The consumer demand for retail has been steadily declining in recent months due to rising prices despite the increase in commodity prices, according to the digital freight forwarding platform Shifl.

Major retailers have indicated an excessive number of stocks, which is likely to lead them to reduce their imports to improve inventory turnaround times.

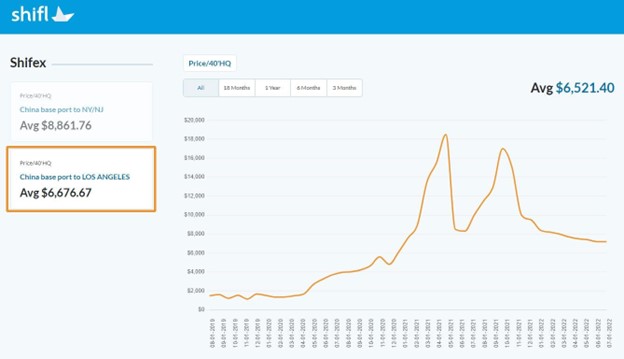

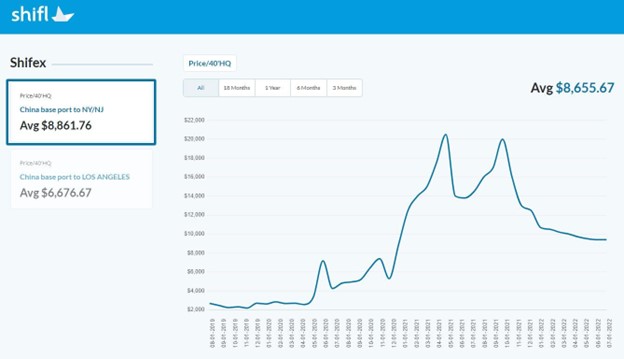

As demand from both consumers and retailers declines, it comes as no surprise that ocean freight spot rates between China and North America see new lows this year.

“Ocean freight spot rates are continuing to drop fast. The SHIFEX index shows China to the US West Coast has gone below US$7,000 per FEU while China to the US East Coast is moving downwards to below US$9,000 per FEU,” said Shabsie Levy, CEO and founder of Shifl.

“Consumer retail expenditure seems to be at a tipping point, inevitably reducing total volumes getting ashore. We expect this to push prices further down in the future,” he added.

It should be noted that ocean freight rates are largely linked to the retail industry, accounting for more than half of all US imports.

Despite the fact that global container lines have taken measures, such as blank sailings and removing capacity from the market, the reduction of ocean spot freight rates, based on the fall in retail demand, does not seem to stop.

“This drop-in freight rates will go a long way in helping combat the rising inflation,” pointed out Levy.

Levy went on to explain, “The issue of increased freight rates and inflation has been a major topic of discussion in the US markets including the efforts by the US Government and Congress who have been actively involved in trying to curb ocean freight prices including the recent passing the Ocean Shipping Reform Act of 2022 (OSRA22), aimed at lowering the costs of everyday items and putting brakes on the high inflation rates.”

At the same time, the growth of new import orders has also slowed, indicating a prolonged period of volumes that remain lower than expected. While it was expected that order numbers in China would reach high volumes with the easing of restrictions in Shanghai, this did not happen.

“While long-term ocean freight prices remain higher than spot ocean freight prices, the situation may not last long,” noted Levy.

“When shippers realise spot prices continue to cascade, they could look to renegotiate their contracts with container lines. With import orders not staying strong in the middle of June — a regular high season, and the Chinese adamance to hold on to Covid-zero measures can result in uncertainty in import flows, negatively impacting freight prices over the course of this year,” continued Levy.

Economist Marc Levinson wrote on LinkedIn, “The US distribution system is stuffed with stuff. Business inventories in April were up nearly 18% from a year ago. Inventories at non-auto retailers were up 20%. One merchant after another — Target, WalMart, Costco, even mighty Amazon — has reported disappointing earnings and is marking down excess merchandise like crazy.”

“The reason for the excess inventory? Simply enough, consumers have stopped spending with abandon. As shopping habits revert to pre-pandemic norms, inflation decimates buying power, and home sales stall, the demand for consumer goods is stalling as well,” added Levinson, echoing what Shifl reported previously in support of the dropping ocean spot freight rates.