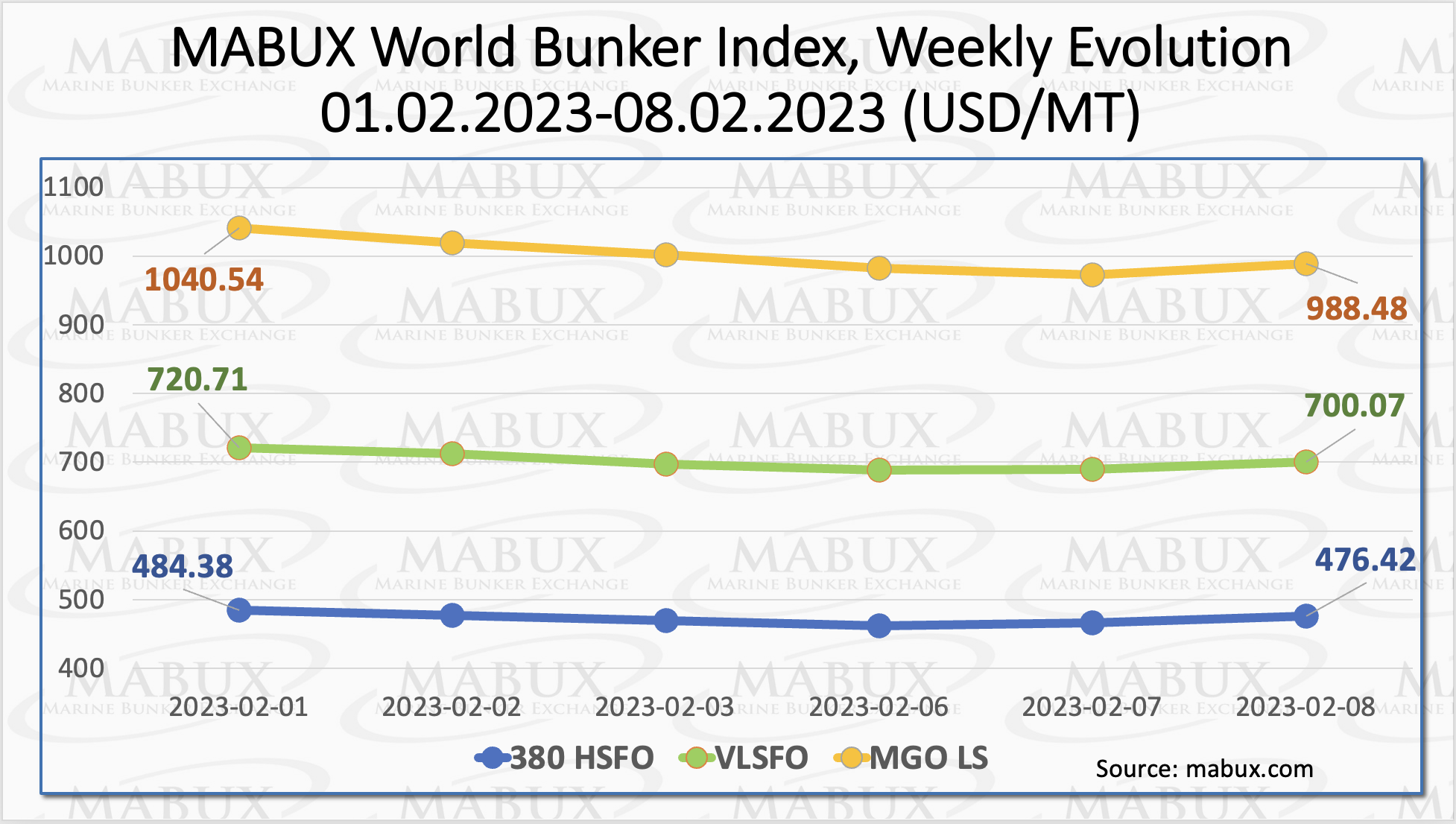

Over the sixth week of the year, MABUX global bunker indices continued a firm downtrend. The 380 HSFO index declined to US$476.42/MT, the VLSFO index fell to US$700/MT and the MGO Index decreased to US$988.48/MT.

