Even before trade went global, shipping played a critical role in international commerce, since globalisation, in the 1980’s, container shipping has been a critical instrument in making modern supply chains effective.

Speed and reliability meant that container ships play a key role in just-in-time logistics, with the costs effectively negligent for much of the first 50 years of containerised trading. One cent was said to be the cost of transporting a US$100 pair of trainers from Asia to Europe and the US.

Air pollution, it is safe to say, was never a great consideration of the early container shipping world, but today container ships are, officially, the maritime industry’s major polluters, being responsible for more than a quarter of maritime greenhouse gas (GHG) pollution, according to the International Maritime Organization (IMO)’s Fourth GHG study.

It is likely, though there is no data to hand, that this is partly because they travel faster than most large vessels in order to maintain their schedules, but bulk carriers and tankers are also in the mix for pollution potential, according to the IMO study.

That same report attributes 86% of maritime carbon dioxide pollution to just six vessel types, crude oil, gas and chemical tankers, container ships, general cargo vessels and, bulk carriers. While three sectors crude oil tankers, container ships and bulkers contribute 66% of carbon dioxide from shipping. Tackling the carbon conundrum in these three sectors will go a long way to solving shipping’s carbon emissions problem.

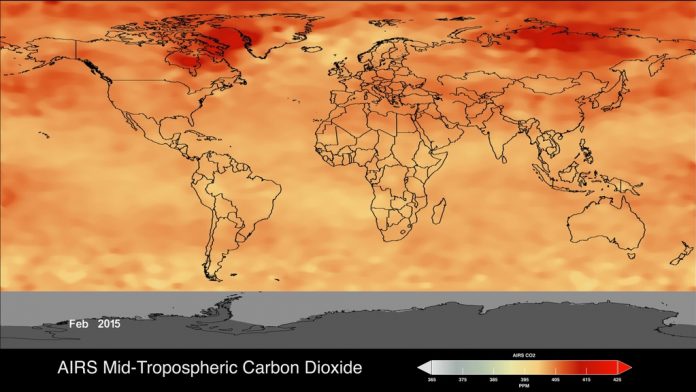

This visualization shows the global distribution and variation of mid-tropospheric carbon dioxide concentration observed by the Atmospheric Infrared Sounder (AIRS) on NASA's Aqua spacecraft. For comparison, it is overlain by a graph of the seasonal variation and interannual increase of carbon dioxide observed at the Mauna Loa, Hawaii, observatory. Source NASA.

In 2018 the IMO committed the industry to halve carbon emissions, compared to 2008 levels, by 2050, while the industry should have already cut emissions by 30% 20 years earlier. That means that the next generation of vessels will need to adapt or be very efficient.

Efficiency gains of these levels are not possible, but a mix of innovation in fuels with more efficient vessels can help the industry meet its climate change targets even with demand rising as it is expected to into the future. According to the IMO report global trade growth has already risen 50% since 2008.

As a result new fuels are going to be key, and innovation in zero carbon fuels will remain the ultimate goal for vessel operators in the three key sectors. Those goals will have multiple solutions, not only relying on innovative new technology to power ships, but also looking to new digital concepts to increase the efficiency of vessels.

It is for these reasons that Container News has launched the Digital Series, which will be published in the middle of each month and the Decarbonisation Campaign which will be published at the end of each month. Watch out for announcements on accompanying seminars and One-to-One interviews.

Decarbonisation and digitalisation will be the two pillars on which modern maritime trade is developed. The IMO’s commitment to decarbonise the industry and its overall strategy to achieve that goal were laid out in 2018, along with the targets to reduce GHG emissions. The plan in general terms is to understand the size of the problem through the Data Collection System (DCS), refine the efficiency of each vessel, and then rely on the energy and shipbuilding industries to innovate, creating new zero carbon fuels and more efficient ships.

The IMO’s DCS was implemented in 2019, with a requirement for all vessels of 5,000 gross registered tonnes (grt) and above to report emissions to the DCS. The first data reporting deadline occurred in March 2020, we are now approaching the second annual deadline, but the situation has changed dramatically in the intervening period.

