European Community Shipowners’ Associations (ECSA), which promotes the interests of 20 shipping associations across the European Union, the United Kingdom and Norway, is among those lobbying against the EU’s proposed Paris Agreement-aligned net-zero pathway.

The group has actively lobbied to delay or weaken efforts to include their sector in EU-level regulations on climate, according to MABUX report.

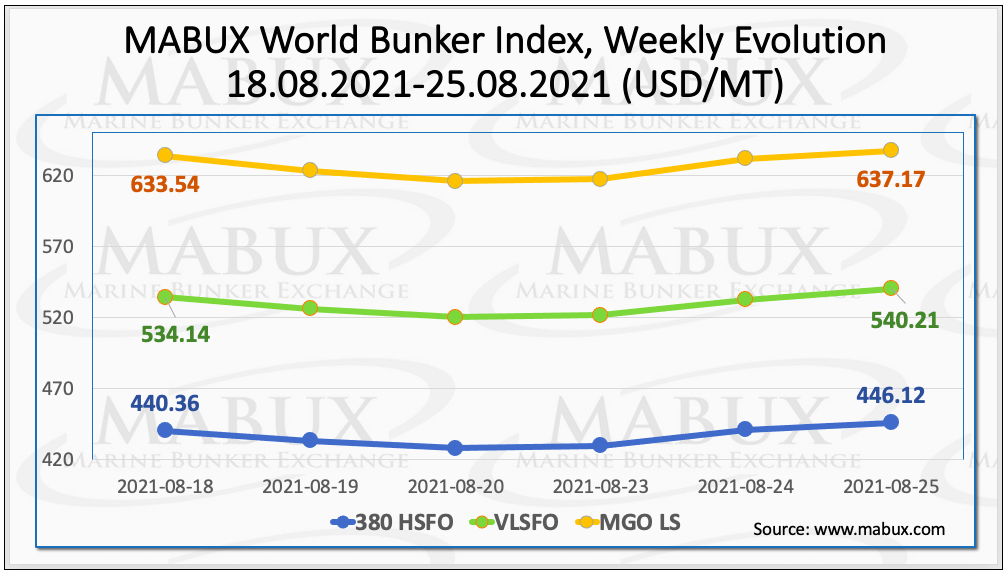

Meanwhile, on week 34 the MABUX World Bunker Index turned into a moderate upward evolution. In particular, the 380 HSFO index rose to US$446.12/MT, the VLSFO index increased to 540.21US$/MT, while the MGO index grew to US$637.17/MT.

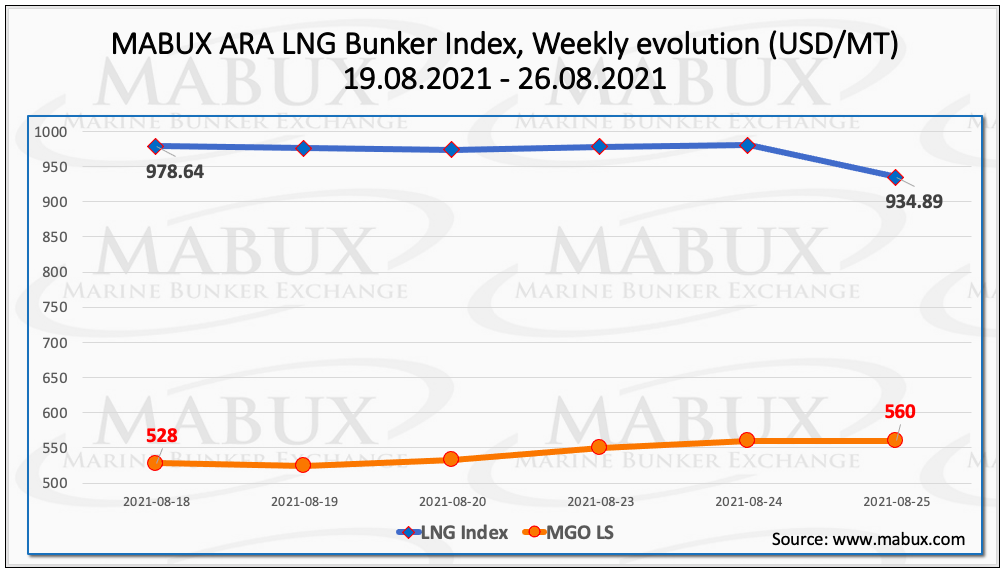

Regarding the Amsterdam-Rotterdam-Antwerp (ARA) area, the MABUX LNG Bunker Index, calculated as the average price of LNG as a marine fuel, fell sharply in the period of August 19-26 to US$934.89/MT.

During the same period, the average value of the LNG Bunker Index increased by US$41.82 compared to the week before. Additionally, the average price for MGO LS in Rotterdam decreased by US$15.16/MT compared to the week before, and the average price difference between bunker LNG and MGO LS in Rotterdam was US$427.75.

