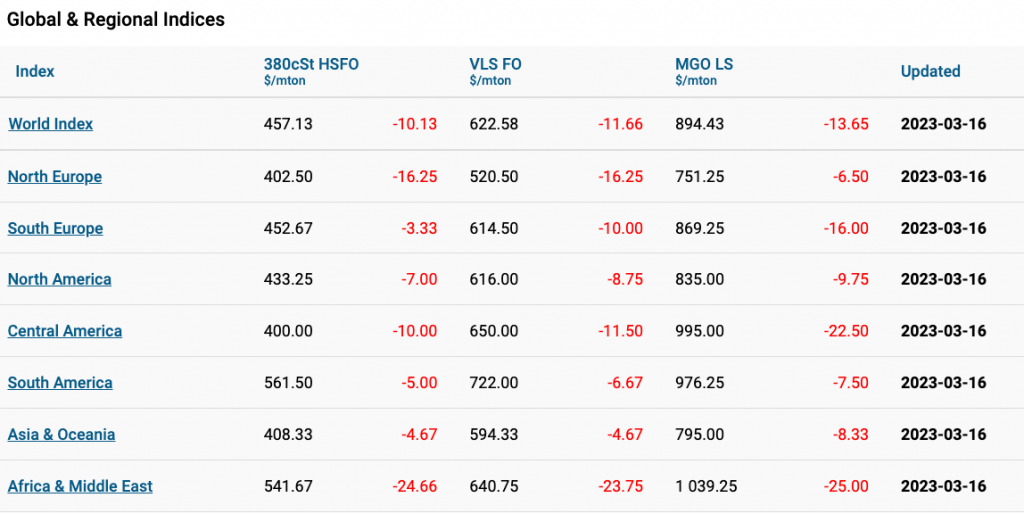

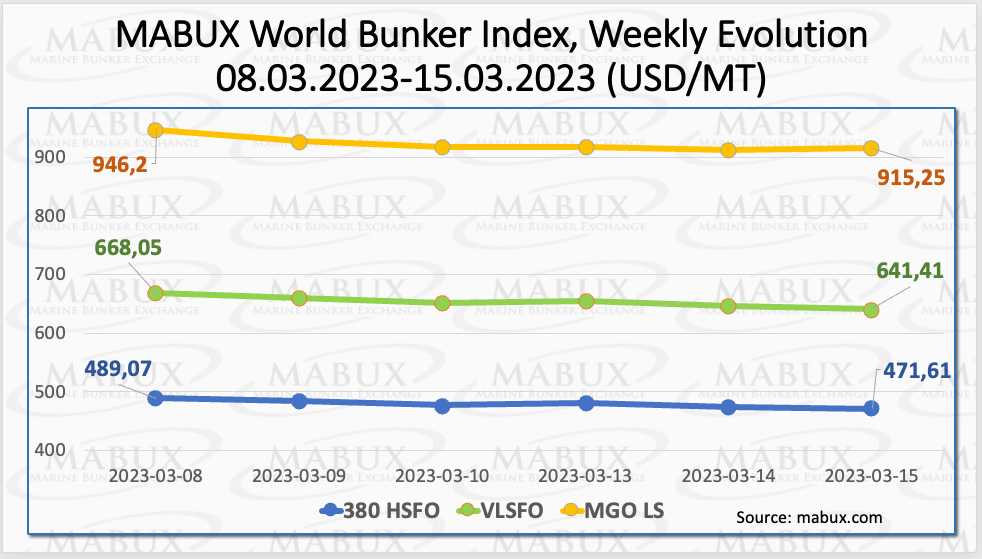

Global bunker indices showed a downward trend during the 11th week of the year, according to Marine Bunker Exchange (MABUX).

In particular, the 380 HSFO index fell to US$471.61/MT, the VLSFO index decreased to US$641.41/MT and the MGO index declined to US$915.25/MT.

