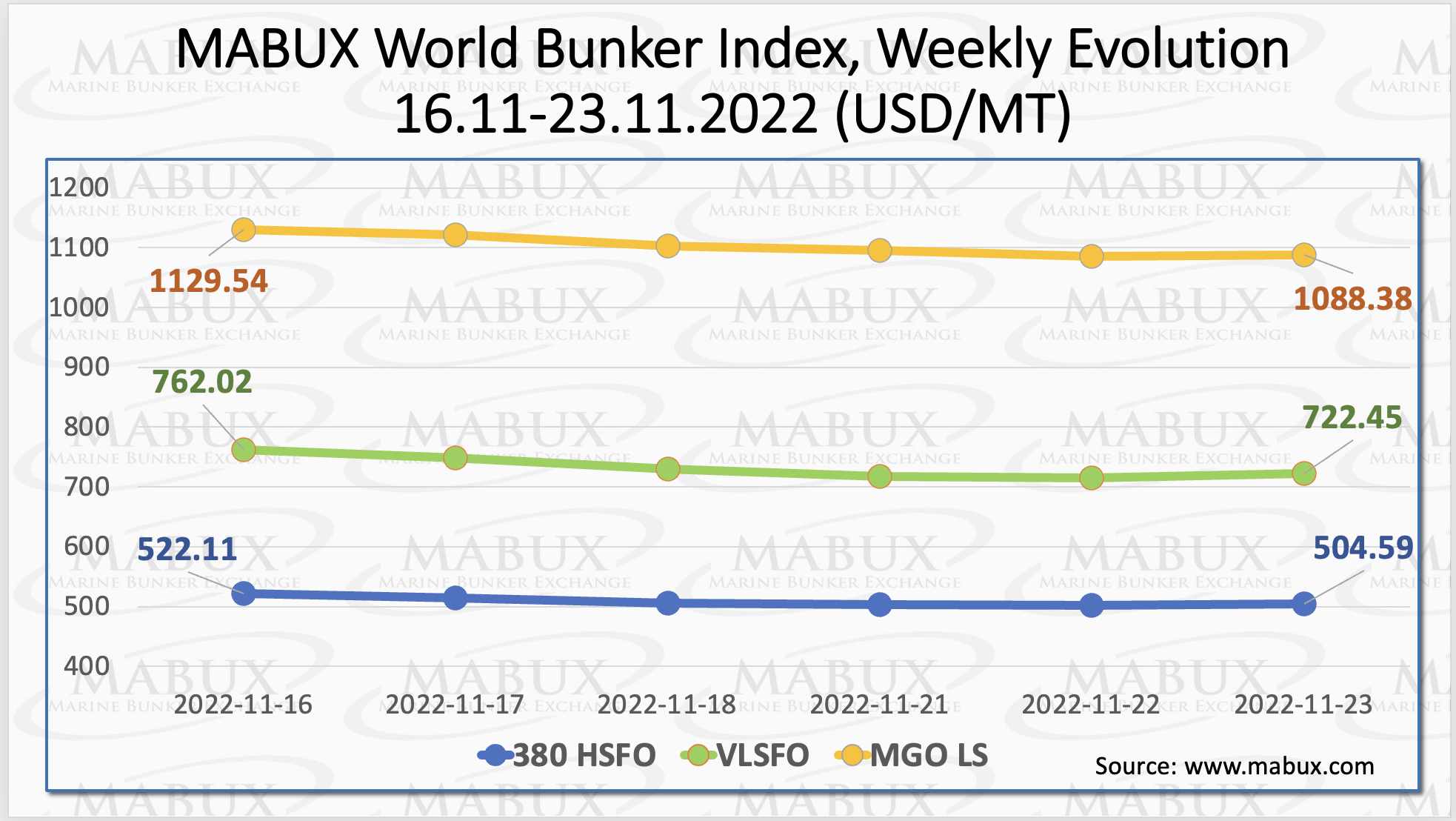

According to the weekly outlook of Marine Bunker Exchange (MABUX) for bunker prices, fuel indexes demonstrate a firm downward trend.

The 380 HSFO index fell to US4,504.59/MT, the VLSFO index decreased to US$722.45/MT and the MGO index dropped to US$1,088.38/MT.

