hai Lines Ltd (2615)

TWD

TWD

Wan Hai Lines Ltd (2615) saw notable fluctuations from October 14 to October 17. Starting at TWD 82 on October 14, the stock dipped slightly to TWD 81.10 on October 15. It then rebounded to TWD 82.20 on October 16 and saw a sharp rise to TWD 86.40 on October 17, followed by a slight pullback to TWD 85.30 on October 18. The significant jump on October 17 suggests a surge in buying activity or positive news, though the slight dip on October 18 indicates some profit-taking or market consolidation after the rapid rise.

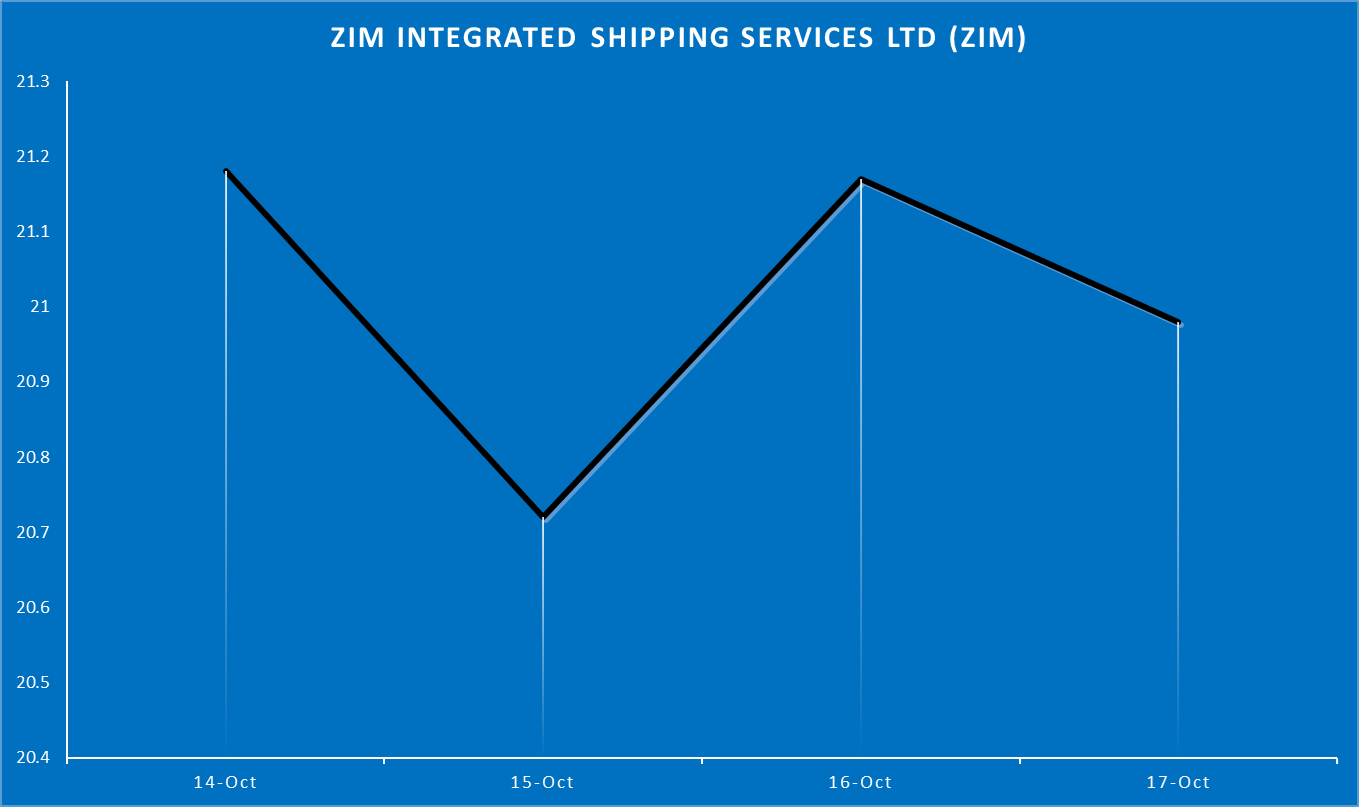

- ZIM Integrated Shipping Services Ltd (ZIM)

