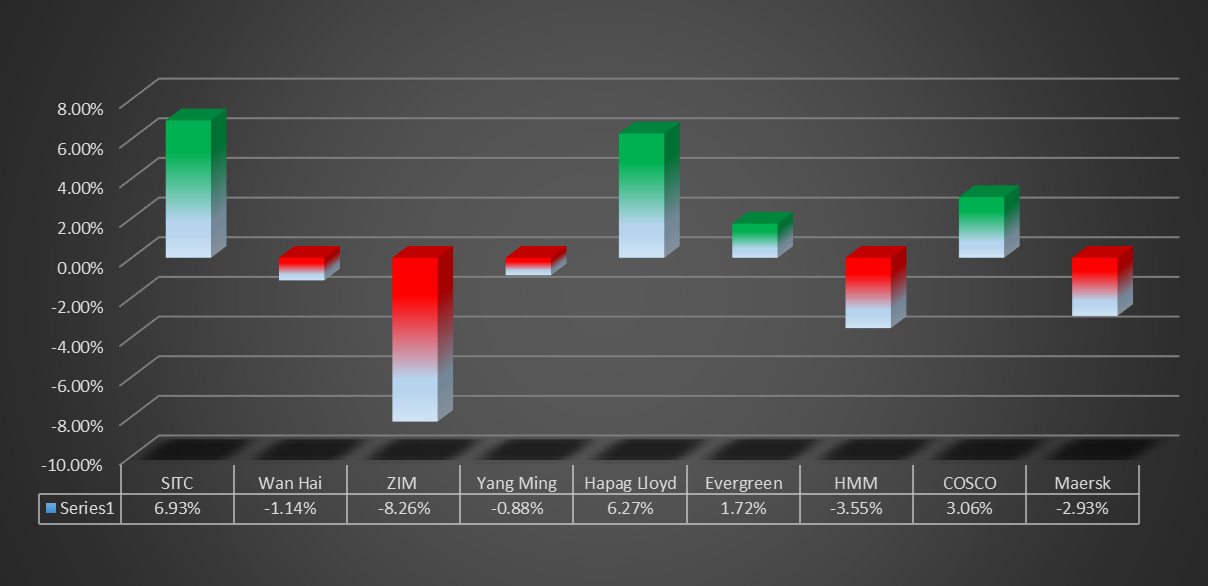

The container shipping industry has been experiencing a dynamic shift in market conditions, significantly impacting the stock performance of various key players. Recent stock price movements reveal a mixed landscape, characterized by fluctuations that reflect underlying trends in global trade, operational challenges, and shifting investor sentiment.

As companies navigate supply chain disruptions, changing demand patterns, and geopolitical influences, understanding these price dynamics becomes essential for stakeholders. This analysis delves into the recent stock performances of several container shipping firms, providing insights into market reactions and potential future trajectories in this vital sector of the economy.

