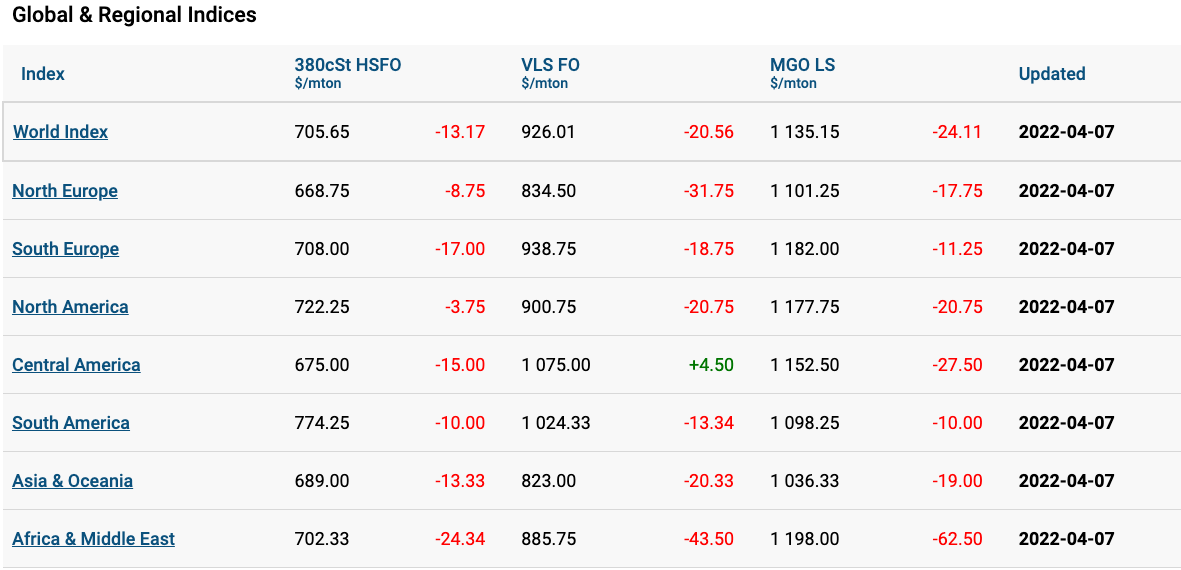

Over the 14th week of the year, the global bunker market did not show any remarkable trends, while the Marine Bunker Exchange (MABUX) index showed slight changes.

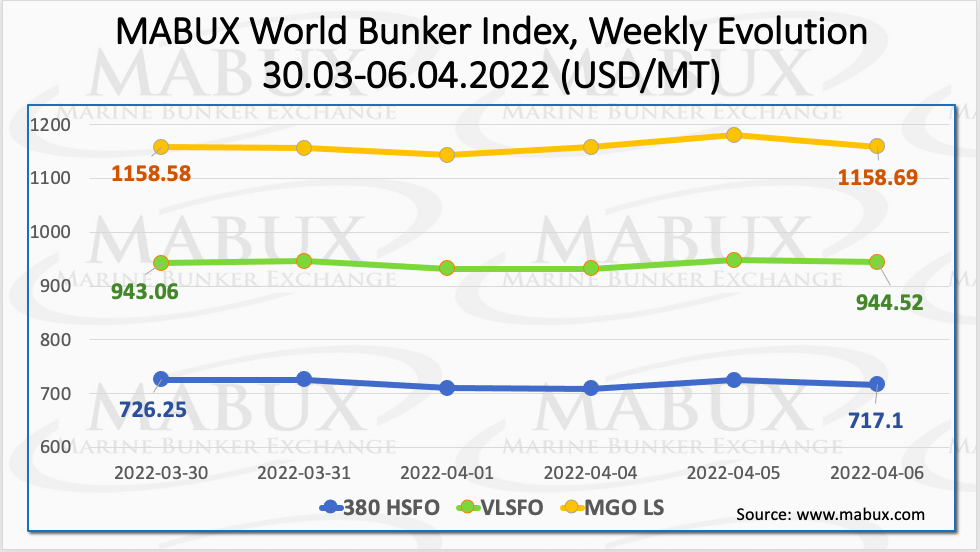

The 380 high-sulphur fuel oil (HSFO) index fell to US$717.10/MT, while the very low sulphur fuel oil (VLSFO) index rose to US$944.52/MT, and the marine gas oil (MGO) index grew marginally to US$1,158.69/MT.