Nevertheless, the fourth GHG study identified trends in the three major vessel types, bulkers, tankers and container ships, that had continued from the previous study period and identified in the third GHG study. These trends include, slower, larger ships, with greater installed power and, although fuel consumption has increased, it is at a slower rate than the increase for installed main engine power.

“This decoupling in the rate of increase in installed power and fuel consumption is the consequence of a general trend of continued reduction in operating speeds (also observed in the Third IMO GHG Study), and continued reductions in the average number of days at sea,” said the GHG report.

Furthermore, in the period of the Fourth GHG Study tankers and container vessels increased their average speeds in 2015 and 2016. According to the study, emissions growth levels were at their highest in these periods too.

“This shows that operating speeds remain a key driver of trends in emissions and rate of emissions growth, and are currently susceptible to fluctuating market forces and behaviour trends (e.g. they are not fixed or constrained by the technical or design specifications of the fleet),” concluded the GHG report.

What is more, the report’s authors’ analysis is that “further reductions in productivity” through speed reductions have left the industry with the potential for substantial emissions increases.

“In 2018, relative to 2012, there is an increased risk of a rapid increase in emissions should the latent emissions in the fleet be realised. This builds further upon a similar finding from the Third IMO GHG Study which noted that the fleet in 2012: ‘…is currently at or near the historic low in terms of productivity (transport work per unit of capacity)…’ and that ‘…these (and many other) sectors of the shipping industry represent latent emissions increases, because the fundamentals (number of ships in service) have seen upwards trends that have been offset as economic pressures act to reduce productivity (which in turn reduces emissions intensity).ʺ

Improvements in carbon emissions between 2012 and 2018 were seen for most ship types, and the overall carbon intensity, as an average across international shipping, reduced in that six-year period by 21% and 29% compared to 2008 figures, measured in annual efficiency ratio (AER) and the Energy Efficiency Operational Index (EEOI), respectively.

Nevertheless, analysis by the GHG Study authors concludes, “Improvements in carbon intensity of international shipping have not followed a linear pathway and more than half have been achieved before 2012. The pace of carbon intensity reduction has slowed since 2015, with average annual percentage changes ranging from 1 to 2%.”

Performance intensity has fluctuated with the tankers recording EEOI’s of ±20% and container vessels of ±10%.

“Quartiles of fluctuation rates in other metrics were relatively modest, yet still generally reaching beyond ±5%. Due to certain static assumptions on weather and hull fouling conditions, as well as the non-timely updated AIS entries on draught, factual fluctuations were possibly more scattered than estimated, especially for container ships,” states the study.

Emission projections from 2018 up to the target date of 2050 from 90% of 2008 levels initially to a maximum level of 130% by 2050, “for a range of plausible long-term economic and energy scenarios”.

Those levels could increase or decrease depending on the prevailing economic growth rates. While the impact of the Covid-19 pandemic cannot as yet be assessed. Though the study authors project, “The impact of Covid-19 is likely to be smaller than the uncertainty range of the presented scenarios.”

It is important to note, as the study authors did that reductions in carbon intensity from international shipping were indexed at 2008, “at which time the shipping market was just reaching its peak right before the long-lasting depression”.

The authors added, “Taking 2012 as the reference instead, the reductions in overall carbon intensity of international shipping narrowed down from 29% (in EEOI) and 21% (in AER) to around 12% (in both EEOI and AER). The individual based percentage changes further shrank to 7% (in EEOI), 5% (in AER/DSIT) and 9% (in TIME).”

The implications here are that improvements in carbon intensity from international shipping have not been linear, with more than 50% of those reductions measured against the highest levels.

In conclusion, the study said, “The pace of carbon intensity reduction has been further slowing down since 2015, with average annual percentage changes ranging from 1 to 2%, due to the limit in speed reduction, payload utilisation, as well as the technical improvements of existing ships.”

