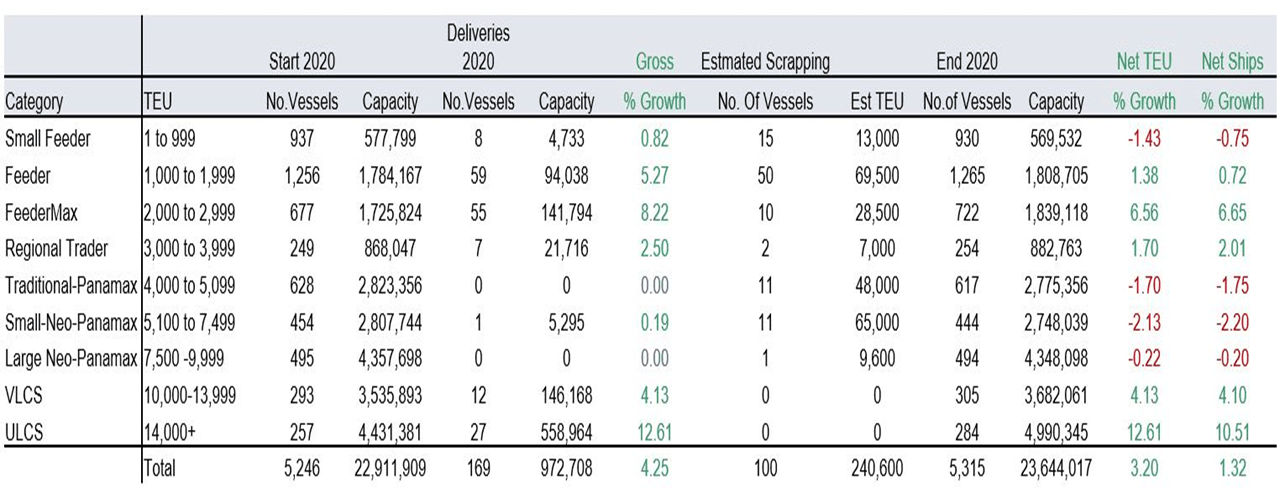

Approximately 100 container ships, aggregating 240,000TEU, are expected to be demolished during 2020, according to Jonathan Roach, a container trade and shipping analyst from Braemar ACM Shipbroking.

During the first three quarters of this year, it is estimated that 81 container vessels totalling 193,000TEU have been sold for demolition, which is around a 15% year-on-year increase in terms of TEU capacity. During the corresponding period in 2019, the industry saw approximately the same number of demolished ships (82), the capacity of which was noticeably lower, 165,000TEU.

| Q1-Q3 2020 Container Ship Demolition | |||

| Sizeband (TEU) | Number of ships | Capacity (TEU) | Average size (TEU) |

| 0-999 | 14 | 12,081 | 863 |

| 1,000-1,999 | 42 | 57,573 | 1,371 |

| 2,000-2,999 | 4 | 9,504 | 2,376 |

| 3,000-3,999 | – | – | – |

| 4,000-5.099 | 10 | 44,573 | 4,457 |

| 5,100-7,499 | 10 | 59,780 | 5,978 |

| 7,500-9,999 | 1 | 9,600 | 9,600 |

| Total | 81 | 193,111 | 4,108 |

| Q1-Q3 2019 Container Ship Demolition | |||

| Sizeband (TEU) | Number of ships | Capacity (TEU) | Average size (TEU) |

| 0-999 | 14 | 8,415 | 863 |

| 1,000-1,999 | 47 | 67,977 | 1,371 |

| 2,000-2,999 | 2 | 10,927 | 2,376 |

| 3,000-3,999 | 1 | 3,607 | – |

| 4,000-5.099 | 12 | 57,009 | 4,457 |

| 5,100-7,499 | 3 | 16,806 | 5,978 |

| 7,500-9,999 | – | – | – |

| Total | 79 | 164,741 | 3,009 |

“The sector reporting the most demolition activity in 2020, firmly falls in the 1,000-1,800TEU feeder sector, with 42 ships demolished, representing 50% of the 2020 demolition sales in 2020 year-to-date,” Roach told Container News.

During September the container ship demolition market showed a significant downturn with the scrapping of only six vessels, compared to the demolition of 14 ships per month for both July and August.

This slow down comes as no surprise, said Roach, as time charter rates have rallied throughout the third quarter.

Braemar’s BOXi, the time charter index for container ships of Braemar, a UK-based shipping, marine, and energy consulting company, has gained 50% in value since 1 July. Although all sectors have seen a growth in their earnings, it is noticeable that a further increase in the earnings of the traditional-Panamax and above – sized ships has taken place, according to Braemar’s analyst.

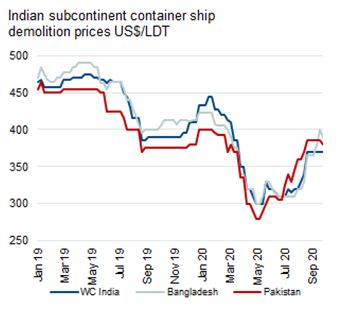

Roach went on to say that container ship demolition prices have fallen away in 2020, in-line with reduced demand for steel scrap during the pandemic. “We estimate that demolition prices have dropped by about 10% since 1 January 2020,” he said.

However, the reopening of recycling facilities in the third quarter has boosted the demolition prices by approximately 12%, compared to Q2 levels, according to Braemar’s estimations. Jonathan Roach expects prices to remain fairly stable in the last quarter of the year.

At the same time, charter rates have also plateaued as we reach the fourth quarter, and “with the slack period for container shipping approaching, we expect time charter rates to level off and soften into 2021 towards the lunar new year,” said Roach.

“We expect charter rates for vessels from traditional-Panamax and above to remain at healthy levels and a steep reduction in charter rates for larger types is unlikely, we expect a marginal softening for the slack season up to Lunar New Year,” he added.

For Feeders, in sizes up to 1,999TEU, oversupply is continuing to cap time charter rates and Braemar expects the pace of feeder demolition to be maintained well into 2021.

On the other hand, scrapping for regional ships, from 2,000 up to 4,000TEU, has been more resilient than the smaller feeders. Braemar believes that demolition will remain subdued for 2,500, 2,800 and 3,500TEU vessels, as charter rates have been maintained at US$10,000 to US$13,000/day respectively.

Moreover, Roach said that fleet removal compared to the trading fleet in TEU capacity is expected to be 1% in 2020, marginally higher than 2019’s percentage (0.9%), and essentially lower than the annual average of 1.6% over the past five years (2015-2019).

Antonis Karamalegkos

Editor