Israel-based ZIM Integrated Shipping Lines aims to fill its newbuildings that will replace expensive chartered tonnage with similarly expensive chartered ships, that are 50% larger vessels over the course of 2024.

The company will see five vessels returned to owners this year and a further 34 going off-hire next year to be replaced by another 39 larger ships entering the fleet next year.

ZIM EVP and CFO Xavier Destriau told Container News that the company’s charter costs will not decrease as a result of taking on the new ships, but because the overall capacity is larger the cost per TEU will decrease.

“Overall, the capacity that we operate will grow next year, this was a choice because we needed to have the right vessel size to address the market in which we are competing. I’m not suggesting that our charter costs will reduce next, but TEU it will if we manage to fill those larger ships, the challenge for us going forward is to gain market share or enter into new markets,” explained Destriau.

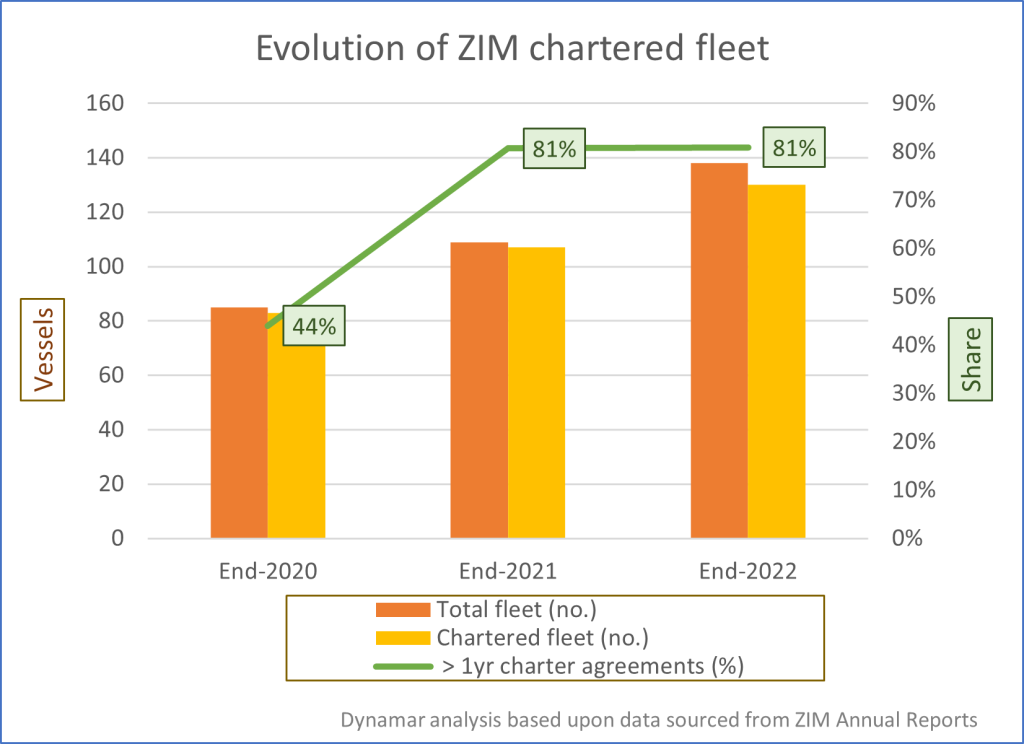

According to the latest Alphaliner figures ZIM operates 138 ships, eight owned and the remainder are chartered. A further 39 vessels are on order with all but three due to be delivered by the end of next year.

Destriau pointed out that the company currently operates six 15,000 TEU ships, with a further four to be delivered next month and next year. These will replace 10,000 TEU units.

“The cost of operating a 15,000 TEU LNG ship is the same as operating a 10,000 TEU ship, so for the same cost, we have a 50% increase in the potential intake in this service. So, providing we fill this ship we get the benefits of the lower costs,” argued Destriau.

According to ZIM, it has changed its view this year, shifting its expectations from an upturn at the end of this year to accepting that “2024 will be a challenging year” rate will be similar.

