Several companies worldwide are taking part in initiatives to conduct safety assessments and establish standards for the use of ammonia and other energy sources as marine fuels, in an effort to realise the International Maritime Organization (IMO)’s target to cut greenhouse gas (GHG) emissions from shipping by at least 50% by 2050.

Since carbon dioxide (CO2) is not emitted when ammonia or hydrogen is burned, they are considered to have promise as next-generation marine fuels that could mitigate shipping’s impact on climate change.

In addition, it is said that zero emissions can be realised by utilising CO2-free hydrogen as a raw material for ammonia. However, due to the extreme toxicity of ammonia, safety assessments are critical to formulate standards for use of it as a marine fuel. A number of other fuels could also be in the mix, including methanol and biofuels.

Green fuel developments will further complicate the bunker fuel scene in the future, but for now conventional fuels remain prevalent.

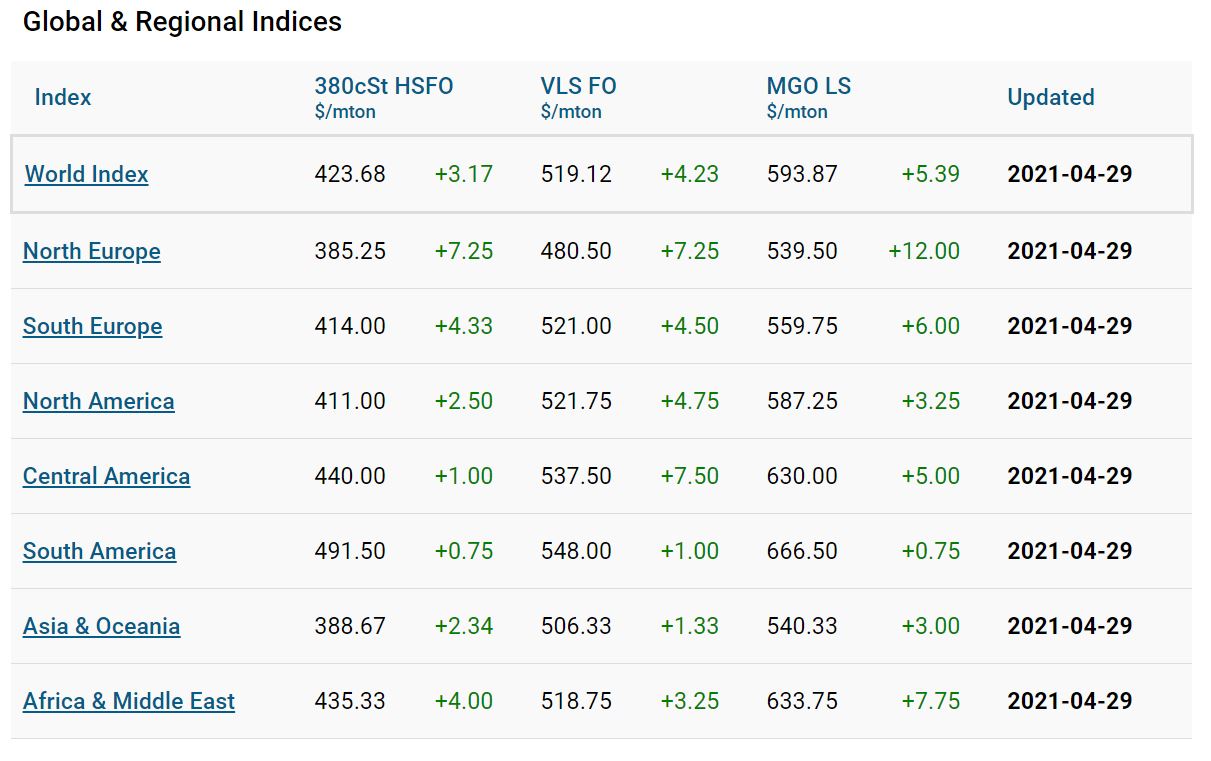

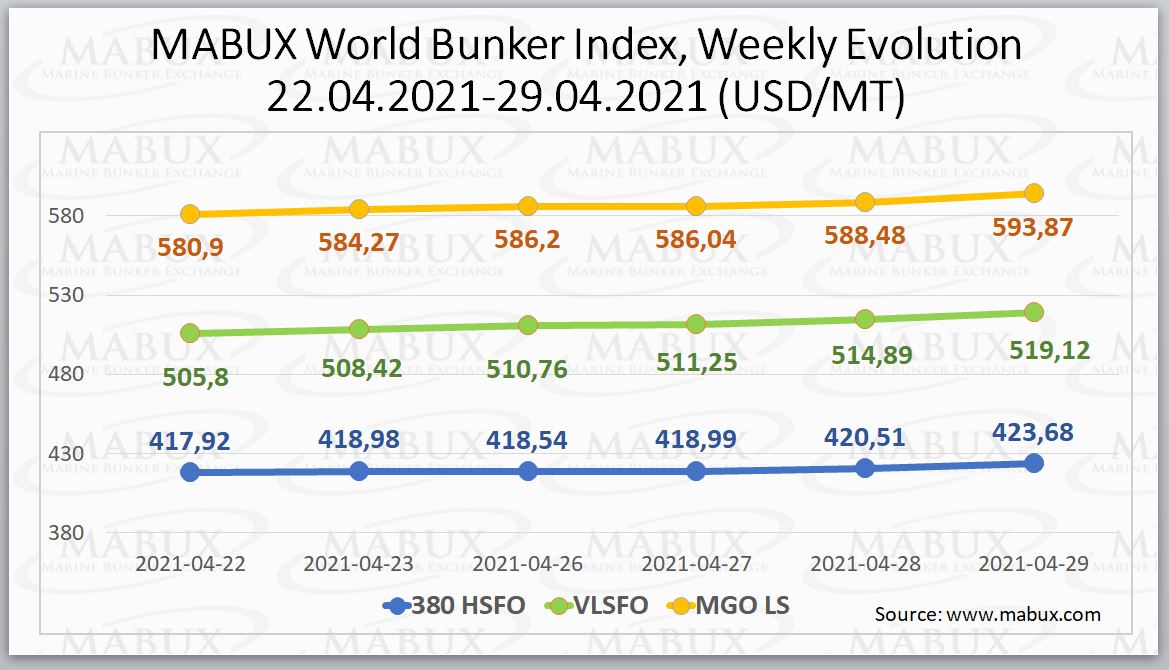

Marine Bunker Exchange (MABUX) World Bunker Index has shown an uptrend during the week, with the 380 HSFO index increasing to US$423.68/MT, VLSFO to US$519.12/MT and MGO LS to US$593.87/MT.