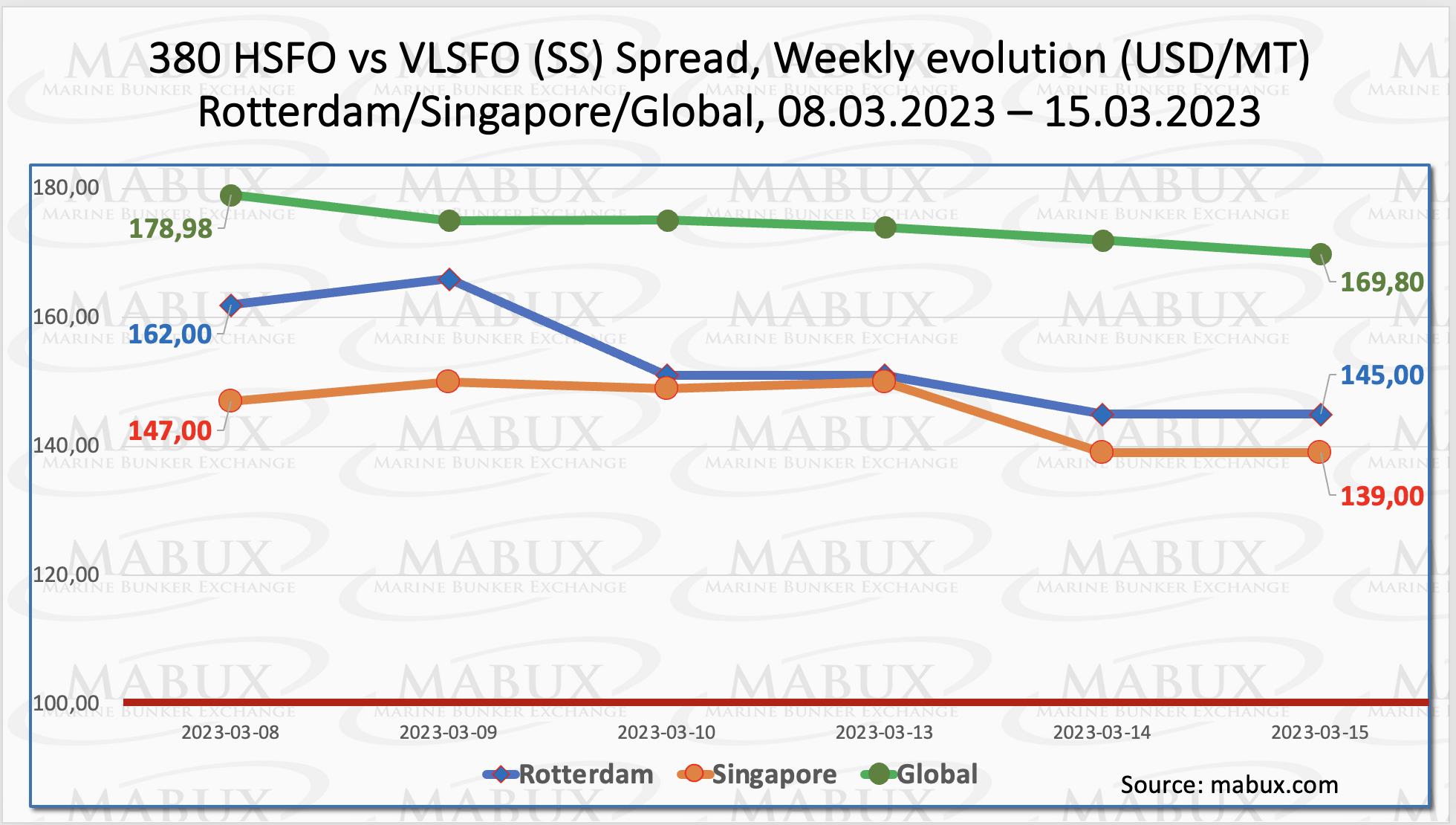

The Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – showed a firm decline in Week 11 – minus US$9.16. At the same time, the weekly average also decreased by US$8.90. In Rotterdam, the SS Spread fell by US$17 to US$145, while the weekly average lost US$8.67. In Singapore, the 380 HSFO/VLSFO price difference also continued to decrease, dropping to US$139, with the weekly average losing US$2.50.