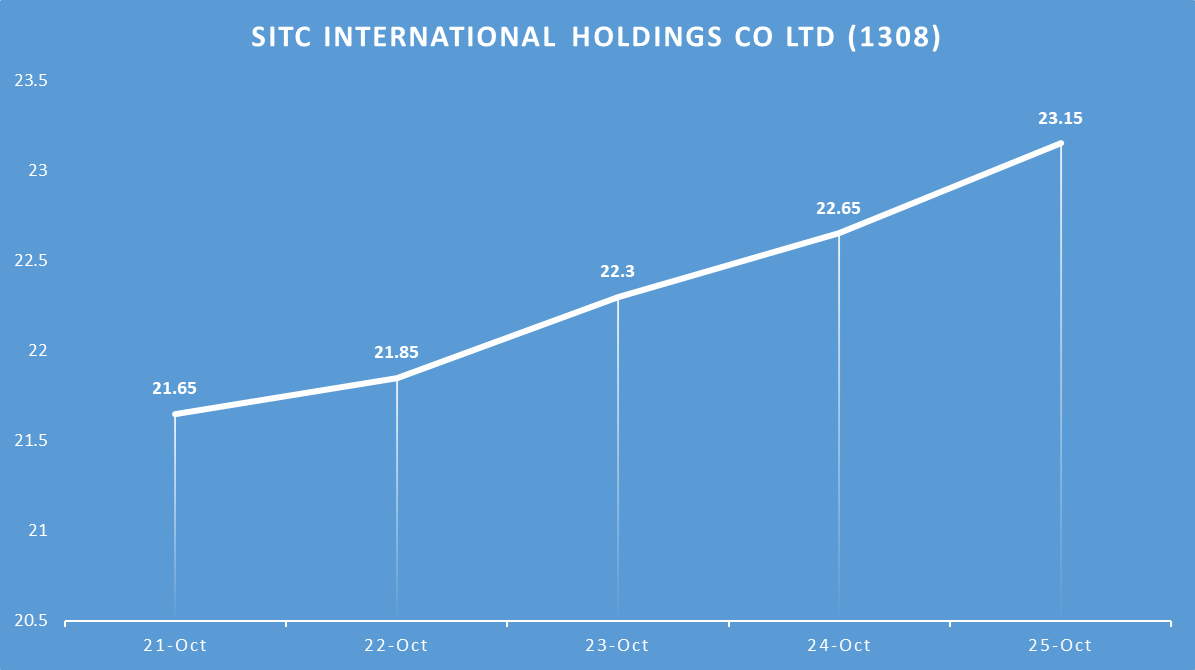

- SITC International Holdings Co Ltd (1308)

HKD

HKD

SITC International Holdings has shown a generally positive trend in its stock prices over the past week, starting at HKD 21.65 on October 21 and rising to HKD 23.15 by October 25. The stock experienced a steady increase, with the most notable jump occurring from October 24 (HKD 22.65) to October 25 (HKD 23.15). This upward momentum suggests growing investor confidence or positive market conditions for the company, which may be driven by strong performance indicators or favorable industry trends. The consistent gains over the period indicate a bullish sentiment among traders.