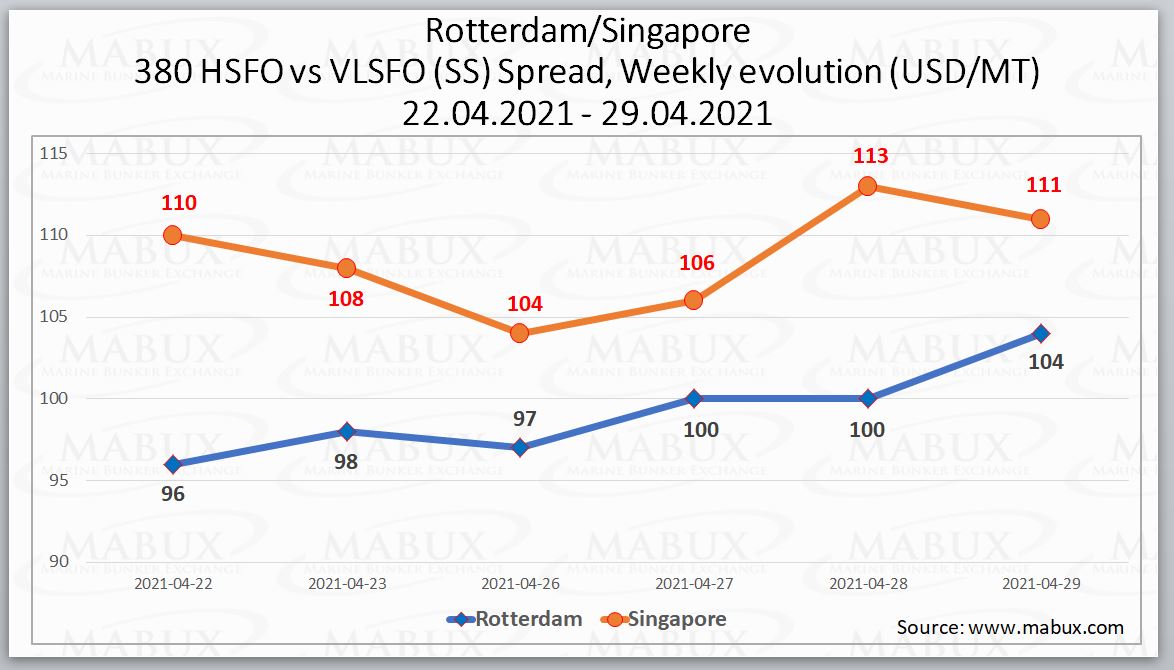

At the same time, the Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – was relatively stable averaging US$91.94.

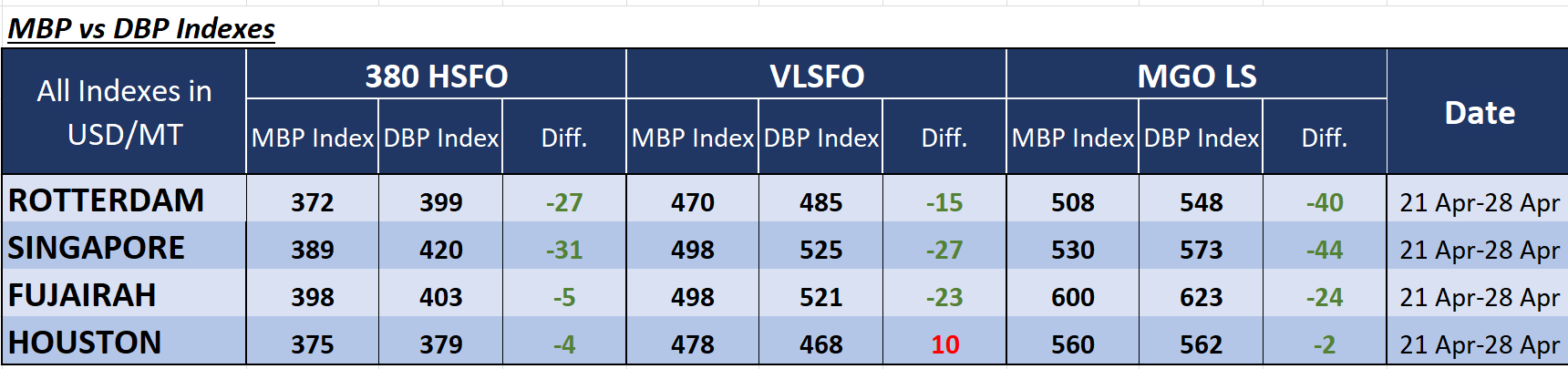

Furthermore, the correlation of MBP Index (Market Bunker Prices) vs DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO remain undervalued in all selected ports in a range of US$4-31.

Moreover, VLSFO according to DBP Index, is undervalued in a range of US$15-27 in all selected ports except of Houston, where it is overpriced by US$10, while MGO LS was also underpriced in all selected ports in a range of US$2-44.