Maritime data company, Sea-Intelligence, examined the only historical precedent for ship delays that comes even closer to the current market situation: the labour dispute at the US West Coast ports in early 2015.

Methodologically, it is possible to analyse how quickly business normality returned in 2015 and use this as a benchmark for how long it will take to reverse the ongoing crisis, according to Danish analysts.

That said, the issues in 2015 were specific to US West Coast ports, not global and not related to landlocked issues (all of which are present today). Therefore, the company is given a minimum timeline for recovery, with the reality likely to be longer.

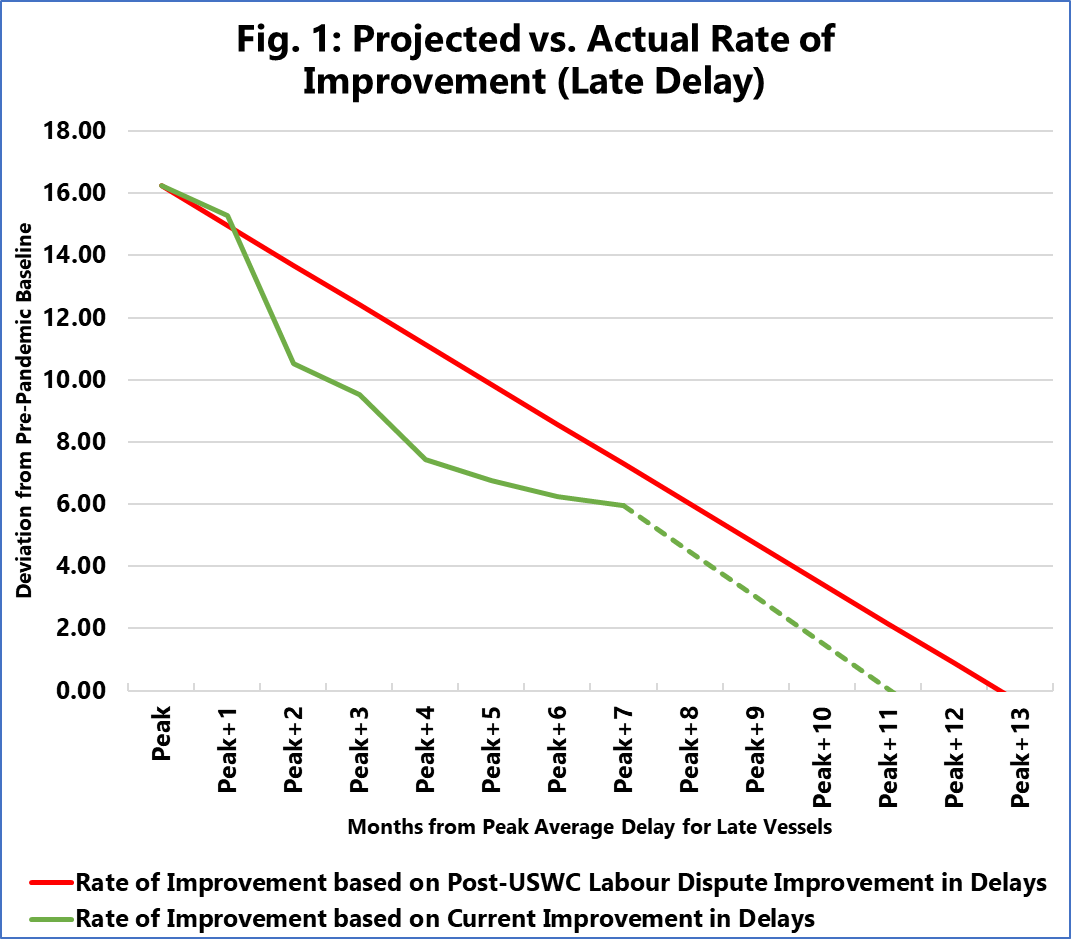

For average delays, the maximum deviation during the US West Coast labor dispute was 8.92 days. Since it took 7-8 months for delays to return to pre-dispute baseline (defined as January 2012-July 2014), the rate of improvement can be calculated as 1.12-1.28 days per month. In comparison, the maximum deviation since the pandemic was 16.25 days (compared to the pre-pandemic baseline defined as January 2017-December 2019).

The figure shows two things. Firstly, if the rate of improvement from the peak of the pandemic delay is the same as it was after the 2015 labor dispute, it would see a reversal of the pre-pandemic baseline in 13 months, which translates to January 2023 (shown by the red line).

Secondly, if, on the other hand, one takes the current average rate of improvement so far in 2022, the average delay will return to its pre-pandemic baseline in 11 months, which translates to November 2022 (shown by the green line).

“This means that the current rate of improvement is faster than a prediction based on the recovery after the US West Coast labour dispute,” noted Alan Murphy, CEO of Sea-Intelligence.