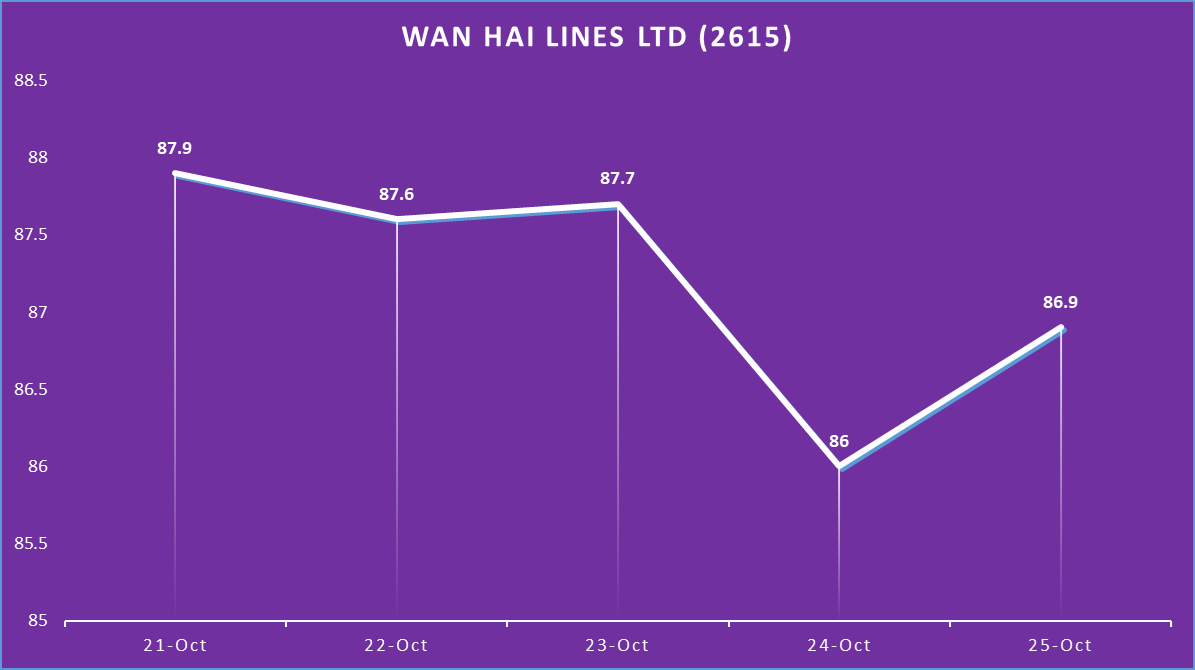

- Wan Hai Lines Ltd (2615)

TWD

TWD

Wan Hai Lines has exhibited a more volatile performance throughout the week. The stock opened at TWD 87.9 on October 21, saw a slight decline to TWD 87.6 on October 22, then experienced a minor rebound to TWD 87.7 on October 23. However, on October 24, it dropped to TWD 86 before recovering slightly to TWD 86.9 by October 25. This fluctuation may reflect market uncertainties or external factors affecting the shipping industry, such as fluctuating freight rates or geopolitical issues. Overall, the stock’s performance suggests cautious sentiment among investors, leading to mixed trading actions.

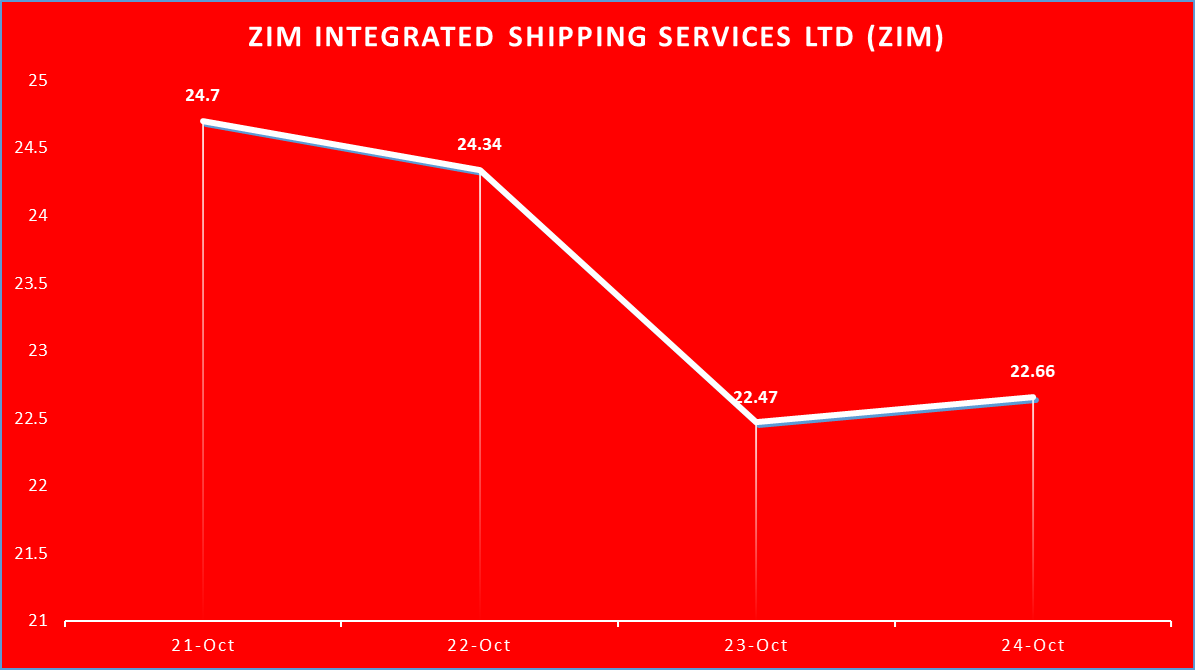

- ZIM Integrated Shipping Services Ltd (ZIM)