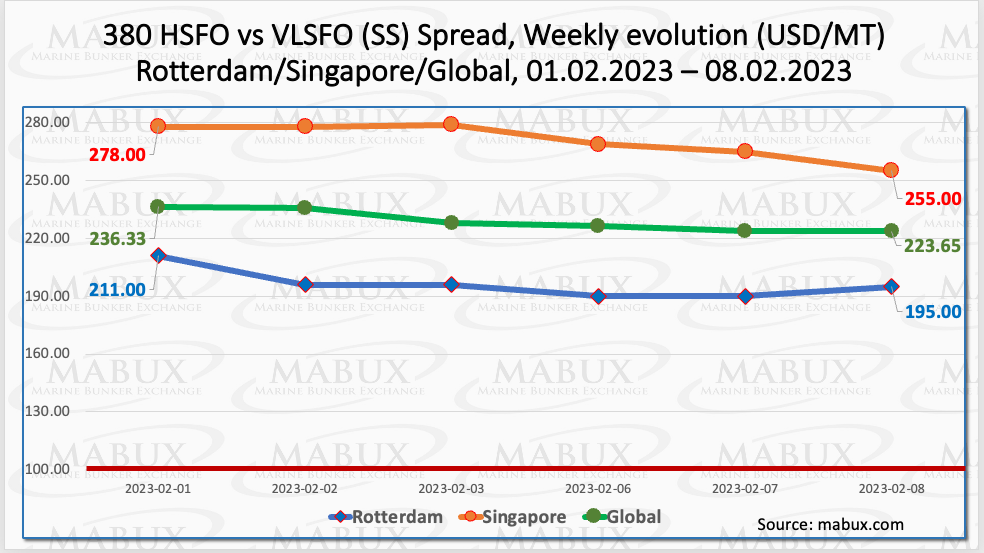

The Global Scrubber Spread (SS) weekly average – the difference in price between 380 HSFO and VLSFO – decreased for Week 06 – minus US$12.68 (vs. US$236.33 last week), while the average also decreased by US$3.84.

In Rotterdam, the average SS Spread also declined by US$16 (vs. US$211 last week). The average weekly price difference of 380 HSFO/VLSFO in Singapore (the most significant decline) was minus US$23 to US$255.

“At the same time, the SS Spread weekly averages in Rotterdam and Singapore remained virtually unchanged,” commented a MABUX official.

“Still, European gas prices are well below the records seen last year due to the mild weather at the start of the winter heating season, continued strong LNG inflows, and a rebound in Norwegian pipeline gas flows. Gas storage sites across Europe were more than 71% full as of 1 February That’s well above the five-year average for this time of the year.” said the MABUX report.

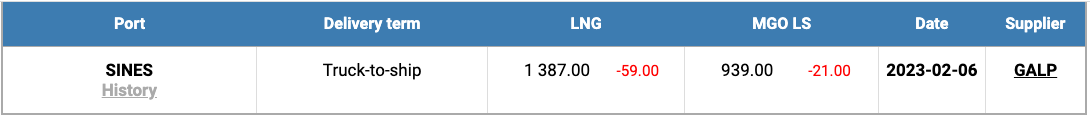

The price of LNG as bunker fuel at the port of Sines in Portugal fell slightly and reached US$1,387/MT on 6 February. The price difference between LNG and conventional fuel was US$448 as of 6 February: MGO LS at the port of Sines was quoted at US$939/MT that day.

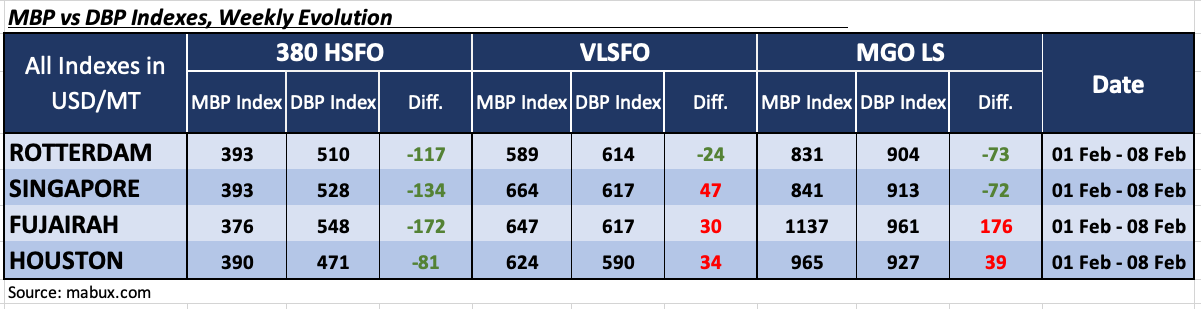

Over the sixth week of 2023, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (digital bunker benchmark)) showed an undercharge of fuel 380 HSFO fuel grade at all four selected ports. In other ports, the undercharge level widened slightly and amounted to: in Rotterdam – minus US$117, Singapore minus US$134, Fujairah minus US$172 and Houston minus US$81.

VLSFO fuel, according to MDI, remained, on the contrary, overpriced in all selected ports:

Singapore plus US$47, Fujairah plus US$30 and Houston plus US$34. Rotterdam remains the only port where VLSFO is undervalued: minus US$24. Overcharge margins have slightly increased while underpricing has not changed.

In the MGO LS segment, Houston moved back into the overprice zone joining Fujairah: plus US$39 and plus US$176, respectively. In the other two ports, the MDI index reported an underestimation of MGO LS: in Rotterdam – minus US$73 and in Singapore – minus US$72.

“The EU embargo on imports of refined petroleum products from Russia came into effect on Sunday, 5 February. However, Russia had diverted most of its fuel oil and vacuum gasoil (VGO) exports to Asia and the Middle East even before the EU embargo,” noted Sergey Ivanov, director of MABUX.

He added, “Last month, the European Union took less than 5% of Russia’s fuel oil and VGO, with Greece, Latvia, and Italy importing small volumes of those products, and these volumes could easily be redirected to other destinations, mostly in Asia, as well. For now, we expect Global bunker indices to keep the potential for an uptrend next week.”