In the sixth week of the year, the evolving situation in Asia and the United States (US) has seen an increase in demand, pre-Chinese New Year, driver shortages in China, extra capacity and a further increase in delayed cargo in key export regions.

[s2If is_user_logged_in()]There are no cancelled sailings in week six and three extra loaders sailing out of Asian ports, one extra ship to the Pacific northwest ports and two extra vessels to the Pacific southwest. However, even with the extra loaders, the expectation is that there will be a drop in bookings during February compared to January.

This week’s three extra sailings are in addition to the seven extra vessel loads over the previous fortnight, which will “further congest the Southern California ports,” Worldwide Logistics’ Jon Monroe pointed out.

He went on to say, “Unfortunately, these vessels will most likely cause more problems for the Los Angeles-Long Beach ports. Expect more delays as congestion builds as we go into Chinese New Year. We do note, however, blank sailings for the PNW, PSW and East Coast (EC) in week seven.”

Monroe also pointed out that the Southern California will have two extra loaders and two blank sailings during week seven. “What is the point?” He asks, “They cancel themselves out.”

With up to 40 or more vessels at anchorage outside of Los Angeles/Long Beach and shortages of chassis and equipment the delays to cargo are expected to persist.

Furthermore, Monroe reports equipment shortages in every major port in Eastern Asia meaning that more cargo will be delayed at the factories unable to find a box for export. This difficulty along with the driver shortages now developing in China will see a backlog of cargo building at factories.

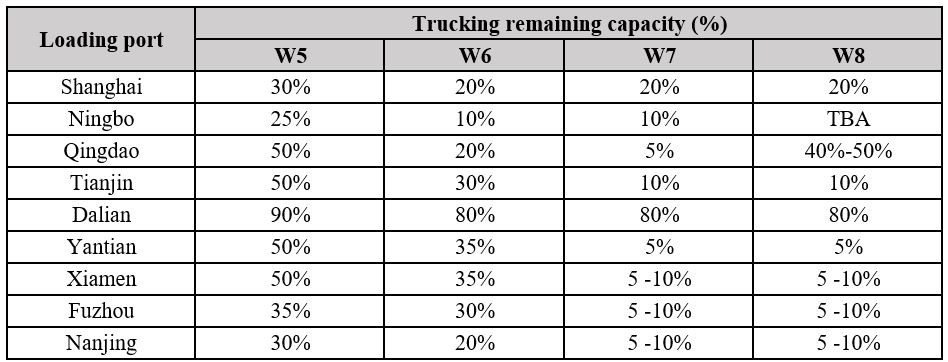

In the Shanghai region, only 20% of truckers are expected to work over the next two weeks, while in Ningbo it’s 10%, while in Yantian, Xiamen, Fuzhou and Nanjing the figure is 5-10%.

It is likely that the major factor delaying cargo exports from China over the coming weeks will be the lack of truck capacity, rather than the lack of equipment, which has caused the bottlenecks up to now.

Nick Savvides

Managing Editor

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]