USD

USD

ZIM Integrated Shipping Services Ltd (ZIM) showed modest price fluctuations between October 14 and October 17. Starting at US$21.18 on October 14, the stock dipped to US$20.72 on October 15 before rebounding to US$21.17 on October 16. It then slightly decreased to US$20.98 on October 17. The overall movement reflects minor volatility within a narrow price range, indicating short-term fluctuations without a clear upward or downward trend during this period. The stock remained relatively stable around the US$21 mark, showing no significant momentum in either direction.

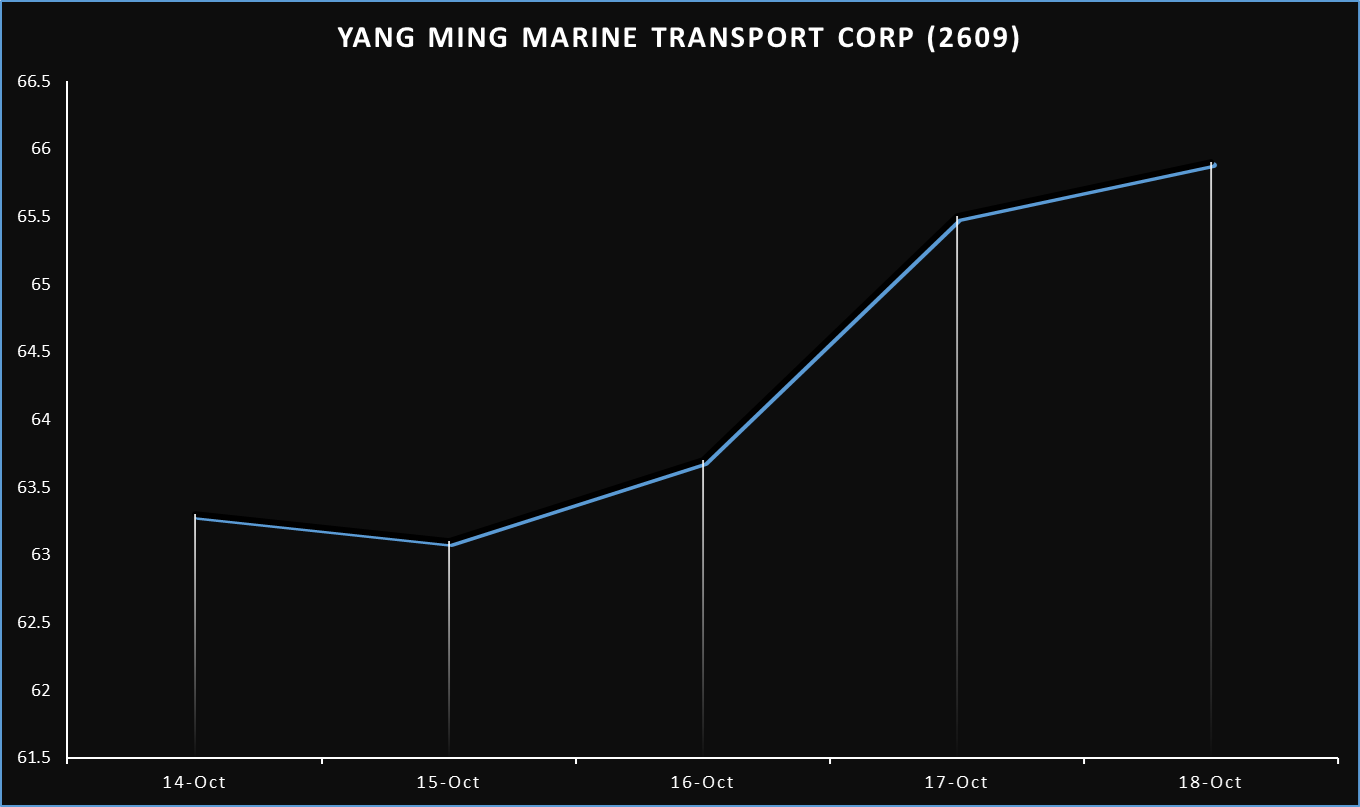

- Yang Ming Marine Transport Corp (2609)