USD

USD

ZIM Integrated Shipping Services has faced a downward trend in its stock prices over the past week. Starting at USD 24.7 on October 21, the stock decreased to USD 24.34 on October 22, followed by a more significant drop to USD 22.47 on October 23. It slightly recovered to USD 22.66 by October 24 but remained below its opening price. This overall decline may signal challenges within the company or the broader shipping sector, possibly influenced by factors such as rising operational costs or reduced demand for shipping services. Investors may be cautious, leading to selling pressure reflected in the stock’s performance.

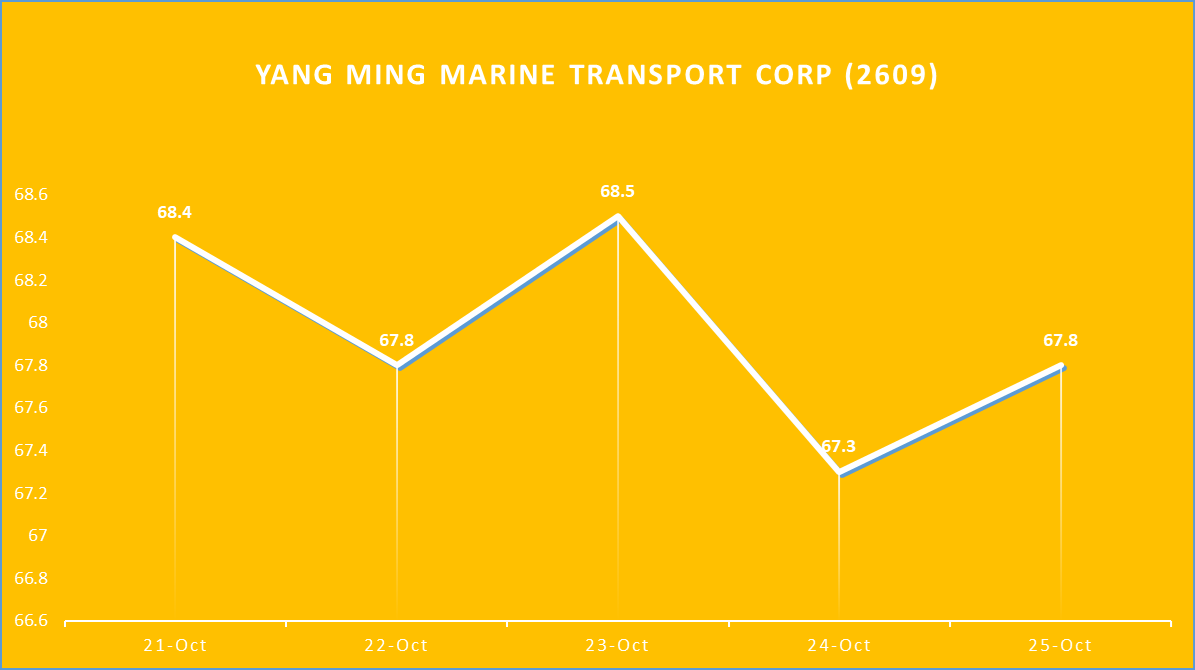

- Yang Ming Marine Transport Corp (2609)

TWD

TWD

Yang Ming Marine Transport Corp experienced fluctuating stock prices throughout the week. Starting at TWD 68.4 on October 21, the stock dipped to TWD 67.8 on October 22 before rebounding to TWD 68.5 on October 23. However, it fell again to TWD 67.3 on October 24, before slightly recovering to TWD 67.8 on October 25. This pattern indicates some volatility, suggesting that investor sentiment may be reacting to market conditions or broader trends in the shipping industry. Overall, the mixed performance reflects uncertainty among investors, as the stock struggled to maintain upward momentum.