“We expect SS Spread to continue a downtrend next week,” pointed out a MABUX representative.

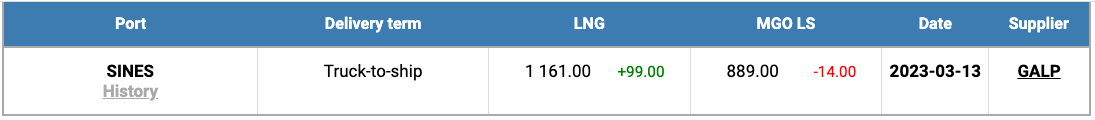

Despite the general downward trend in natural gas indices, the price of LNG as a bunker fuel at the port of Sines in Portugal increased and reached US$1,161/MT on 13 March.

The price difference between LNG and conventional fuel also widened on 13 March to US$272, MGO LS at the port of Sines was quoted at US$989/MT that day.

“However, we do not expect LNG prices to continue their upward trend in the near term,” noted a MABUX official.

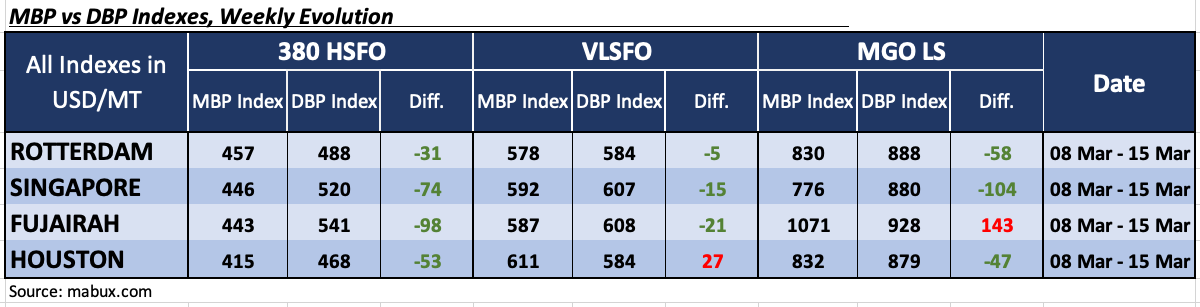

Over the Week 11, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered undervaluation of 380 HSFO fuel in all four selected ports. The weekly average showed a reduction at all ports.

The most significant was MDI decline at Rotterdam: minus 76 points at once reaching minus US$31 mark. In Singapore, Fujairah and Houston, MDI showed minus $74, minus $98 and minus $53, respectively.

In the VLSFO segment, according to MDI, the three selected ports – Rotterdam, Singapore and Fujairah – remain undervalued by minus US$5, minus US$15 and minus US$21, respectively. The underestimation weekly average moderately narrowed. Houston remained the only overvalued port in this fuel segment with a plus US$27, the overpricing level slightly increased.

There are still three ports in the MGO LS segment: Rotterdam, Singapore and Houston. The weekly average underpricing premium rose moderately in Rotterdam and Singapore to US$94 and US$101 respectively but decreased in Houston to US$54. Fujairah remained the only overvalued port – plus US$155.

“In general, the MDI changes in this fuel segment were insignificant,” said MABUX in its report.

There are three underpriced ports in the MGO LS segment: Rotterdam, Singapore and Houston. The average weekly undercharge ratio slightly declined at Rotterdam and Houston to US$58 and US$48 respectively but rose to US$104 in Singapore. Fujairah remains the only overvalued port – plus US$143.

“In general, there is a gradual narrowing of undervaluation margins registered in all fuel segments,” noted a MABUX spokesperson.

“Global bunker market retreated to downtrend following crude oil as the collapse of Silicon Valley Bank and problems with Credit Suisse sparked fears of a fresh financial crisis that

could reduce future oil and fuel demand. We expect bunker indices to keep falling next week,” commented Sergey Ivanov, director of MABUX.