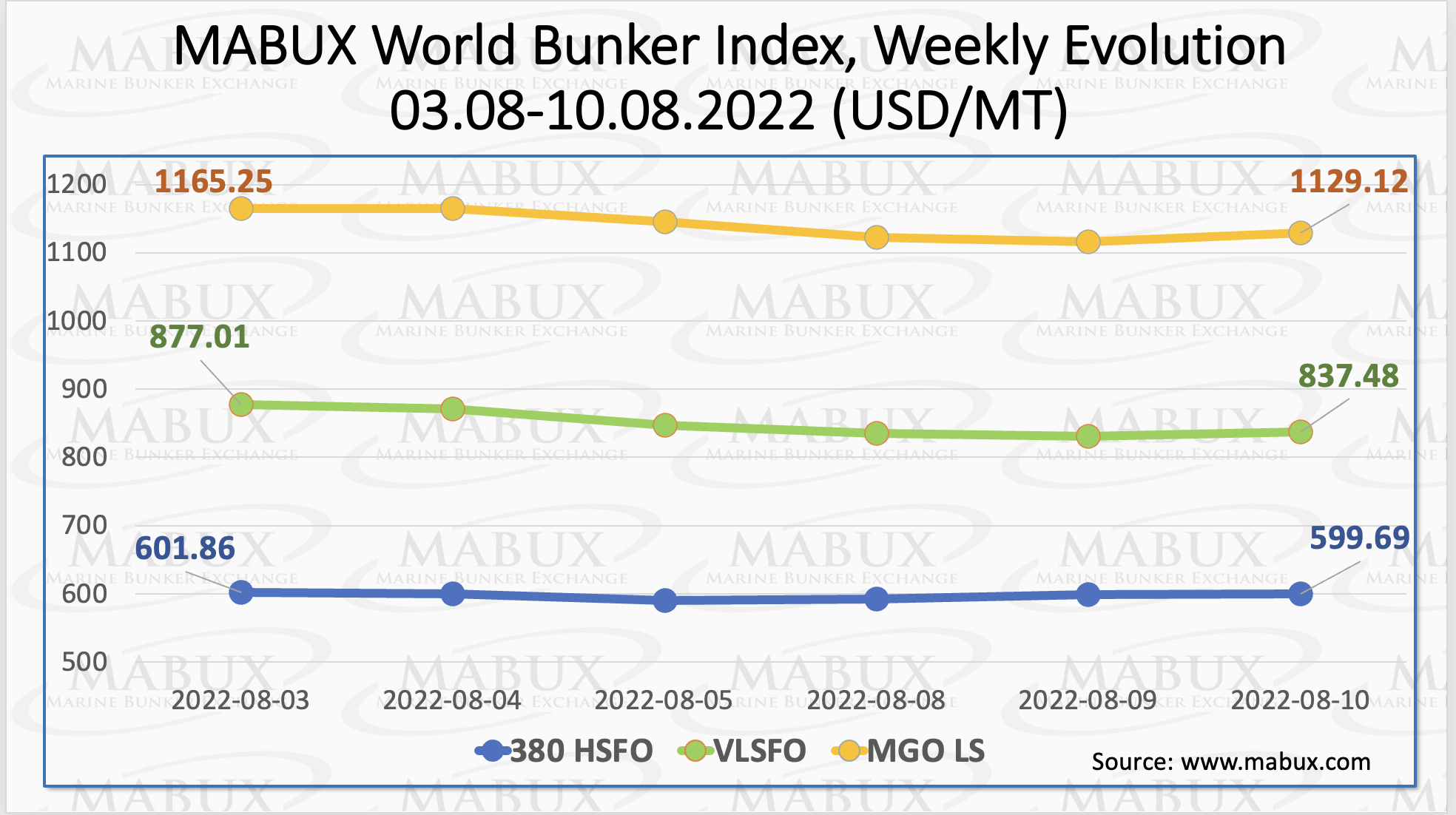

“Over the Week 32, MABUX global bunker indices continued firm downtrend,” said Sergey Ivanov, director of Marine Bunker Exchange (MABUX).