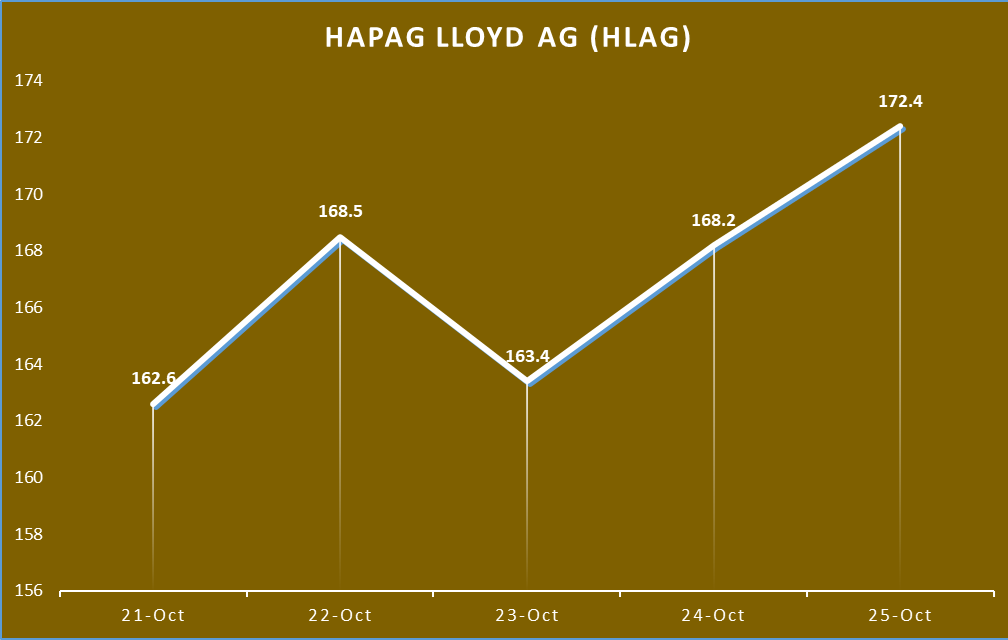

- Hapag Lloyd AG (HLAG)

EUR (€)

EUR (€)

Hapag Lloyd AG has demonstrated a positive upward trend in its stock prices over the past week. Opening at €162.6 on October 21, the stock rose to €168.5 by October 22, reflecting a strong initial gain. After a minor decline to €163.4 on October 23, the stock rebounded to €168.2 on October 24, ultimately closing at €172.4 on October 25. This steady increase indicates growing investor confidence in the company, possibly driven by favorable financial results or positive developments within the container shipping sector. The overall trend suggests that Hapag Lloyd AG is well-positioned to capitalize on current market conditions, making it an attractive option for investors seeking stability and growth.