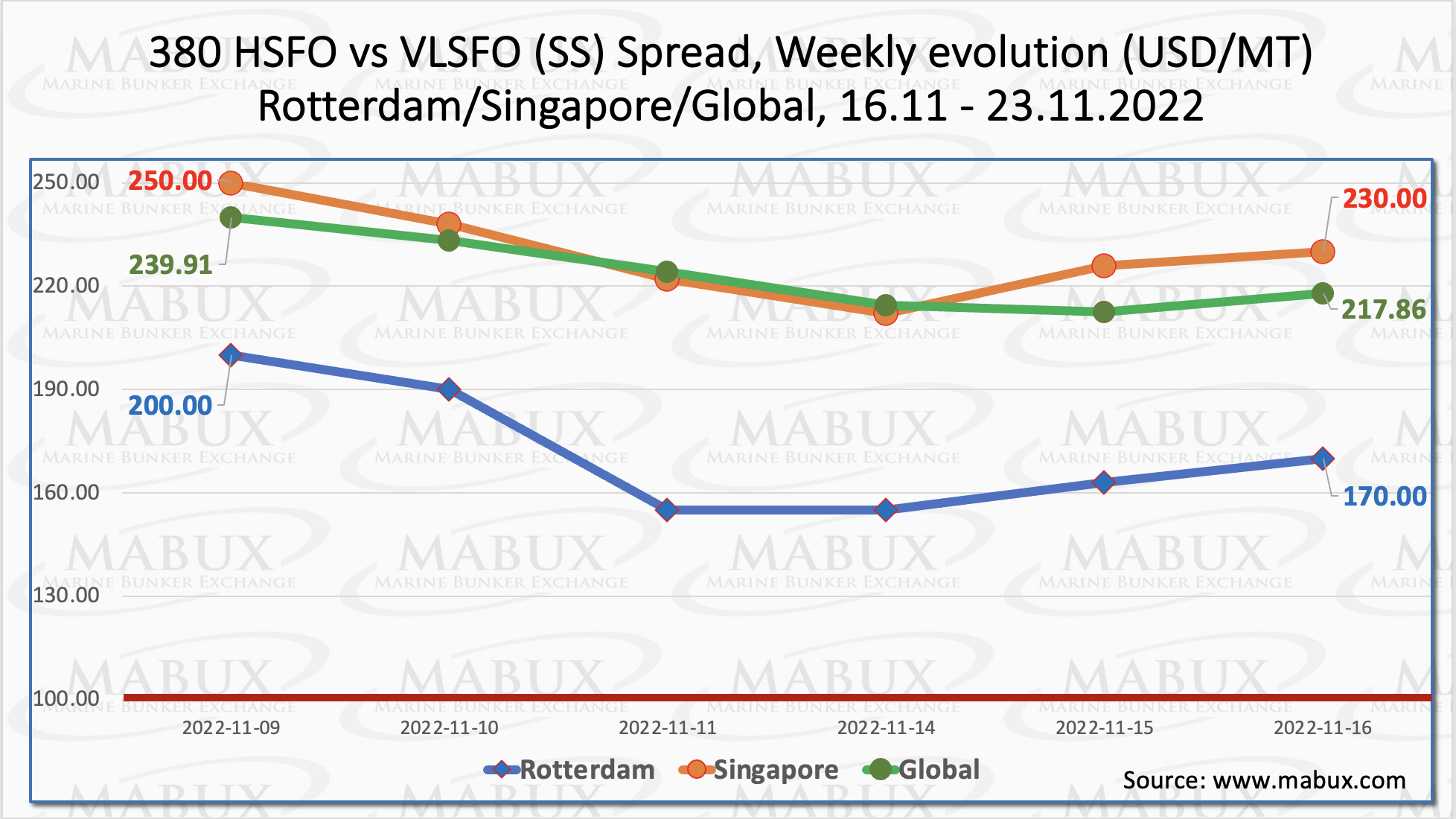

In the meantime, the Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – continued its firm decline over week 47 – minus US$22.05, approaching US$200. In Rotterdam, SS Spread showed an even more significant reduction of US$30, falling to US$170. In Singapore, the price differential of 380 HSFO/VLSFO has narrowed by US$20.