TWD

TWD

Yang Ming Marine Transport Corp (2609) experienced a gradual upward trend from October 14 to October 18. The stock started at TWD 63.30 on October 14, slightly dipped to TWD 63.10 on October 15, and then began to rise steadily, reaching TWD 63.70 on October 16. This upward momentum continued, with the stock closing at TWD 65.50 on October 17 and further increasing to TWD 65.90 on October 18. The consistent rise over this period suggests growing investor confidence or positive market factors influencing the stock.

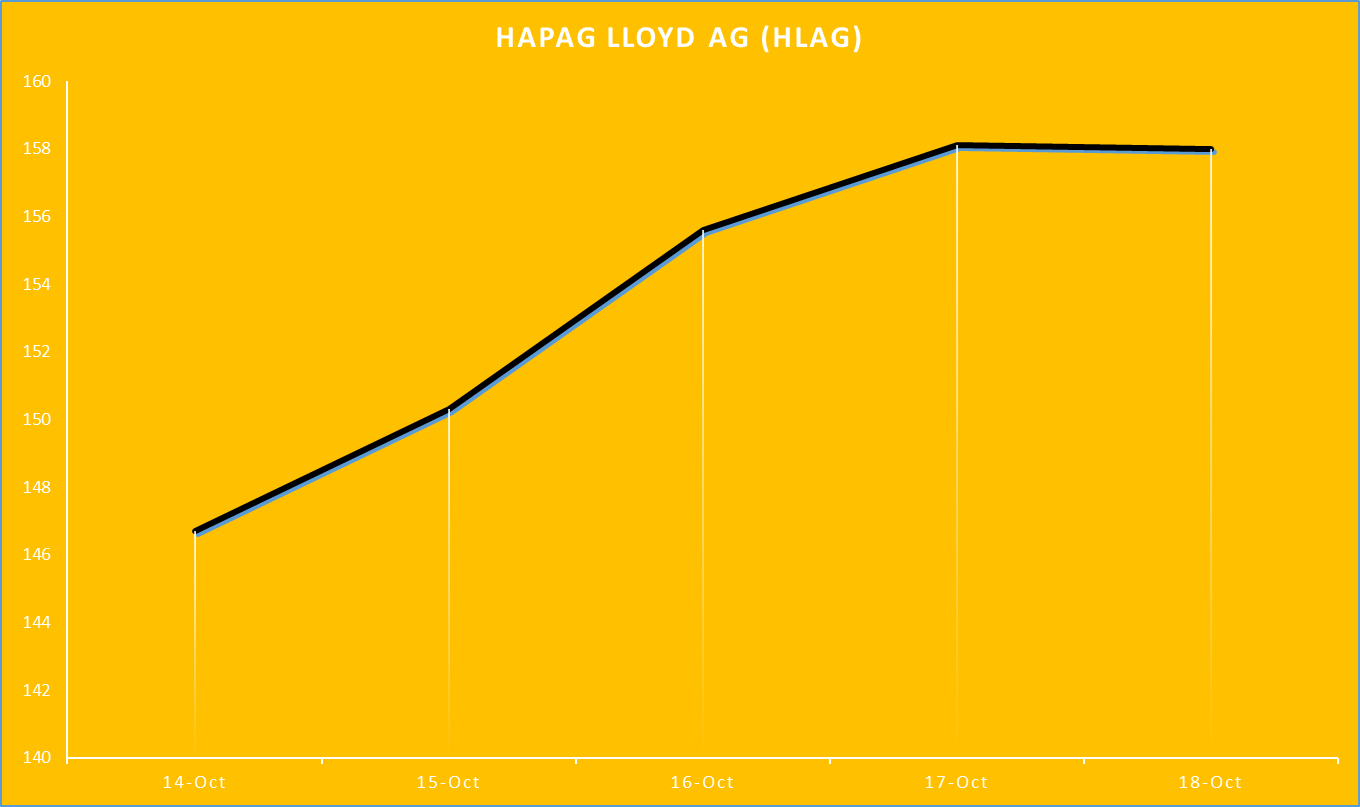

- Hapag Lloyd AG (HLAG)