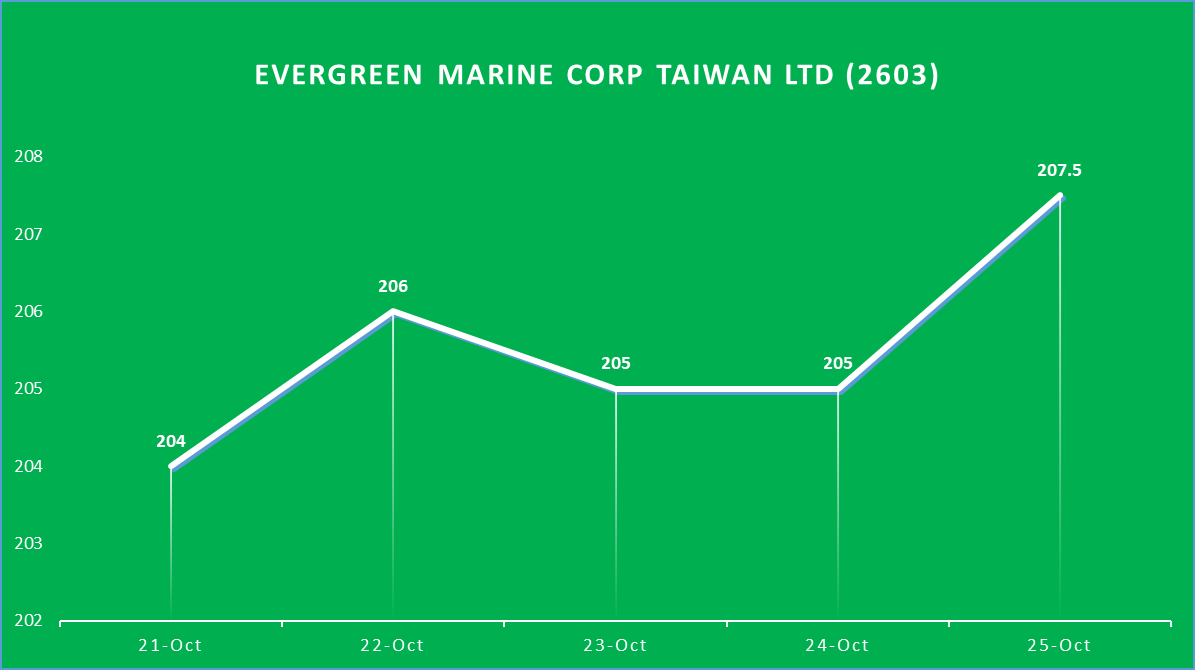

- Evergreen Marine Corp Taiwan Ltd (2603)

TWD

TWD

Evergreen Marine Corp has shown a generally stable performance over the past week. Opening at TWD 204 on October 21, the stock rose to TWD 206 on October 22, before experiencing a slight dip to TWD 205 on October 23 and 24. On October 25, the stock made a notable gain, closing at TWD 207.5. This positive trend indicates strong investor confidence, potentially driven by solid financial results or favorable market conditions within the shipping sector. The consistent trading range suggests a robust performance, making Evergreen Marine a potentially attractive option for investors looking for stability.

