Brazilian coffee producers experiencing a bumper harvest have been struggling to get their beans to market due to the severe equipment imbalance being felt on the east coast South America to Asia trade lane.

Andrew Lorimar Datamar CEO told delegates at the TOC Americas Virtual Expo that in some trades, the economic benefits of a weaker currency for Brazilian exporters were being diminished owing to a painful imbalance in container equipment and a severe shortage of ship capacity.

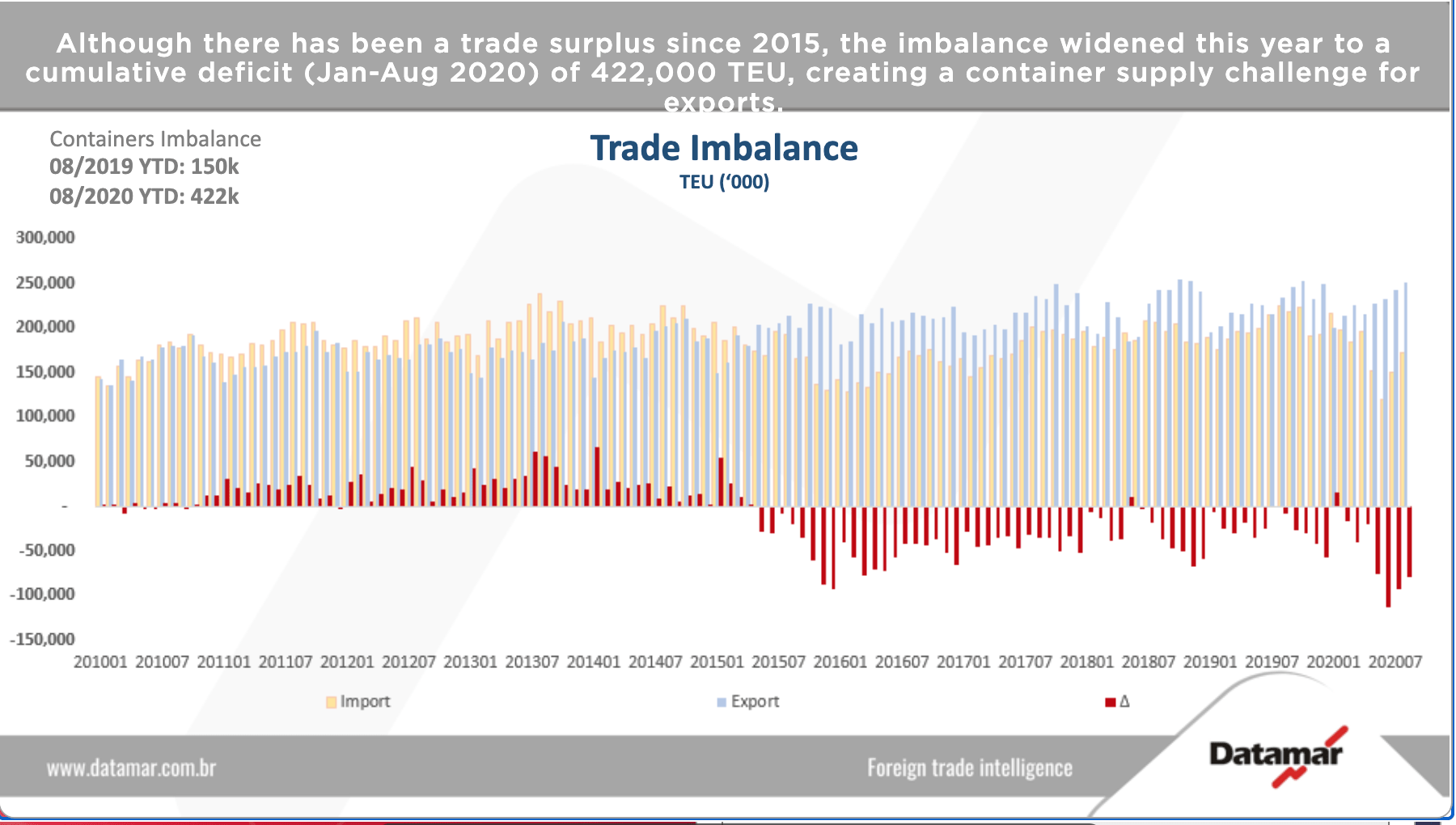

Lorimar said the number of export boxes shipped had outstripped imports by 422,000TEU in the period between January and August of this year, almost three times the accumulative imbalance in 2019.

The most obvious negative impact was coffee exports up 11% year-on-year to 9,118TEU in July but unable to continue that double-digit pace in August. The total number of boxes shipped outstripped 2019 volumes by only 19TEU in August.

“There’s a huge harvest, but while it’s pretty similar to last year in terms of the exports and perhaps that would be a lot higher if there had been containers and ships available,” he said.

Whilst last year there was a deficit of negative flow of 150,000TEU outbound, this year that number had nearly been reached in the month of June.

The difficulties being felt in the rest of the world – where there is a severe shortage of boxes for Chinese and Asian exports – has left carriers unable to cater for soaring demand.

As retailers rush to replenish their inventories, factories in China, India and Vietnam are hoovering up the world’s containers leaving shippers of lower value commodities unable to persuade carriers to ship their cargoes for fear of tying-up boxes for longer periods of time. The lines prefer to re-position empty boxes rapidly to allow them to carry more profitable export cargoes from Asia.

“What we see is that shippers are struggling to find containers when the ships are leaving full, a lot of cargo is being left behind,” said Lorimar.

The devaluation of the Brazilian and Argentine currencies had resulted in a 12% contraction in imports from 1,054,000TEU in 2019 to 924,000TEU in the same period in 2020. There was a similar swing in the other direction for exports – with ECSA-Asia volumes up 11% to 875,000TEU.

Other smaller trade lanes were following a similar trend.

Maersk’s senior vice president, head of Latin America and the Caribbean, Robert Van Trooijen, said that the situation was causing plenty of headaches for shippers and carriers.

“We see that the fleet size is going to be pretty tight so the ability to meet demand is very much about forward planning,” he said. “Trying to work with customers to have better visibility of the supply chain and make sure that their equipment is there where it is needed. When you have equipment in the wrong place at the wrong time then it’s basically a planning challenge. Demand visibility has been a challenge to the industry for a while and certainly this year simply because who could have predicted the market would flow the way it has over recent times?”

Rainbow Blue Nelson

Americas Correspondent