EUR (€)

EUR (€)

Hapag Lloyd AG (HLAG) showed a strong upward trend from October 14 to October 18. Starting at €146.70 on October 14, the stock rose to €150.30 on October 15, then increased further to €155.60 on October 16. It continued to gain momentum, reaching €158.10 on both October 17 and October 18, indicating a solid performance with a total increase of €11.40 over the five days. This consistent rise suggests positive investor sentiment and possibly favorable market conditions for the company.

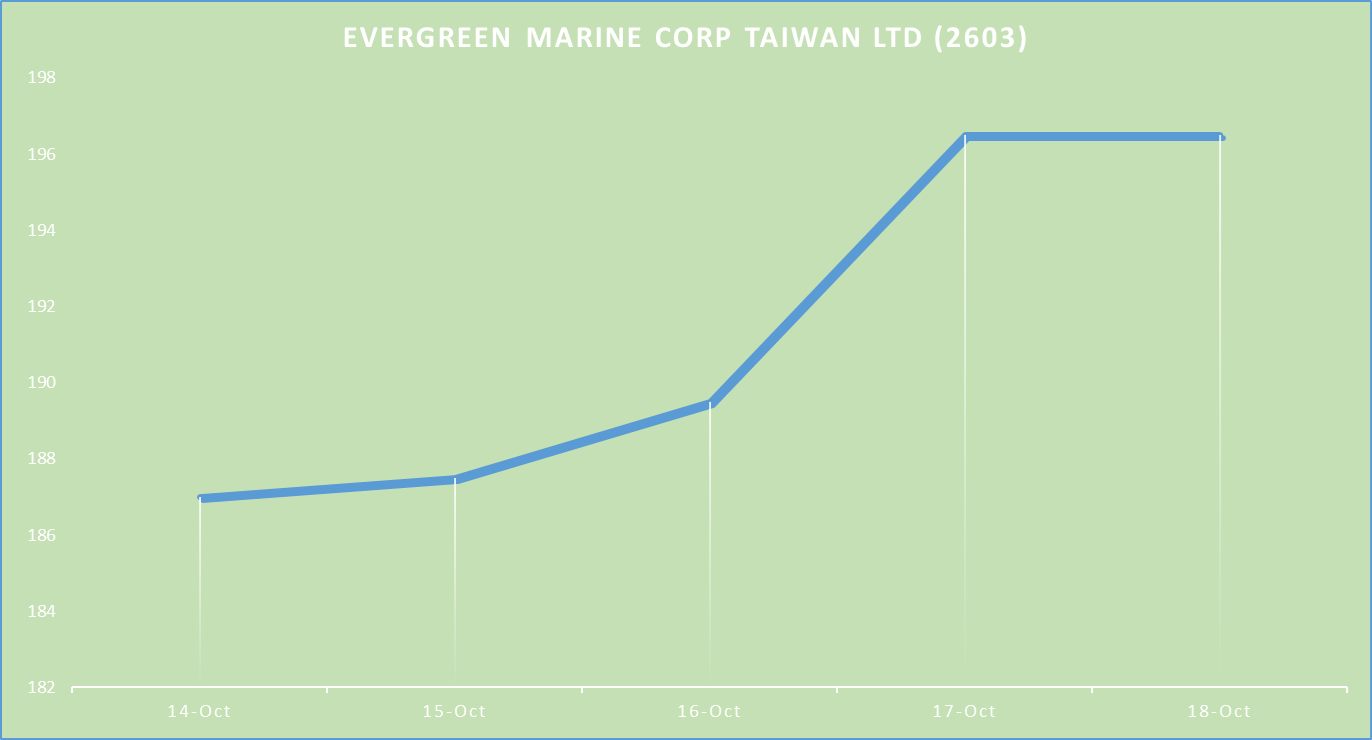

- Evergreen Marine Corp Taiwan Ltd (2603)

TWD

TWD

Evergreen Marine Corp Taiwan Ltd (2603) also demonstrated a steady upward movement from October 14 to October 18. The stock opened at TWD 187 on October 14 and saw incremental gains each day, reaching TWD 187.50 on October 15, TWD 189.50 on October 16, and TWD 196.50 on both October 17 and October 18. The overall increase of TWD 9.50 reflects strong investor interest and confidence in the company’s prospects during this period.