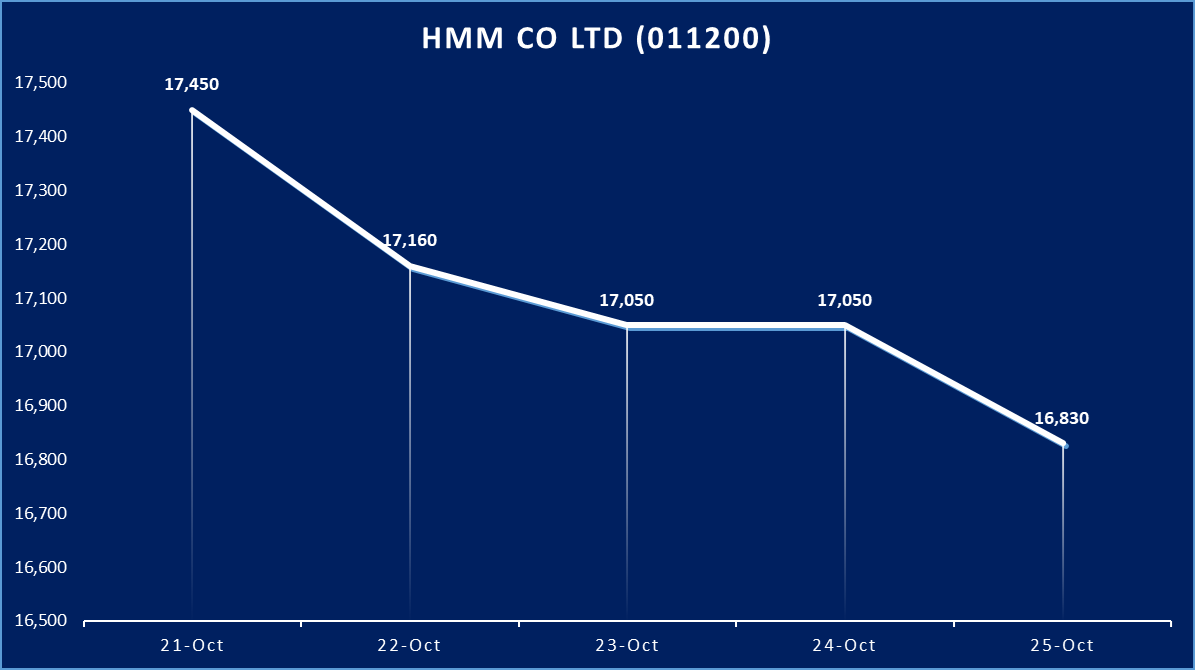

- HMM Co Ltd (011200)

KRW

KRW

HMM Co Ltd has faced a downward trajectory in its stock prices over the week. The stock started at KRW 17,450 on October 21 and gradually declined, dropping to KRW 17,160 on October 22, followed by a further decrease to KRW 17,050 on October 23 and remaining stagnant at that level through October 24. By October 25, it fell to KRW 16,830. This consistent decline may indicate investor concerns regarding the company’s performance or external factors affecting the shipping industry, such as rising fuel prices or reduced demand. The overall bearish trend suggests a need for caution among potential investors.

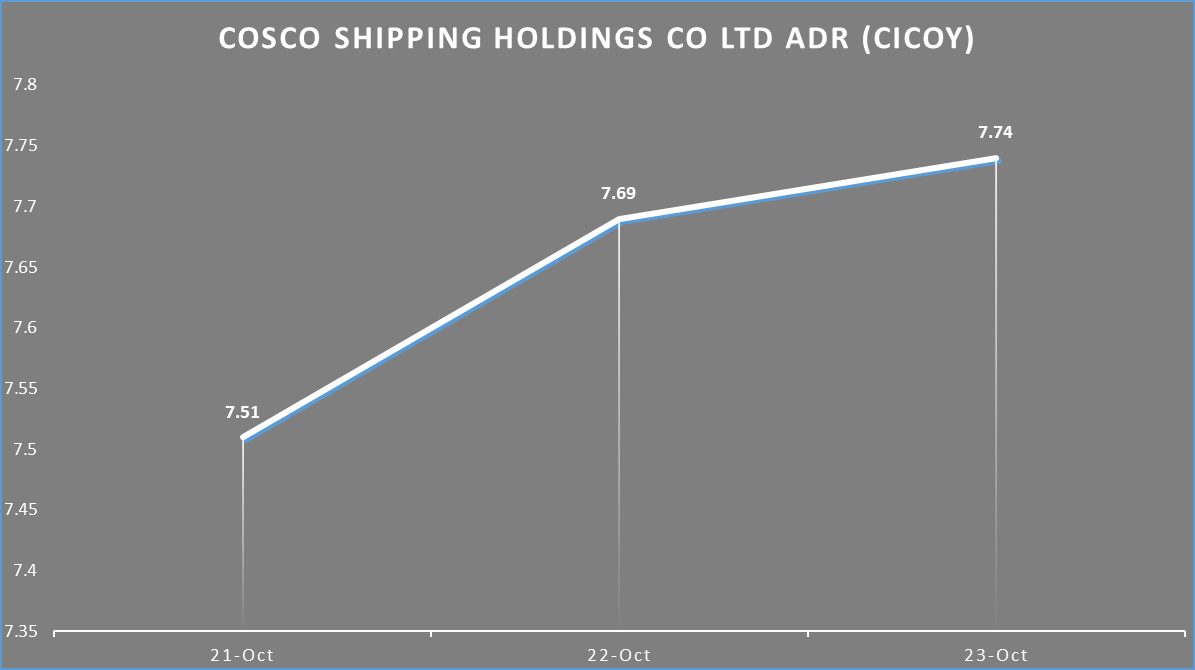

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

USD

USD

COSCO SHIPPING Holdings has experienced a modest increase in stock prices during the observed period. The stock opened at USD 7.51 on October 21 and rose to USD 7.69 on October 22. The upward momentum continued slightly, reaching USD 7.74 on October 23. This positive performance indicates a potentially favorable outlook for the company, possibly due to strong operational results or positive news regarding the shipping sector. The sustained rise in stock prices reflects growing investor confidence, making it a noteworthy option for those interested in the maritime transport market.

