The market is assessing the stalled recovery in fuel demand as countries continue to battle the coronavirus pandemic with rolling Covid-19 lockdowns.

This has created uncertainty about whether demand for transportation fuels will ever return to normal.

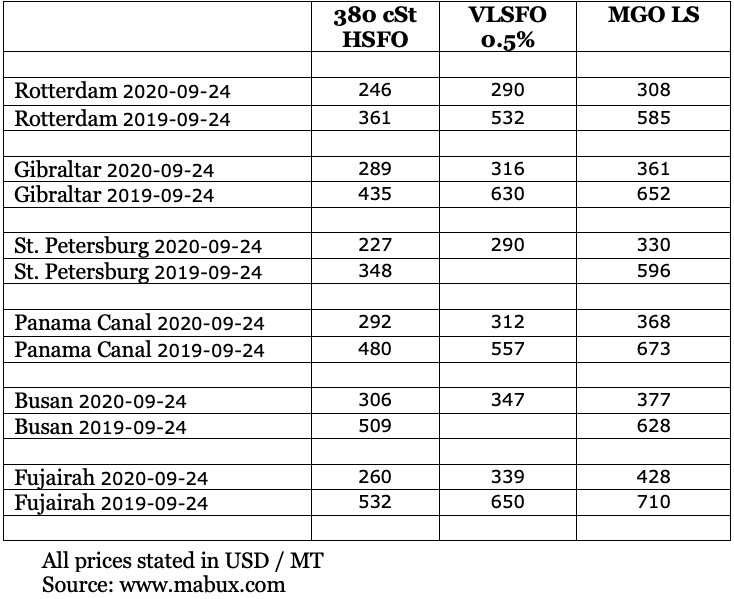

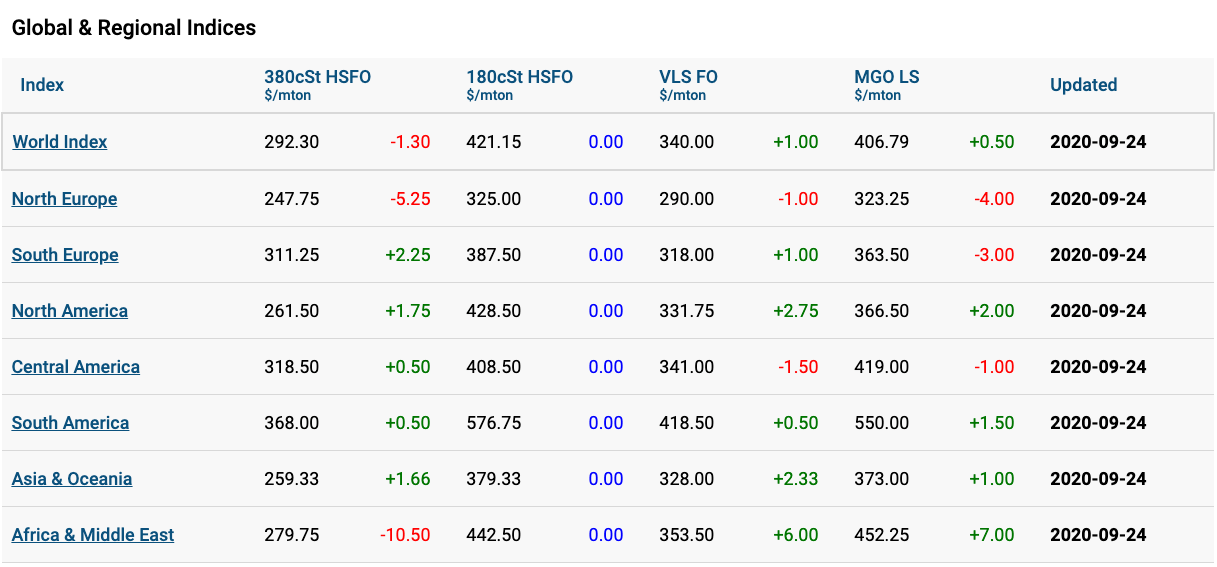

The World Bunker Index MABUX was steady with no any firm trend for a week. The 380 HSFO index fell to US$292.30/ mt, VLSFO stayed at the level of US$340 while MGO lost US$4.32, reaching US$406.79/mt.