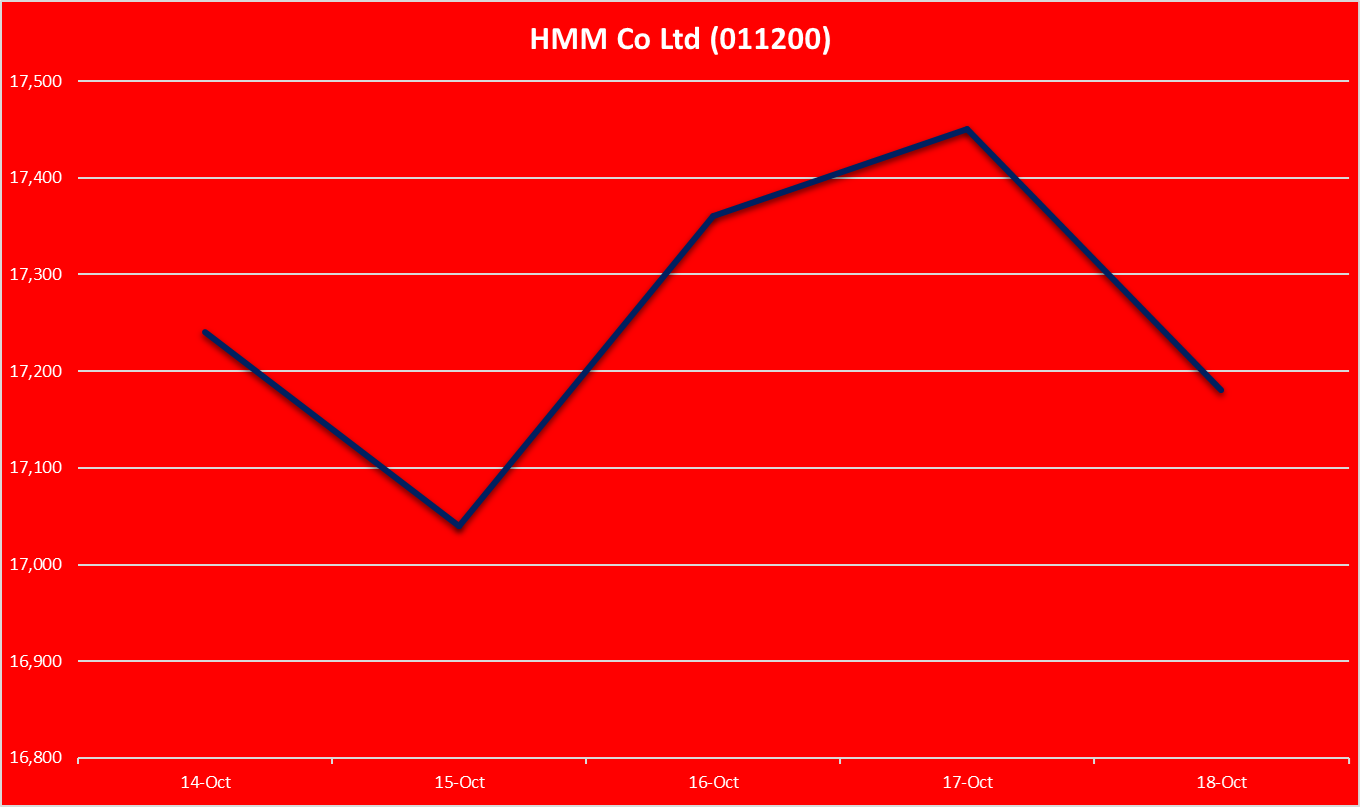

- HMM Co Ltd (011200)

KRW

KRW

HMM Co Ltd (011200) experienced some fluctuations in its stock price from October 14 to October 18. It opened at KRW 17,240 on October 14, decreased to KRW 17,040 on October 15, and then rebounded to KRW 17,360 on October 16. The stock continued to rise slightly to KRW 17,450 on October 17, before dropping again to KRW 17,180 on October 18. Overall, the stock displayed moderate volatility, ending slightly lower than its opening price but reflecting a recovery from the mid-week dip.