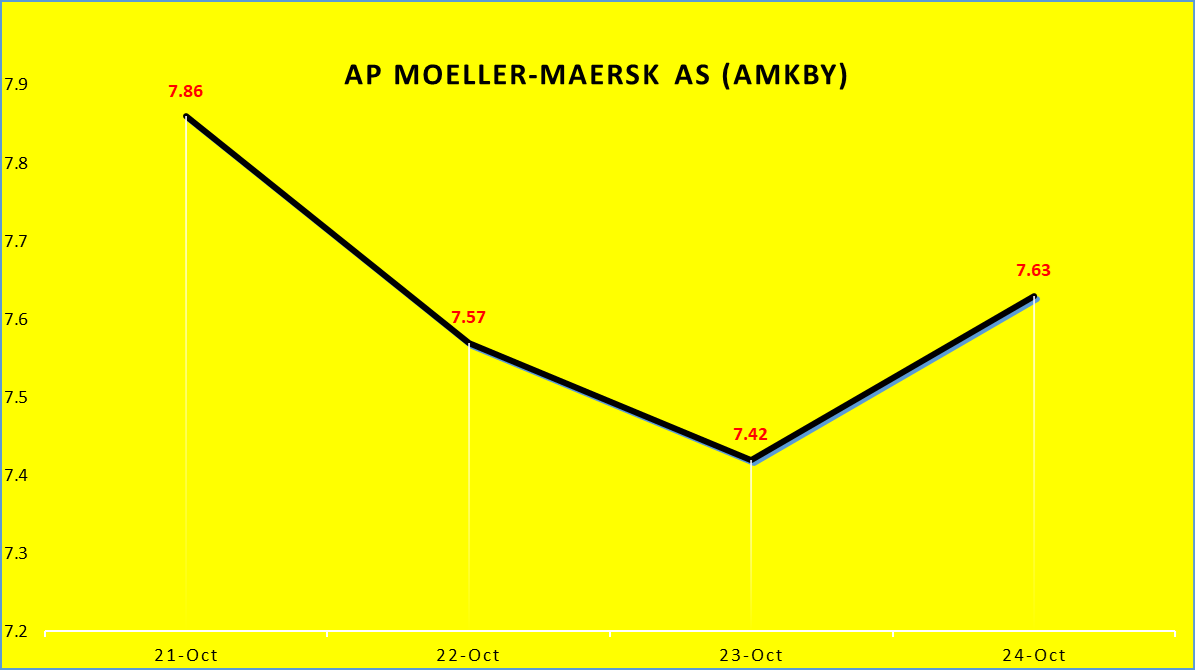

- AP Moeller-Maersk AS (AMKBY)

USD

USD

AP Moeller-Maersk AS has shown a declining trend in its stock prices over the past week. Starting at USD 7.86 on October 21, the stock decreased to USD 7.57 on October 22, followed by a further drop to USD 7.42 on October 23. There was a slight recovery on October 24, closing at USD 7.63, but it remains below its initial value. This overall downward trend suggests potential challenges facing the company, which could include market volatility or operational difficulties. Investors may approach this stock with caution, reflecting a bearish sentiment in the market.

In summary, the recent stock price movements within the container shipping sector highlight the complexities and challenges faced by companies operating in this volatile environment. While some firms show resilience and positive investor sentiment, others struggle with declining prices amid broader market uncertainties. These trends underscore the importance of continuous monitoring of market conditions, operational performance, and global economic factors that influence the container shipping industry. As stakeholders assess these dynamics, informed investment decisions will be crucial in navigating the ever-changing landscape of maritime logistics.