The 380 HSFO index went down to US$599.69/mt, the VLSFO index, in turn, fell to US$837.48/mt and the MGO index decreased to US$1,129.12/mt.

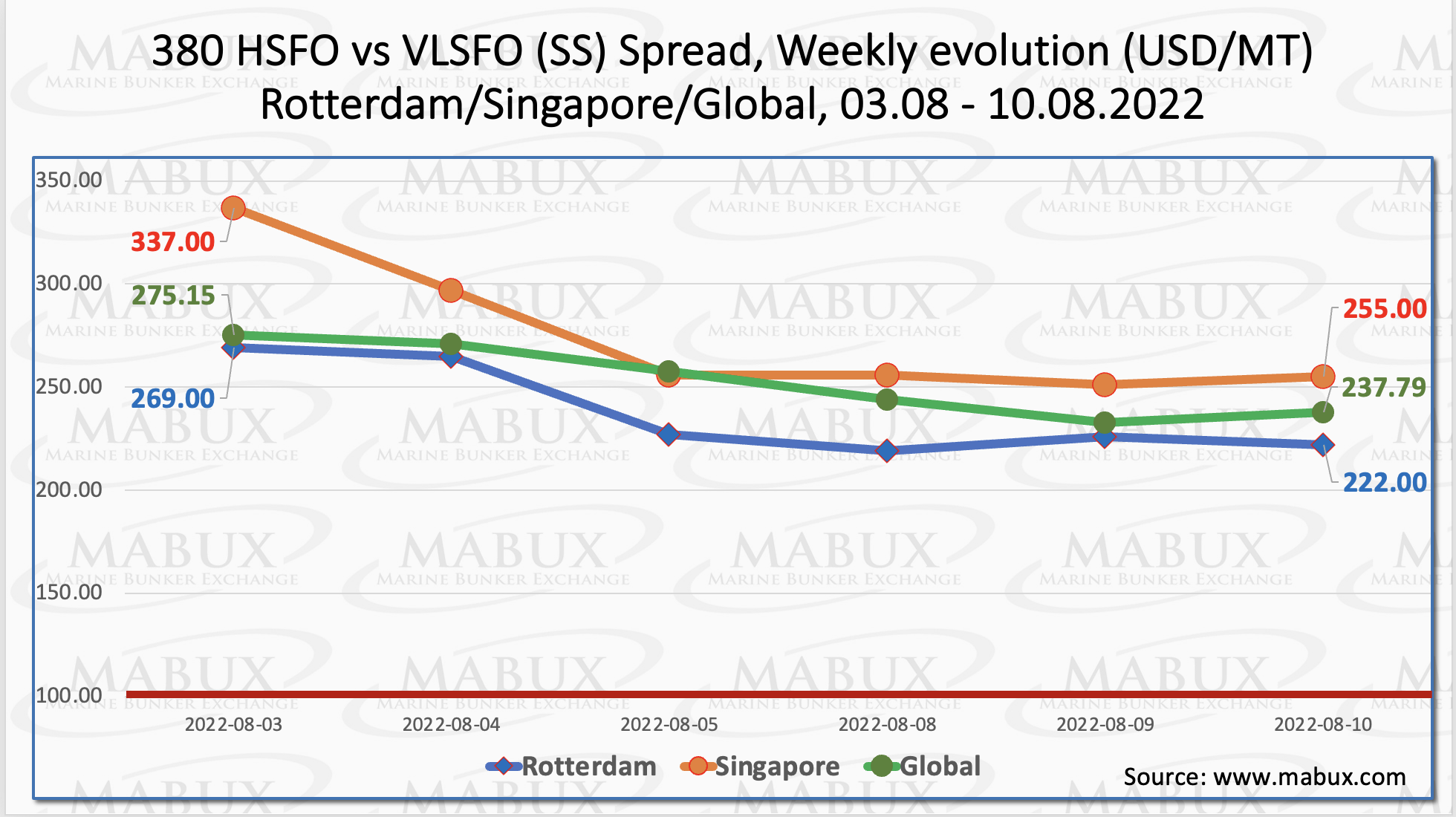

Meanwhile, the Global Scrubber Spread (SS) weekly average – the differential between 380 HSFO and VLSFO – continued its sharp fall for the fifth week in a row, losing US$39.11 from US$292.14 last week. In Rotterdam, the average SS Spread dropped significantly to US$238. However, the largest decline in the average weekly price differential 380 HSFO/VLSFO was recorded again in Singapore, which decreased by US$106.