It is probable that reductions in carbon intensity through vessel efficiency have reached a limit and that the need for new fuels is, therefore, now critical.

With that in mind, it will be necessary to reflect on the alternative fuels that might be available for both the transition period, up to 2030 and the shift to zero carbon fuels in the run up to 2050, bearing in mind that a ship’s life cycle is at least 25 years and that there is a lot of carbon tied into the steel plate and manufacture of ships.

Interestingly, in a recent press conference for the launch of its new tonnage tax regime, which is designed to encourage greener fuels, Cyprus said it did not regard Liquefied natural gas (LNG) as a viable alternative fuel, arguing that the methane emissions will have a greater effect on global warming than carbon dioxide.

For the purposes of the Fourth IMO GHG Study emissions measured included carbon dioxide, methane (CH4) and nitrous oxide (N2O), and were expressed in the study as CO2e.

Total emissions from all vessel types (international, domestic and fishing) increased from 977 million tonnes in 2012 to 1,076 million tonnes by 2018, an increase of 9.6%.

Heavy fuel oil (HFO) remained the major fuel used, in international shipping, it totalled 79% of fuel consumption by energy content in 2018, by voyage-based allocation.

“However, during the period of the study, a significant change in the fuel mix has occurred. The proportion of HFO consumption has reduced by approximately 7% (an absolute reduction of 3%), while the share of marine diesel oil (MDO) and LNG consumption grew by 6% and 0.9% (absolute increases of 51 and 26%, respectively),” the study reported.

Given that methane is considered to have far greater potency as an agent of global warming, although it remains in the atmosphere for a far shorter time, the shift to LNG is causing some alarm.

According to the Fourth GHG Study methane emissions increased 87% over the period of the study, from a low base, which was driven by both an increase in consumption of LNG, while the absolute increase is dominated by a change in the use of LNG as a fuel, “with a significant increase in the use of dual-fuel machinery that has higher specific exhaust emissions of CH4”.

Dr Elizabeth Lindstad – chief scientist at the Norwegian research institute SINTEF Ocean AS, told an audience of shipowners at a conference in 2019 that the use of low-pressure LNG power in dual fuel engines would mean that the emissions on a well-to-wake basis would be higher than emissions from HFO operating with scrubber technology.

In an eight-year research project SINTEF compared the use of low and high-pressure LNG technology in both two and four stroke engines and used the emissions for MGO as a baseline, 100% emission level.

Low pressure, dual fuel, two-stroke engines operating on LNG as a fuel were rated at 137% of the MGO emissions, while low pressure four stroke dual fuel engines fared better at 106% of the MGO emissions, low pressure LNG only, four-stroke engines produced comparable carbon emission levels to MGO.

Lindstad said with Energy Efficiency Design Index (EEDI) only measuring CO2, and the low-pressure LNG system being the cheapest option in terms of capital expenses to satisfy EEDI phase III this could lead to an increase in GHG emissions if owners were to take up the cheapest LNG option.

In fact, this is exactly the path that CMA CGM has taken with its ‘green ships’. The LNG powered Jaques Saade, the first in a series of ultra-large container ships, at 23,000TEU has a WinGD X92 two-stroke dual fuel engine installed.

The WinGD X-DF range of engines are marketed by the company, presenting the low-pressure units as low-cost, “Low-pressure gas supply means maximum simplicity, low investment costs and low power consumption–extremely small pilot fuel quantity, below 1% of total heat release–X-DF engines can be operated on gas down to very low loads–Low NOX emissions, close to zero SOX emissions, IMO Tier III compliant without exhaust-gas after-treatment–Particulate matter emissions reduced to almost zero.”

Nevertheless, the maritime industry is split on the LNG question. Class society DNV GL once hailed LNG as the fuel of the future. More recently the company has refined its LNG position arguing that it can be a transitional fuel from oil to zero emission fuels at a later date. This view has gained some traction in some quarters, notably with CMA CGM building its series ultra-large vessels, as well as Jones Act operator Matson in the US with its fleet of smaller LNG-powered vessels.

