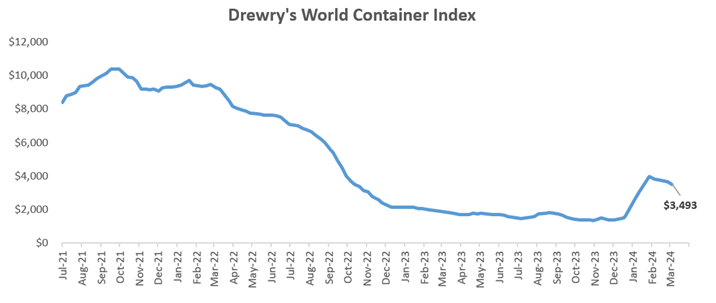

The latest quote by the Drewry World Container Index (WCI) voiced the correction in spot prices after the massive 138% swing in 6 weeks witnessed between 15 December 2023 and 30 January 2024.

The WCI registered a 5% loss for the week, and at US$3,493 ended at a six week low. But in February though, the index lost over 8% with the primary laggards being the China- Europe and China-Mediterranean trade lane pairs, which lost 15-19% for the month. The transatlantic trade lane (Europe- US) registered a 40% upside for the month, ending at US$2,220, which is an eight-month high.

Container trade statistics point that the Europe to US had seen about a 6.2% rise in container traffic in December 2023, while those to South America rose by 9.9%. While the post-Chinese New Year season depicts a quiet period historically, the steepness of the fall is protected by the Red Sea Supply Chain disruptions, which have been on full fledge. The Chinese Economic activity has been shrinking over the past five months and it remains to be seen, if a course correction happens.

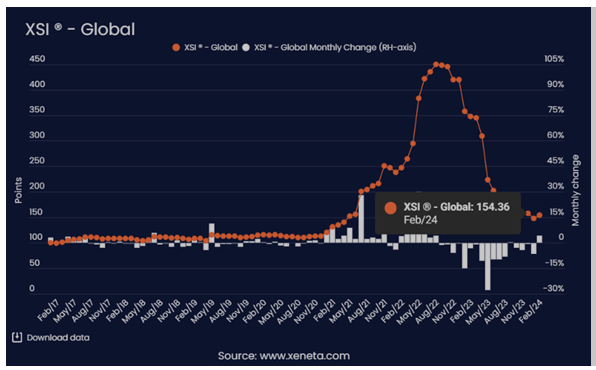

The Shanghai Containerized Freight Index (SCFI) fell below the 2,000 mark, registering its biggest weekly loss since November 2022 (in percentage terms) while indices such as the Freightos Global Index (FBX) were also seen inching lower. However, the higher base for the transpacific rates would mean higher contract rates being revised in Q2 2024 which will also see the re-introduction of General Rate Increases (GRIs) for Freight All Kind (FAK) rates. The contract market seems to enjoy the green shoots which have possibly become a base for the next round of contractual negotiations. Predictably. the Xeneta Shipping Index (XSI) which tracks the shipping contract rates’ scenario witnessed its highest monthly rise in 18 months to end at 154.36, appreciating 4.3% over the January quote of 148 which was its lowest ever level since April 2021.

The way forward for the market is to have an eye on the negotiations happening in the contract market space. For the container spot segment, the Chinese PMI data which fell to 49.2 would indicate concern. However, would this be a seasonal one-off remains to be tracked and seen?

While shipping lines have settled to the ‘post Red Sea disruption normal’ to an extent, the geopolitical trends will be keenly watched. For the Panama region, the situation remains status quo until May 2024, when the rainy season is expected to bring some relief to the region’s water tables. March has traditionally been a relatively quieter month in the freight segment, but this year has the added effect of possible consolidation in the industry by M&A activity too.

Author of the article: Gautham Krishnan

Gautham Krishnan is a logistics professional with Fluor Corporation, who has expertise in the Supply Chain area focusing in the Project Logistics domain, analytics and the LogTech space. He has worked in the areas of Project Management, Business Development and Government Consulting. For his body of work in the mentioned areas, he was bestowed the AntwerpXL 40-under-40 award in the year 2023, and touted to be one of the upcoming, future leaders in the project logistics & supply chain function.