Danaos Corporation has announced its financial results for the first nine months of the year, reporting an average of 71 container ships. The company’s fleet utilisation for the nine months ended on 30 September 2022 was 98.1%.

“The drop in demand for containerized freight has also significantly reduced vessel demand from opportunistic market participants, who were aggressively contracting smaller vessels or extra loaders which were used during the peak of demand last year,” commented Danaos’ CEO, John Coustas.

He added, “This has led to a significant correction in the sub-3,000 TEU segment as charterers are on the sidelines waiting for the market to drop before they commit a vessel.”

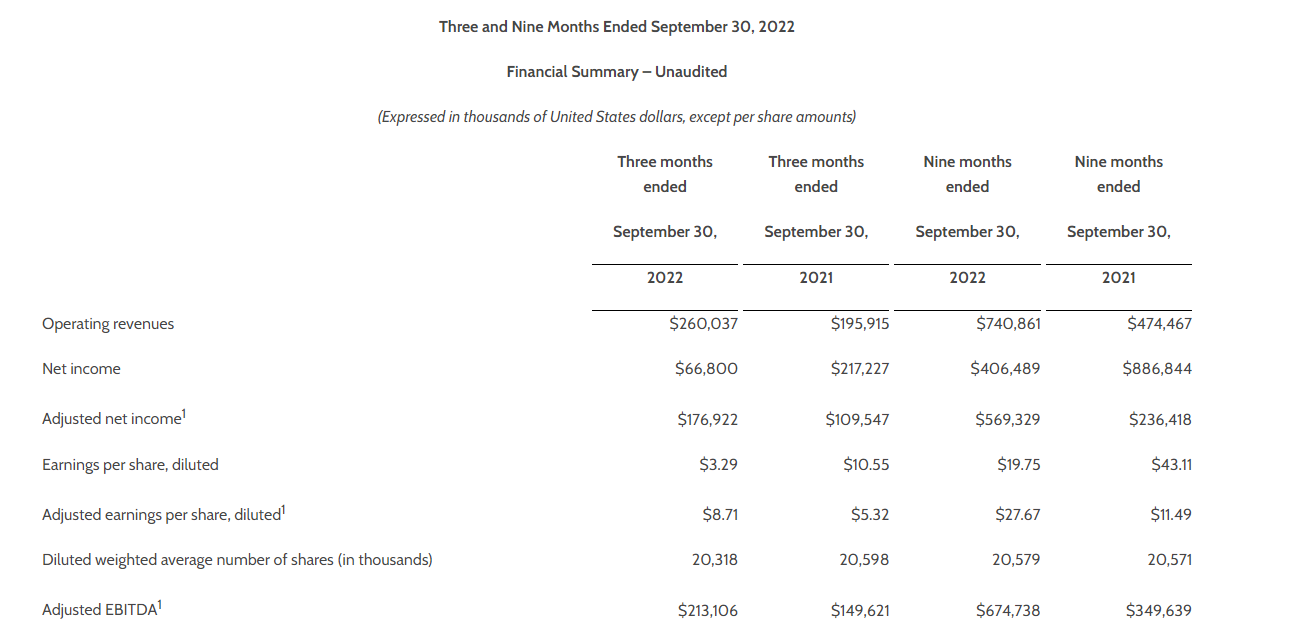

The Greek shipping company’s adjusted net income amounted to US$569.3 million, or US$27.67 per share, for the first nine months of the year.

Danaos has adjusted its net income in the nine months ended on 30 September for the change in fair value of its investment in the Israeli container carrier ZIM of US$176.4 million, gain on debt extinguishment of US$22.9 million and a non-cash fees amortisation of US$9.4 million.

The US$332.9 million increase in adjusted net income for the first nine months of the year compared to the same period last year is attributable mainly to a US$266.4 million increase in operating revenues and a US$134.9 million increase in dividends from ZIM.

On a non-adjusted basis, Danaos’ net income amounted to US$406.5 million, or US$19.75 earnings per diluted share.

Moreover, Danaos’ net income for the first nine months of 2022 includes a total loss on its investment in ZIM of US$29.2 million and a gain on debt extinguishment of US$22.9 million.

“Danaos is well-insulated from the current market environment and achieved record operating profit in the third quarter of 2022. Our commercial efforts earlier this year resulted in a number of new vessel fixtures for our vessels, and we ended the quarter with a multi-year backlog of US$2.3 billion in contracted revenue,” said John Coustas. “We have also continued to strengthen our balance sheet and we have now fully liquidated our shareholding in ZIM, as we stated we would. In addition, we have new commitments from our bank group to extend existing bank debt facilities until 2027.”

He added, “This means we have no significant capital requirements or refinancings until then, and we have the necessary flexibility to pursue our strategy of growth, share buybacks, and acquisitions. In fact, our net debt will be very close to zero by the end of this year, which protects Danaos from the recent dramatic increase in interest rates.”

Furthermore, in the same period, the company’s operating revenues increased by 56.1%, to US$740.9 million and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reached US$674,738,