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

USD

USD

COSCO SHIPPING Holdings Co Ltd (CICOY) showed a mixed performance over the same period. Starting at US$7.61 on October 14, the stock increased to US$7.67 on October 15, but then dropped to US$7.34 by October 17. The fluctuations suggest some instability, with the stock unable to maintain the gains made at the beginning of the week, indicating potential market challenges or investor caution.

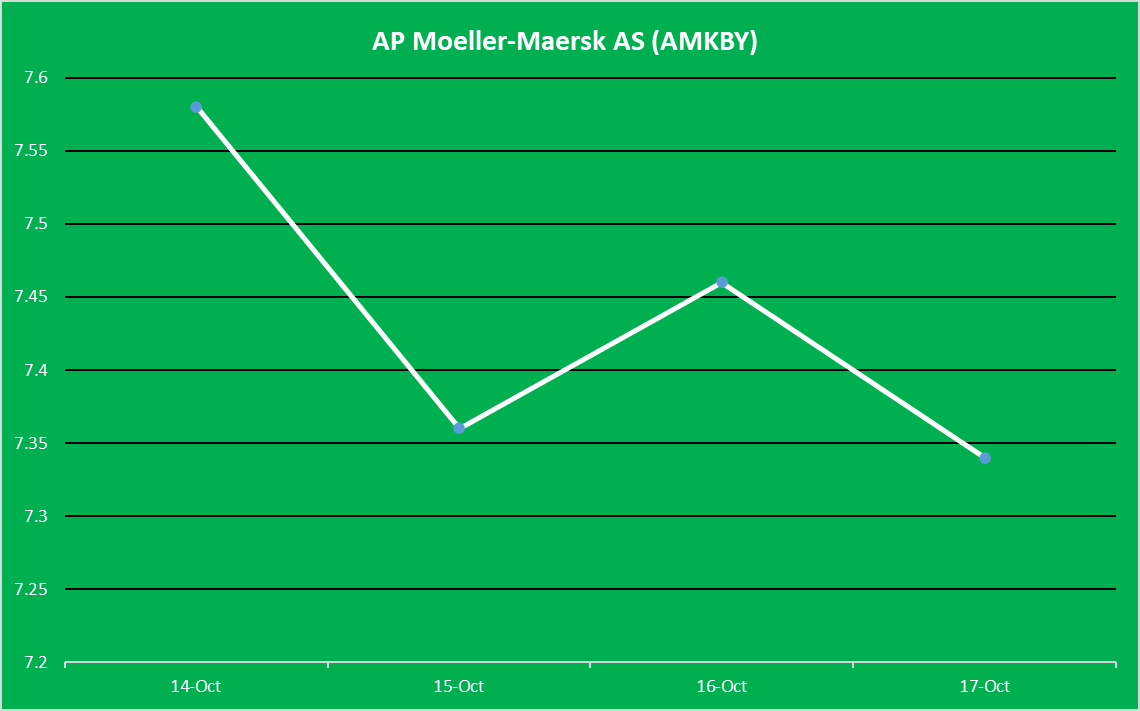

- AP Moeller-Maersk AS (AMKBY)

USD

USD

AP Moeller-Maersk AS (AMKBY) also experienced a downward trend from October 14 to October 17. The stock opened at US$7.58 on October 14 and decreased to US$7.36 by October 15. It made a slight recovery to US$7.46 on October 16 but fell again to US$7.34 by October 17. This decline suggests some headwinds for the company, reflecting a broader trend of declining investor confidence or sector challenges. Overall Maersk faced downward pressures, contrasting with the upward movement seen in other shipping stocks.