“We believe 2025 will be different, first of all, we will get the full benefit of our cost reductions with new vessels, and redelivered our expensive tonnage, so our cost structure, no matter what the market does, will continue to improve quarter after quarter and assuming that rates recover in 2025 there is room for optimism,” claimed Destriau.

Asked about the flood of new capacity that will be delivered that some analysts believe will hit rates for up to the next four years, Destriau said there needs to be an upturn in the scrapping of tonnage that needs to be factored in with pressure from the regulator.

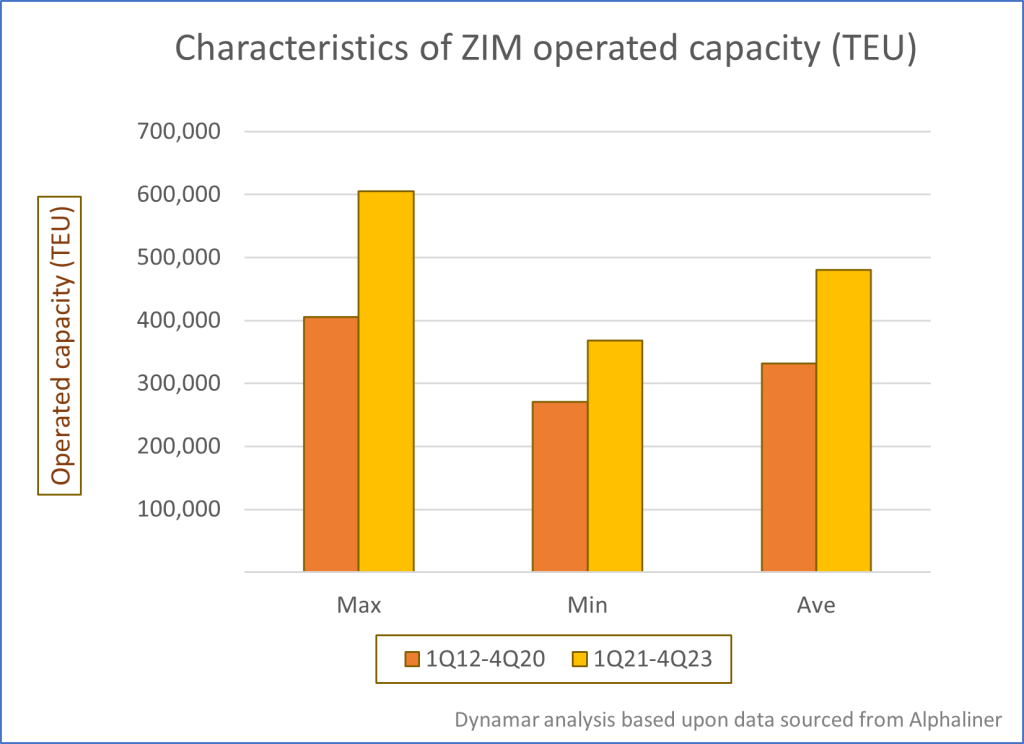

Darron Wadey, an analyst at Dutch consultants Dynamar, said, “From start-2012 to end-2020, ZIM was admirably disciplined in controlling its fleet. Over that period, its operated capacity averaged a touch over 330,000 TEU with fluctuations on either side of that; it was not the case that the fleet was consistently expanding. The highpoint during that period was only 405,000 TEU, this being reached in Q3 2018.

Wadey added, “However, from 2021, Zim’s fleet capacity has increased, significantly so. It has averaged 481,000 TEU, +45% over the 2012-20 average, with a highpoint in excess of 600,000 TEU being reached in Q3 2023, a growth of nearly 50% over the 2012-20 equivalent.”

Earlier this month, ZIM reported a Q3 operating loss of over US$2.2 billion, including an accounting impairment and a permanent reduction in the value of the company’s assets.

ZIM’s volumes increased slightly from 842,000 TEU in Q3 last year, to 867,000 TEU, but average rates per TEU fell to $1,139, a year-on-year decrease of 66%.

Mary Ann Evans

Correspondent at Large