Container News recently undertook a comprehensive comparative analysis focusing on the emergence of new shipping services and alliances, particularly evaluating ports in Southeast Asia and Africa.

This assessment was driven by a selection of countries that are attracting significant investments and possess the potential to evolve into pivotal trade hubs amid intensifying global maritime competition. The evaluation centered on port performance, leveraging connectivity indicators and logistics performance metrics to gauge development.

The analysis encompassed the following ports: Haiphong and Ho Chi Minh (Vietnam), Laem Chabang (Thailand), Tanjung Pelepas and Kuantan (Malaysia), and Batam and Jakarta (Indonesia). For Africa, the selected ports for this analysis were Djibouti, Tema (Ghana), Lekki (Nigeria), Walvis Bay (Namibia), and Dar es Salaam (Tanzania).

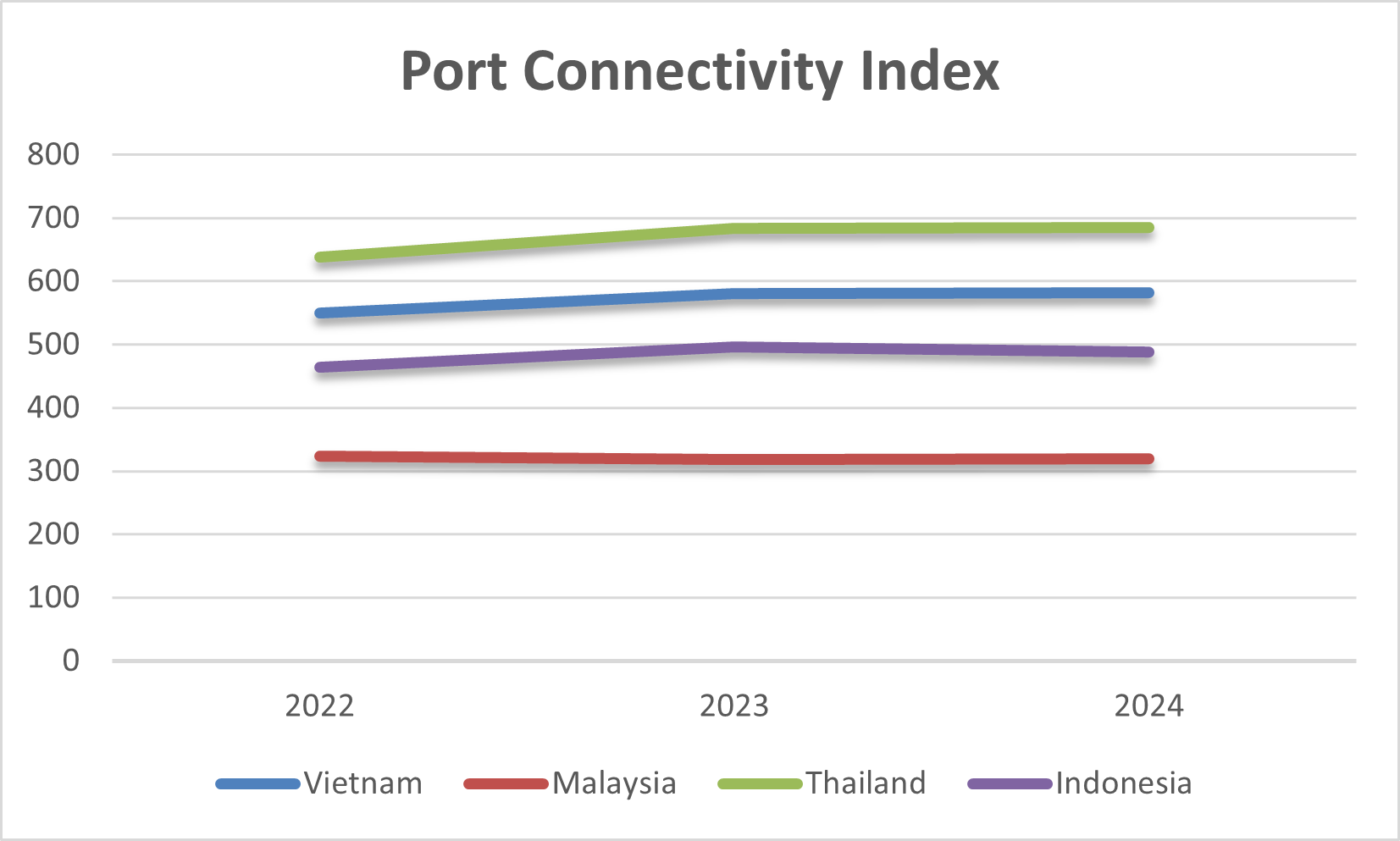

Over the past three years, the port connectivity in these Southeast Asian countries has notably increased, reflecting the region’s dynamic investment landscape. This surge is particularly evident in Vietnam, which has attracted substantial Western corporate presence, necessitating advanced developments in shipping infrastructure to remain competitive.

The analysis also underscores a burgeoning rivalry among these nations, as they collectively enhance their port capabilities to manage increased volumes and transform into major maritime centers.

