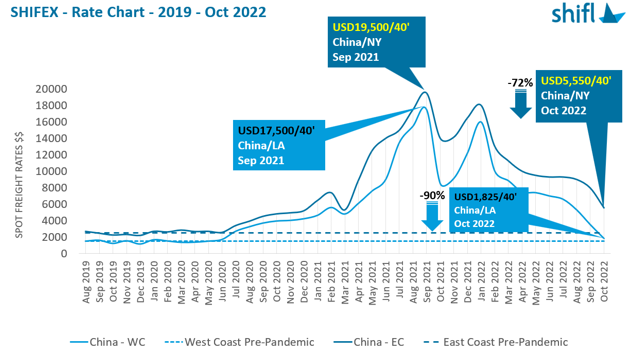

SHIFEX, a container spot freight rate index, shows that freight rates for 40’ containers moving from China to the port of Los Angeles fell to US$1,825 in October, which was equivalent to the peak season rates pre-pandemic.

Even as vessels continue to queue outside East Coast ports, freight rates between China-US East Coast are declining, with freight rates for 40’ containers on the China-New York trade corridor dropping to a rate of US$5,550, which is still higher than the peak season rate pre-pandemic, according to a recent report by Shifl.

While falling consumer demand and a drop in shipment orders are compelling reasons for the headwind in freight rates, this price movement across the China-West Coast trade lane is also supported by shipper concerns on the ongoing International Longshore and Warehouse Union (ILWU) contract negotiation with the Pacific Maritime Association (PMA), said Shifl.

The fall in freight rates can also be explained by a ‘shift’ in peak shipping season over this year, reflected in extremely strong import TEU volumes over the second quarter, pointed out Shifl in its report.

With delays being the norm during last year’s peak shipping season, shippers and retailers seem to have ordered products several months earlier this year, to avoid getting their freight stuck in transit. This could explain the tipping import volumes now, considering shippers have already stocked up their inventories.

“While the Fed has increased rates and inflation still remains high, it is expected that the fall in spot freight rates will eventually alleviate inflation. It remains to be seen whether the rates will stabilize at pre-pandemic levels or will fall lower than that,” commented Shabsie Levy, CEO and founder of Shifl.

The Divergence of Transit Times

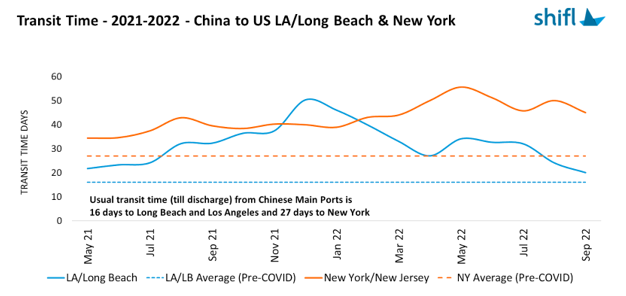

This is seen in the divergence of transit times across the US West and East Coasts, according to the report.

The China to Los Angeles/Long Beach transit time has continued to improve, dropping 60% from its highs in December 2021. The transit time yardstick from the pre-pandemic days is 16 days, and at the current transit of around 20 days, the West Coast has done well to close the gap from a disastrous situation a year before.

On the other hand, transit times from China to New York/New Jersey in September ‘22 increased 13% from the highs in December 21 and is currently sitting at around 45 days compared to a pre-pandemic normal of 27 days. So there is a long way to go for the East Coast to gain a semblance of normalcy.

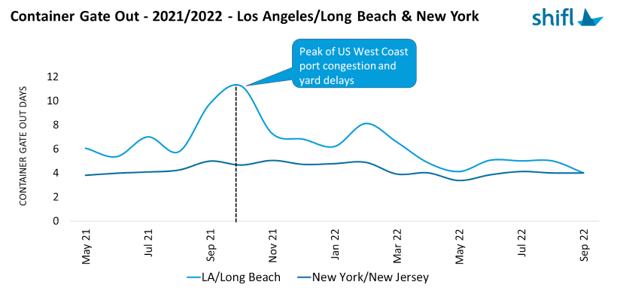

Meanwhile, import container gate out times has also stabilised at around four days at both coasts, which is close to pre-pandemic levels.

The port of New York has announced that it will start levying tariffs on long dwelling empties, as they stifle capacity availability within the port premise. Lack of space reduces port efficiency, delaying loading/unloading operations and gate out times.

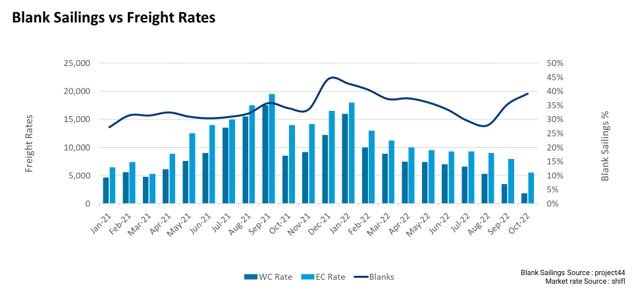

Shifl noted that falling freight rates have led to an increase in blank sailings from container liners, who look to find a bottom to the fall in rates by constricting capacity. “This has largely not been as effective as anticipated, with maritime spot rates of the China-US eastward trade route continuing to tank,” stated the company.

As per data from project44, blank sailings were recorded at 39% in the first week of October, a steep increase from 28% in August.

“Products coming in at cheaper prices and lowered consumer demand will put a tremendous strain on importers sitting with excess inventory imported at expensive freight prices resulting in considerable loss,” said Levy.

Some container liners like MSC are suspending entire services across the Trans-Pacific route due to an unexpected fall in demand.

However, Shifl mentioned that liner profits for major carriers will continue to stay higher than pre-pandemic levels for a while as they are still carrying cargo negotiated at higher long-term contract rates and some high spot contracts, especially to the East Coast.

“I think it will be rougher seas for new carriers who entered the market driven by the high spot freight rates, compared to legacy carriers who have more contract rates and enough cash reserves to sustain the reduction in rates for a while,” concluded Levy.