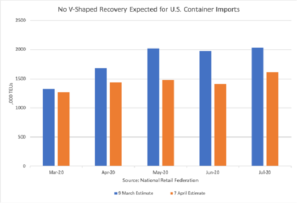

A container import recession is expected to last through the first half of 2020 with only gradual improvement in the second half as US consumers remain at home due to the nation’s coronavirus pandemic, a leading research firm said.

The outlook ends hopes for a so-called “V-shaped” recovery as the pandemic lasts longer and hits deeper than anyone expected. In its last earnings call, Maersk Chief Executive Officer Soren Skou held out hope for a “weak March, and hopefully a strong rebound in April, May, and June.”

Looks like that won’t be happening anytime soon. The National Retail Federation (NRF) expects 1.81 million TEU fewer imports in March through July than its last forecast as halting the coronavirus “entails the closure of significant portions of both the service and manufacturing industries,” the trade group said.

While February container imports of 1.51 million TEU came in nearly 100,000TEU better than forecast, March is expected to see only 1.27 million TEU in imports, a 21% drop from a year earlier and the lowest monthly total seen since the West Coast port labour strike in 2015.

Long Beach, one of the first to report March volumes, announced that it continued to feel the economic effects of Covid-19 in March with more cancelled sailings and a decline in cargo containers shipped through the nation’s second-busiest seaport.

Terminal operators and dockworkers moved 517,663TEU last month, a 6.4% decline compared to March 2019. Imports were down 5% to 234,570TEU, while exports increased 10.7% to 145,442TEU. Empty containers shipped overseas dropped 21% to 137,652TEU.

Overseas health concerns over the coronavirus caused 19 cancelled sailings to the Port of Long Beach during the opening quarter of 2020, which contributed to a 6.9% decline in cargo shipments compared to the first three months of 2019.

“The coronavirus is delivering a shock to the supply chain that continues to ripple across the national economy,” said Mario Cordero, Executive Director of the Port of Long Beach. “We’re definitely seeing a reduction in the flow of cargo at San Pedro Bay, but the ports remain open and operating, and we are maintaining business continuity.”

The frequency and intensity of cleaning efforts have been increased on the docks, at Port offices and other common areas, in order to maintain the health and safety of dockworkers, truckers, terminal operators and others, according to a statement.

“The largest drop is forecast for the first half of this year but with uncertainty about the length of the lockdown and extent of the pandemic, the second half may not be in better shape,” the NRF said.

Mike Angell

North America Correspondent

And Antonis Karamalegkos

Editor