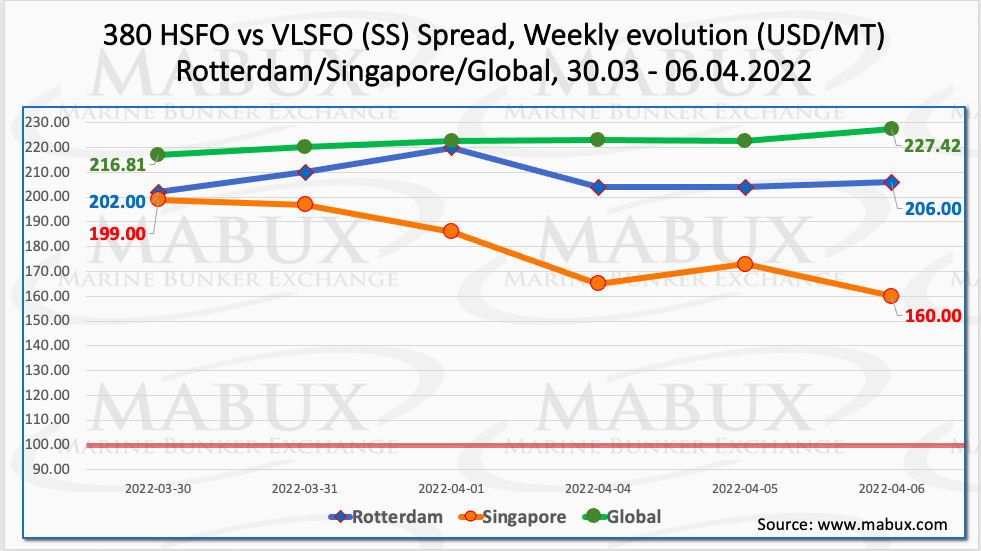

The Global Scrubber Spread (SS) weekly average, the difference between 380 HSFO and VLSFO, remained almost unchanged over the week at US$222.13.

In Rotterdam, the average SS Spread dropped to US$207.67, but the most significant decline was recorded in Singapore at US$180. SS Spread in this port continues plunging for the second week in a row, reaching US$160 on 6 April.

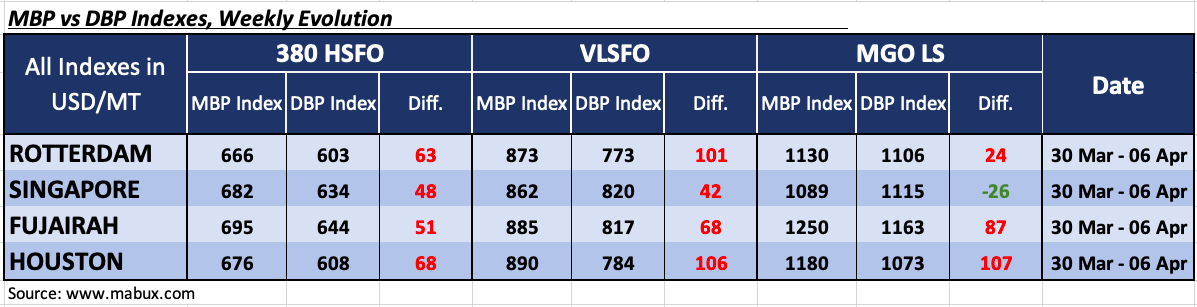

During the same period, the average correlation of the MABUX market bunker prices (MBP) Index vs MABUX digital bunker benchmark (DBP) index showed that the fuel overpricing trend prevailed in the global bunker market amid high volatility.

Thus, 380 HSFO fuel remained overvalued in all four selected ports, while the overcharge ratio increased significantly: in Rotterdam with a plus of US$63, in Singapore with a plus US$48, in Fujairah plus US$51 and in Houston, plus US$68, with the most significant overprice growth observed in Fujairah by 48 points compared to the previous week.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, also remained overpriced on average in all selected ports: plus US$101 in Rotterdam, plus US$42 in Singapore, plus US$68 in Fujairah and plus US$106 in Houston.

As for MGO LS, MABUX MBP/DBP Index registered an underpricing of this fuel grade only in Singapore out of four ports selected, with a minus of US$8, while all other three ports demonstrated an overcharge: Rotterdam – plus US$24, Fujairah – plus US$87 and Houston – plus US$107.

In this fuel segment, there is registered a change in trend and a gradual transition to the overprice zone, according to the MABUX analysts.