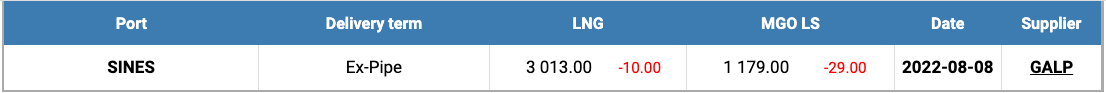

“Natural gas prices in Europe remain at their highest levels,” pointed out Ivanov. LNG as a bunker fuel in the port of Sines in Portugal decreased on 8 August by US$10/mt to US$3,013/mt.

Additionally, LNG prices are well above the cost of the most expensive fossil bunker fuel: the price of MGO LS in the port of Sines was quoted at US$1,179 /mt on 8 August.

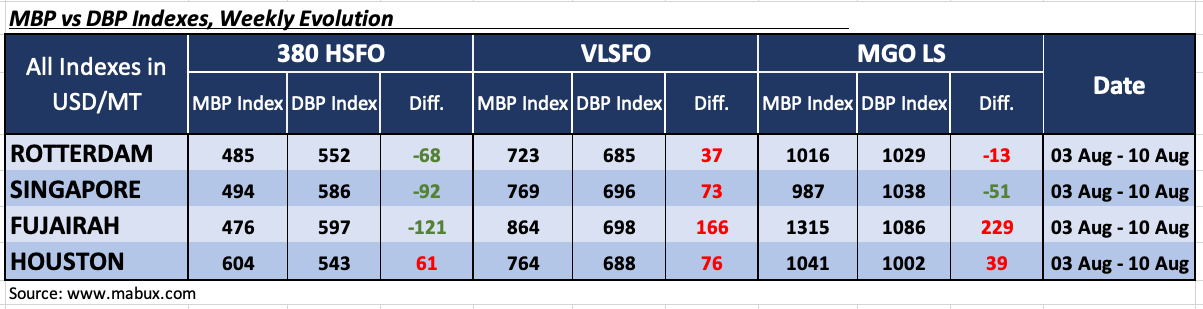

Over the Week 32, the MDI index (comparison of MABUX MBP Index -market bunker prices- vs MABUX DBP Index -MABUX digital bunker benchmark-) showed an undercharge of 380 HSFO fuel in three out of four ports selected: Houston remains the only overestimated port: plus US$6. In other ports, the underpricing decreased slightly and amounted as follows: Rotterdam – minus US$68, Singapore – minus US$92 and Fujairah – minus US$121.

VLSFO fuel, according to MDI, remained, on the contrary, overpriced in all four selected ports: plus US$37 in Rotterdam, plus US$73 in Singapore, plus US$166 in Fujairah and plus US$76 in Houston. “Here, the MDI index did not have a firm trend: the overcharge decreased in Singapore and Houston but rose in Rotterdam and Fujairah. VLSFO fuel is still the most overvalued segment in the global bunker market,” noted Ivanov.

As for MGO LS grade, the MDI index registered a fuel overcharge in two out of four selected ports: Fujairah – plus US$229 and Houston – plus US$39. Rotterdam and Singapore are still in the underestimation zone: minus US$13 and minus US$51, respectively. The underestimation premium did not virtually change over the week. Overpricing ratio rose in Fujairah but fell in Houston, according to MABUX.

“We expect the downward trend to continue in the global bunker market next week,” concluded Ivanov.