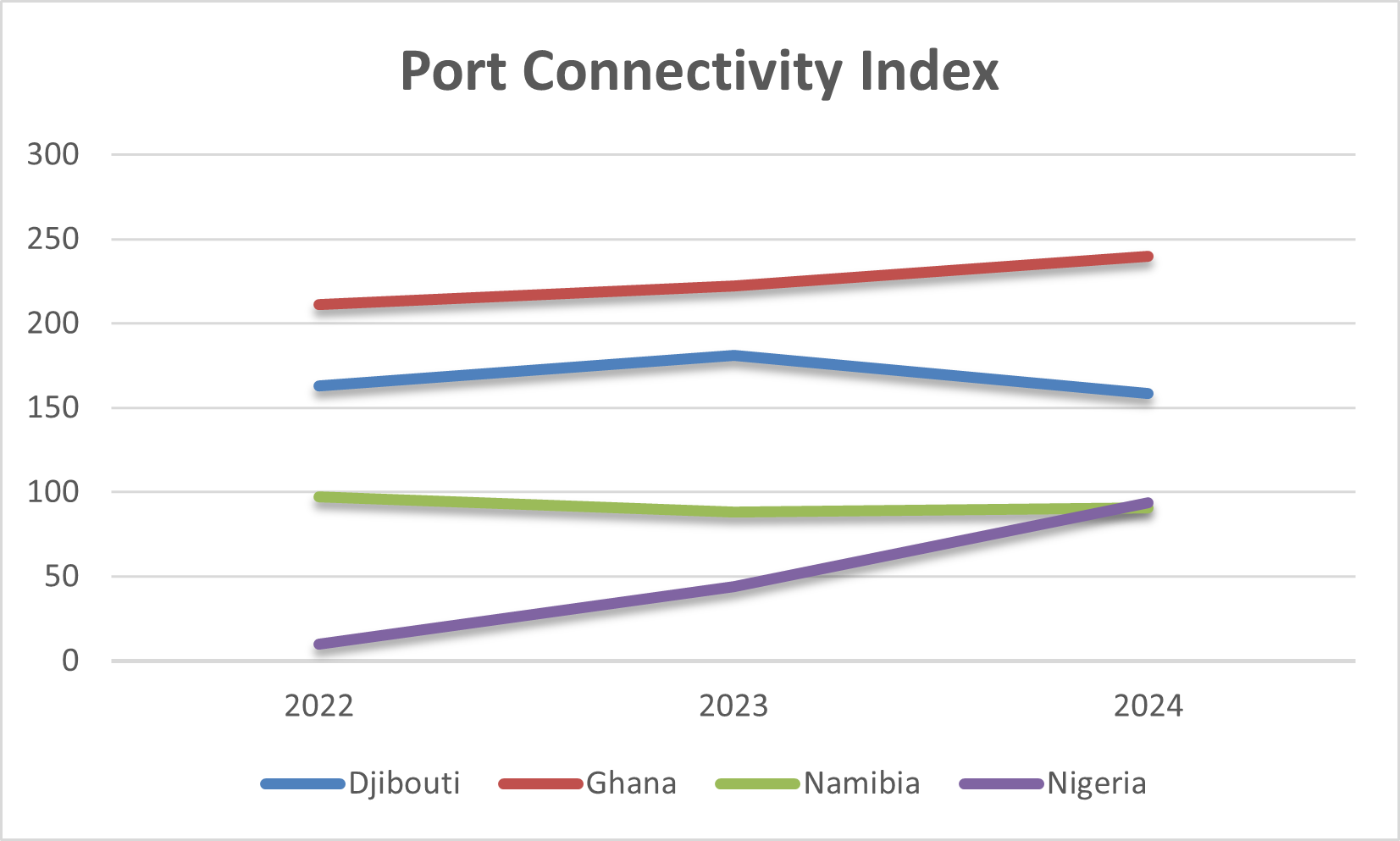

The scenario in Africa presents more variability, illustrating significant disparities across the continent. Ghana’s port of Tema shows a stable and positive trajectory in connectivity, likely linked to its strategic inclusion in new maritime routes, as previously reported by Container News.

This is indicative of West Africa’s potential pivotal role in forthcoming maritime services, with firms such as CMA CGM announcing new routes involving African ports.

Conversely, Djibouti has experienced a noticeable decline, potentially due to disruptions in the Red Sea. Similarly, Namibia has seen a downturn, although efforts are underway to stabilize this trend. Nigeria, on the other hand, is witnessing substantial growth due to new shipping services and subsequent investments that are catalyzing port development.

To provide a holistic view of the dynamics at these emerging ports, the analysis integrated the Logistics Performance Index and the Port Connectivity Index.

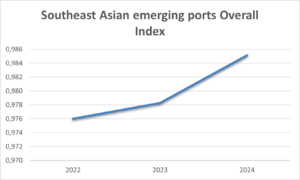

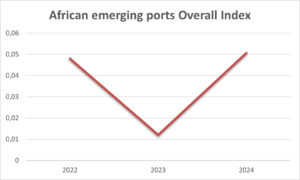

Initial findings suggest that both Southeast Asian and African ports have demonstrated significant improvements in logistics performance and port connectivity since 2023. This growth underscores the regions’ escalating importance as emerging trading hubs, with new services reshaping the trade landscape and propelling further investments and development.

While the trend in Asia shows a consistent competitive escalation, the sharp rise observed in African ports underscores a more tumultuous environment, influenced by regional disruptions and disparities.

However, the overarching trend indicates that emerging ports are increasingly gaining ground, reflecting their growing significance on the global shipping stage.