The global scrubber spread (the price difference between 380 HSFOs and VLSFOs) has increased slightly to US$47.28.

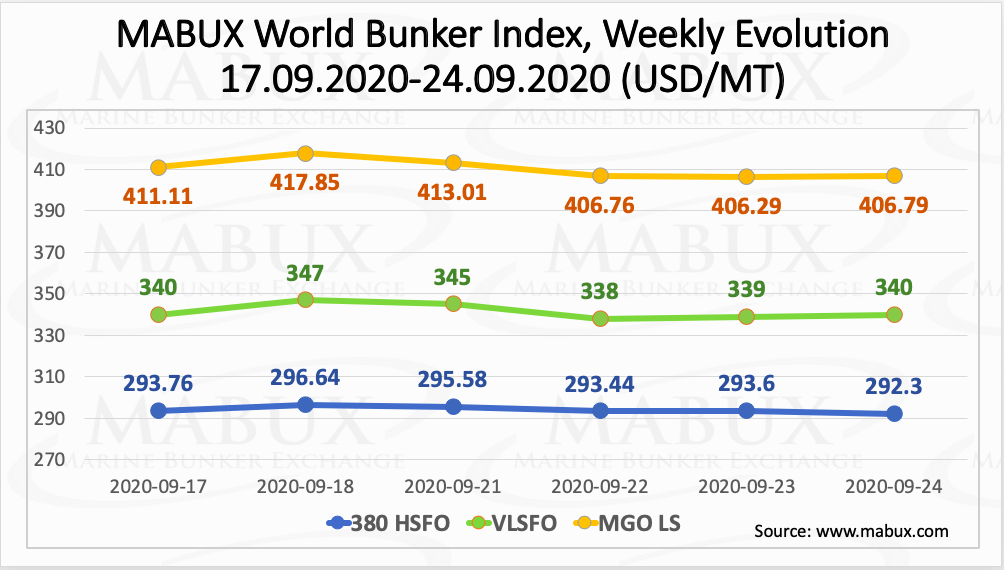

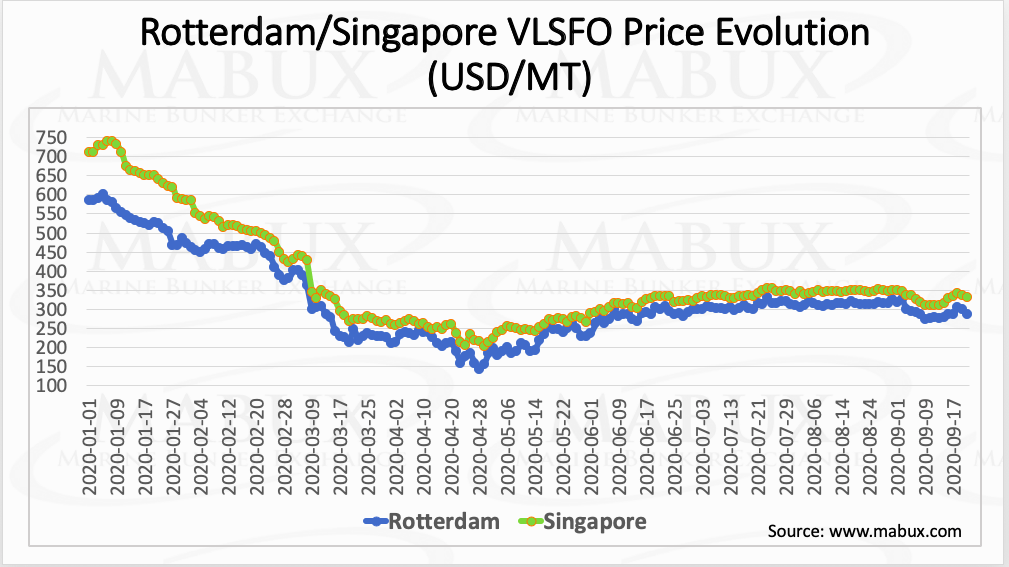

At the same time, the prices for VLSFO – compliant low-sulphur fuel – have remained fairly stable since June in world major hubs. The difference in prices of VLSFO in Rotterdam and Singapore, which reached its maximum levels in early 2020, has now significantly decreased and is in a range of US$35-45.

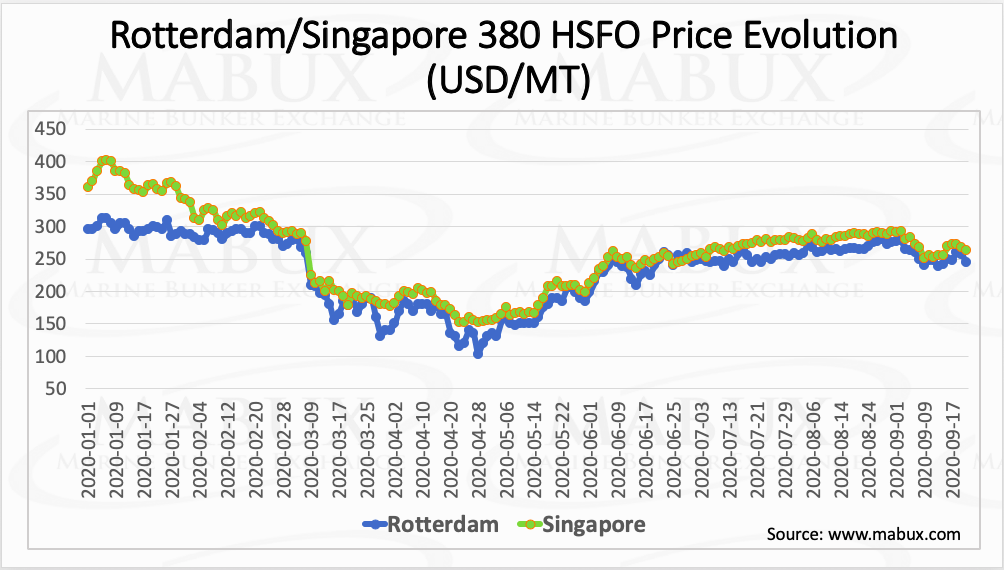

In the meantime, prices for 380 HSFO in both ports are practically at the same levels, starting from February, after the highs in the price difference in January. In September, the difference in 380 HSFO price ranged from US$5/mt to US$25/mt in favour of Rotterdam.

Lloyd’s Register FOBAS points to an increase in ‘excessive cylinder component wear’ on large two-stroke engines from November 2019, when vessels began to switch over to very low sulphur fuel oils (VLSFO). FOBAS data indicates that overall incidents relating to cylinder component damage almost doubled for the studied period between November 2019 and June 2020. Sludging incidents were said to have remained on similar levels although a reduction in fuel injection equipment failure incidents has been observed.

Deliveries of residual fuel oil in the US fell to 294,000 barrels per day (bpd) in August – 24.6% down on the 390,000 bpd recorded in July. The marked decreases were consistent with weak industrial activity and lower marine demand due to IMO 2020 implementation compounded by the effects of the Covid-19 pandemic.

The technology group Wärtsilä concluded that the environmental impact of exhaust gas cleaning systems (EGCS) will be less than that of low-sulphur marine fuel. It notes that CO2 emissions associated with producing and installing an EGCS are small compared to those generated when operating the system. By contrast, with de-sulphurised fuels the overall CO2 footprint increase is a result of the refining processes.