“It is expected that SS Spread decline will continue next week,” commented a MABUX official.

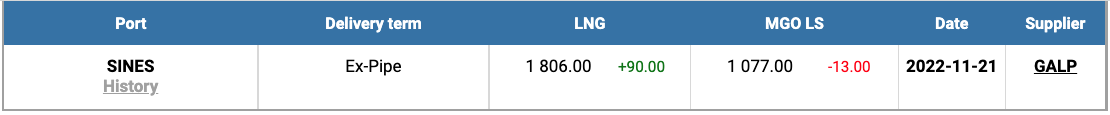

Natural gas prices in Europe continued an upward trend this week with the price of LNG as bunker fuel at the port of Sines in Portugal rising to US$1,806/MT on 21 November.

Thus, the price of LNG exceeds the cost of the most expensive traditional bunker fuel grade by US$729, on 21 November. The price of MGO LS at the port of Sines was quoted at US$1,077/MT.

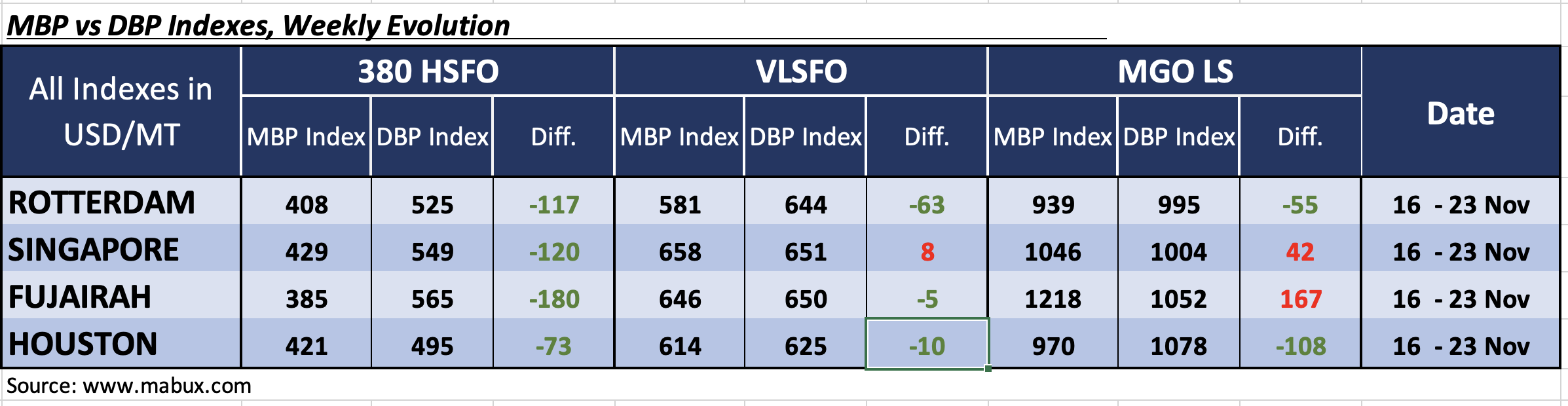

Over week 47, the MDI (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) continued to register an underestimation of 380 HSFO fuel in all four selected ports. The underprice margins declined slightly and showed: in Rotterdam – minus US$117, Singapore – minus US$120, Fujairah – minus US$180 and in Houston – minus US$73.

In the VLSFO segment, according to MDI, Houston returned to the underpricing zone again, joining Rotterdam and Fujairah: minus US$10, minus US$63 and minus US$5, respectively.

Singapore thus remains the only overvalued port – plus US$8. Undercharge premium has increased, and overvaluation has narrowed.

In the MGO LS segment, MDI registered fuel underpricing in two out of four selected ports: Rotterdam – minus US$55 and Houston – minus US$108. Singapore and Fujairah remained in the overpricing zone, plus US$42 and plus US$167, respectively. MDI did not have a sustainable trend in this bunker fuel segment.

“Global bunker indices may continue to trend lower next week ahead the sanctions against

the oil products’ export from Russia to Europe to be imposed on 5 December,” commented Sergey Ivanov, director of MABUX.