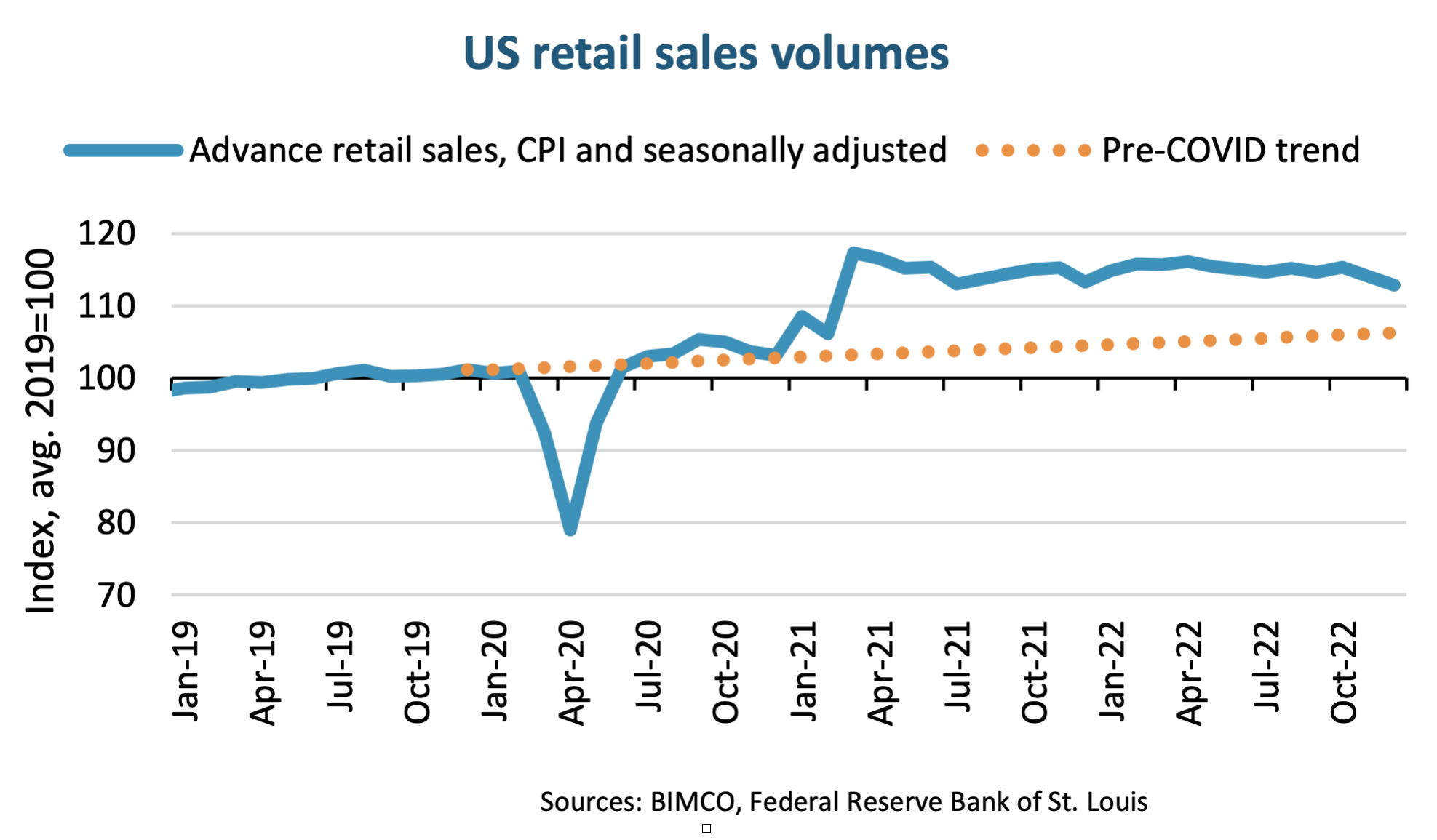

“Despite falling 1.1% m/m in both November and December, US retail sales volumes remain 13% above 2019 levels and 6% higher than the pre-Covid trend. However, sales volumes could return to trend during 2023 and thereby pose a risk for Asia to North America container volumes,” stated Niels Rasmussen, chief shipping analyst at BIMCO.

Supported by Covid stimulus packages and mobility restrictions limiting spending on services, retail sales volumes in the US have remained on average 15% higher than 2019 levels since early 2021. Combined with a 28% increase in retail inventories this led container volumes from Asia to North America in 2021 and 2022 to end respectively 27% and 18% higher than in 2019. However, in the second half of 2022, the container volumes fell 17% y/y as businesses began to adjust inventories in preparation for a more uncertain future.

“Though average wages have finally caught up with inflation and employment is high, retail sales volumes in the US are still at risk of returning to trend. Further interest rate increases, dwindling savings, lower house prices, a struggling stock market, and muted economic growth all present risks to consumption and thereby to container volumes,” said Rasmussen.

During 2020 and 2021, US consumers built up higher-than-normal savings amounting to US$2.1 trillion. However, during the last 16 months, consumers have been dipping into those excess savings to maintain spending levels, reducing excess savings by US$1.2 trillion.

As highlighted by a recent Bankrate survey, the remaining excess savings are, however, not evenly distributed among consumers as only 43% responded that their savings would be able to cover an unexpected expense of US$1,000. At the same time, credit card debt has increased by US$210 billion since April 2021 to reach an all-time high.

“Should US retail sales volumes gradually return to trend during 2023, volumes could end 4% lower in 2023 than in 2022. Combined with ongoing inventory adjustments, it could result in negative growth for container volumes between Asia and North America. However, when inventory adjustments come to an end, monthly container volumes could still increase from the very low levels seen recently,” says Rasmussen.

The above article is the “Shipping Number of the Week” report from BIMCO, in which chief shipping analyst, Niels Rasmussen, looks at the November and December fall in US retail sales volumes and whether the decline could be an early warning for Asia to North America container volumes.