More recently AP Møller – Mærsk CEO Søren Skou argued that there were significant technical risks to the fuel transition, which were “not trivial” and that finding a solution for decarbonisation makes ordering vessels a far more complex issue than it already was.

“We will need to order ships to be delivered two years later to last 25 years,” said Skou, adding, “It is a risk when you don’t know what fuels you’ll be using in 2030.”

In conclusion, Skou said, “I don’t believe that LNG will play a major role for us as a transition fuel, we’d rather go from what we do today straight to a carbon neutral type of fuel.”

Proponents of the gas as a transitional fuel, such as SEA LNG, remain convinced of its benefits. “LNG is the only commercially viable and scalable alternative marine fuel that can enable the shipping industry to remain competitive while phasing-out of emissions this century,” said SEA LNG.

In addition, in its August 2020 paper SEA LNG argued that methane slip, the emission of unburnt methane from the exhaust, is not an “irremediable design flaw”.

According to the paper, “Engine manufacturers recognise slip as an issue for certain types of internal combustion engines but not for all of them.” Modern LNG engines have reduced methane slip by half in some cases.

Even so, SEA LNG also admits that the gas would only reduce carbon emissions by 21% compared to oil-based fuels, not enough to meet the 30% reduction by 2030. It is perhaps for this reason that not many owners have ordered LNG powered vessels.

Another reason could be that, as one of the authors of the IMO’s Fourth GHG Study, Tristan Smith told Container News, “For those that have fitted engines with high methane slip, the concern is whether or not they will be subsequently regulated to fit exhaust treatment to control for their CH4 [methane] emissions (and at what cost), as well as how ships with that machinery will be viewed in the second-hand market.”

This debate is expected to continue and could form a key element to the IMO’s review of its decarbonisation strategy in 2023.

Bo Cerup-Simonsen, the CEO at the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping, in an interview that will be broadcast on Container News TV, on 30 January, said that he would not rule out the development of carbon neutral, bio-LNG as an alternative fuel.

He believes that there could be a place for a wide range of fuels in the future including Methanol, which is estimated to be the fourth most significant fuel currently in use, at approximately 130,000 tonnes of consumption in 2018 on voyage-based international routes (160,000 tonnes of total consumption), and the much touted ammonia.

All of these fuels have their complexities, according to Cerup-Simonsen, and much research work needs to be completed to achieve the IMO’s goals.

So far the 2020’s are shaping up to be a critical decade in the battle against climate change. Though there have been some positive shifts from the maritime sector, including the decoupling of growth and the increase in maritime emissions.

During the period from 1990 to 2008 – emissions growth (CO2e) and emissions were tightly coupled to growth in seaborne trade. From 2008 to 2014 – CO2e emissions reduced in spite of growth in demand, and therefore a period of rapid carbon intensity reduction that enabled decoupling of emissions from growth in transport demand.

In the period that was studied by the Fourth GHG report, 2014 to 2018 there was continued but more moderate improvement in carbon intensity, but at a rate slower than the growth in demand. And therefore, this led to a return to a growth in CO2e emissions.

However, the IMO’s Fourth GHG study also reveals that there were 962 million tonnes of CO2 emissions in 2012, by 2018 this amount had increased by 9.3% to 1,056 million tonnes.

“The share of shipping emissions in global anthropogenic emissions has increased from 2.76% in 2012 to 2.89% in 2018,” said the report.

Tristan Smith pointed out, “The 2020’s are clearly a critical decade for shipping and society. We know from the IPCC’s [the Independent Panel on Climate Change] work that we need to approximately halve anthropogenic GHG emissions by the end of this decade. Shipping can ignore the climate science and take a risk of having to decarbonise very rapidly in the 2030’s, or it can be more aligned and in proportion to other efforts to decarbonise. The risks of waiting until the 2030’s is the risk of losing social license to operate and becoming a pariah industry that is increasingly blamed for climate change disasters.”

Nick Savvides

Managing Editor