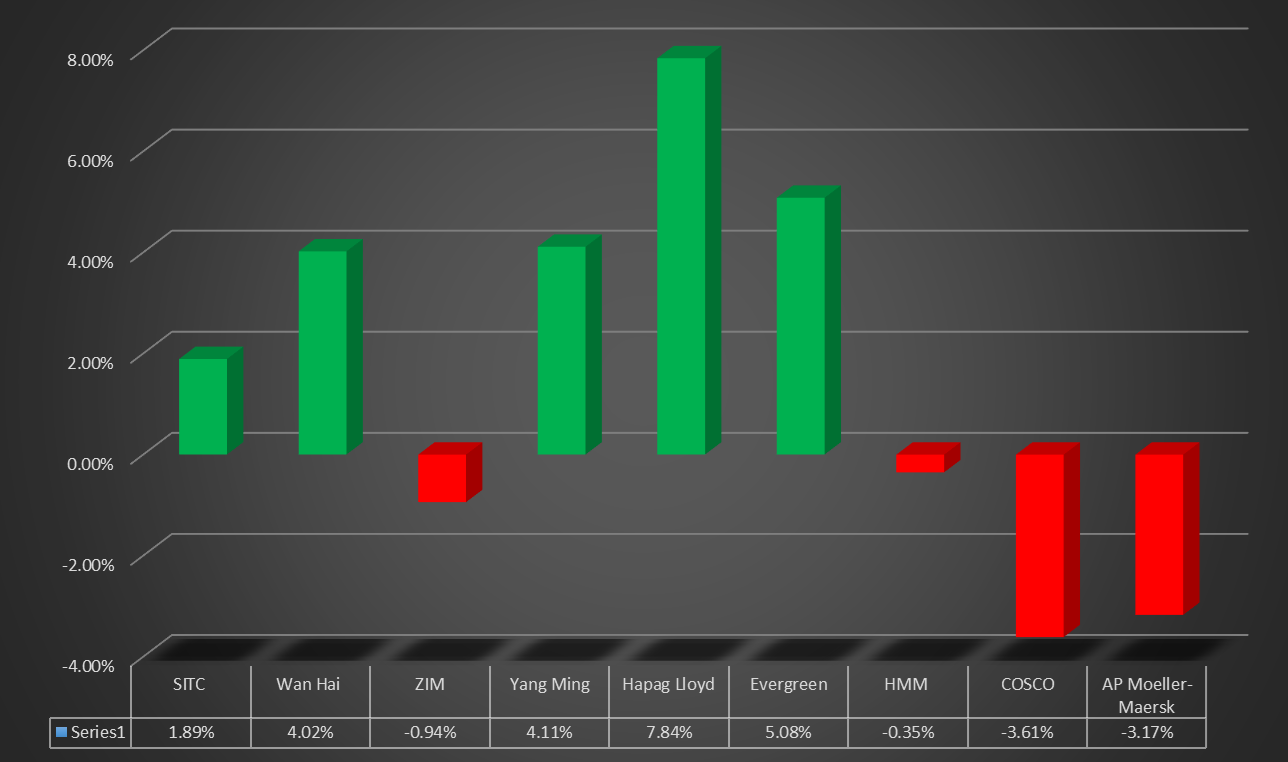

In summary, the container shipping sector has demonstrated a mix of performance across major players over the past week. Companies like Hapag Lloyd AG and Yang Ming Marine Transport Corp exhibited steady upward trends, reflecting positive investor sentiment and confidence in their operational strategies. In contrast, HMM Co Ltd, COSCO SHIPPING Holdings, and AP Moeller-Maersk faced fluctuations and slight declines, suggesting market challenges that may be impacting their stock performance.

The ongoing effects of inflation, supply chain disruptions, and regional conflicts continue to exert pressure on the industry. As the market adapts to these evolving circumstances, the contrasting performances of these shipping companies underscore the need for strategic agility in an unpredictable environment.