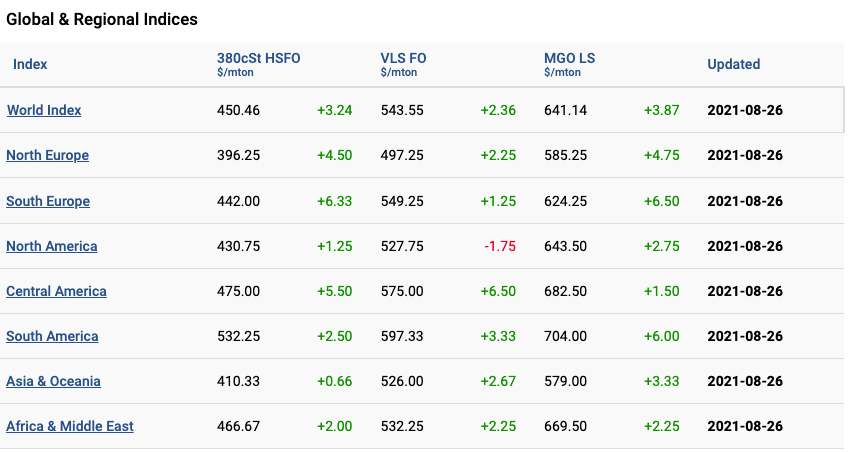

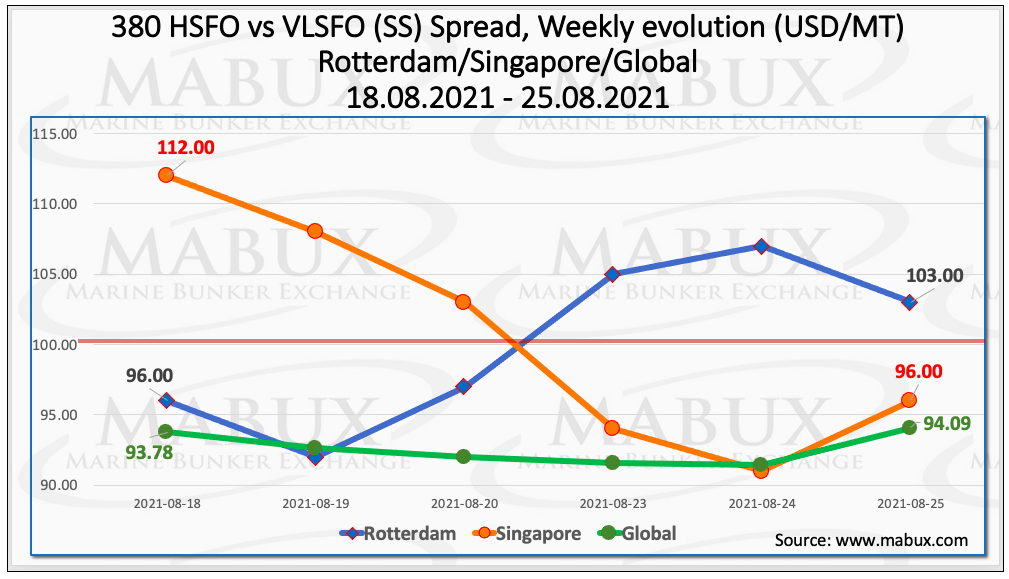

Furthermore, the average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued to decline to US$92.59.

More specifically, the average SS Spread in Rotterdam has not changed and is still at the US$100 mark, but since August 23, its values have slightly exceeded US$100, while the average SS Spread has also decreased by US$11.50 in Singapore and is close to US$100 now.

SS Spread below US$100 reduces the cost-effectiveness of scrubbers’ installation as a method to cut emissions.

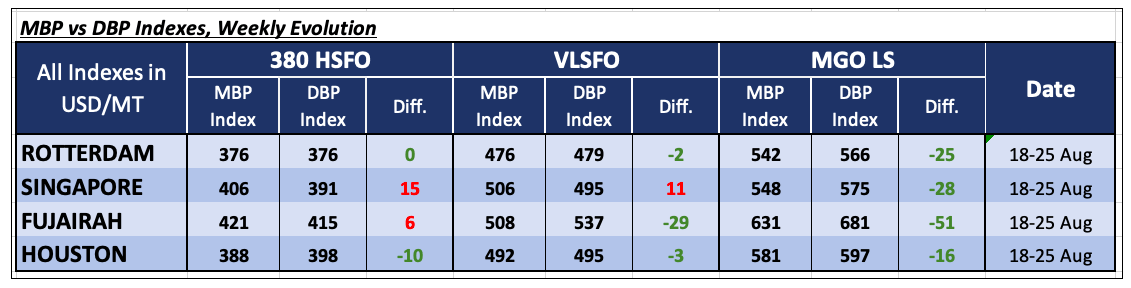

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel returned into the overpricing segment in two of the four ports: in Singapore, the overcharge was registered as plus US$15 and in Fujairah – plus US$6.

In Rotterdam, the MABUX MB /DBP Index had a 100% correlation, while Houston is the only port where 380 HSFO fuel was undervalued by minus US$10, according to the MABUX MBP/DBP Index.

VLSFO fuel was underestimated in all selected ports, except Singapore, where an overpricing of this fuel grade was registered as plus US$11, compared to the previous week.

In other ports, the average underpricing ratio was: in Houston – minus US$3, in Rotterdam – minus US$2 and minus US$29 in Fujairah. The most significant change of the MABUX MBP/DBP Index was registered in Singapore: minus US$48.

As for MGO LS, on week 34 the MABUX MBP/DBP Index registered an undercharge of this fuel grade at all selected ports ranging from minus US$16 in Houston to minus US$25 in Rotterdam, minus US$28 in Singapore and minus US$51 in Fujairah.

Overall, a significant reduction of the underestimation margin of all fuel grades has been the result of a steady upward trend of bunker prices on a global market over the past four days, according to MABUX report.